Question: This is negotiation and contract You would be much better off if you could avoid spending your entire cash reserves. Any money you save could

This is negotiation and contract

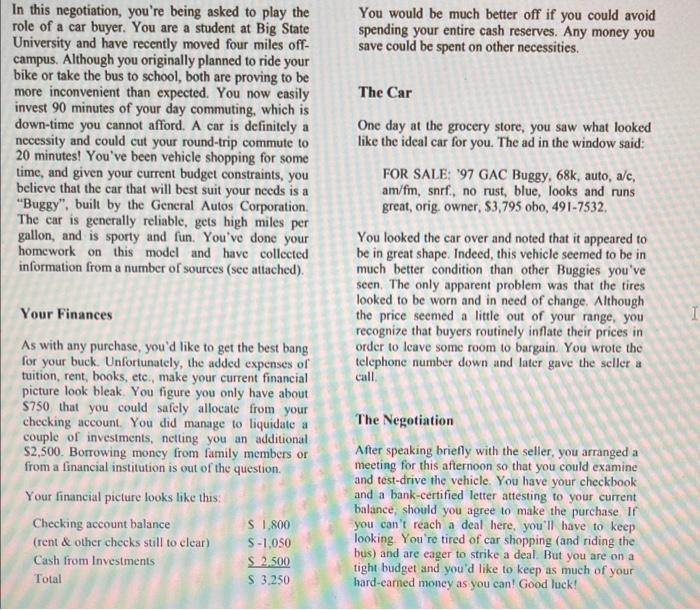

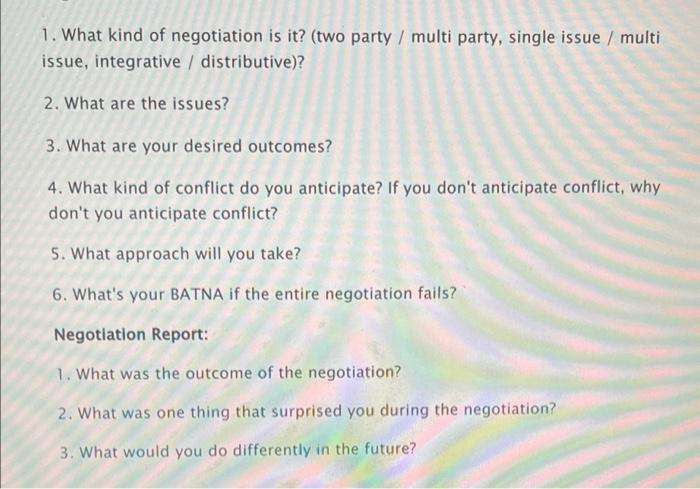

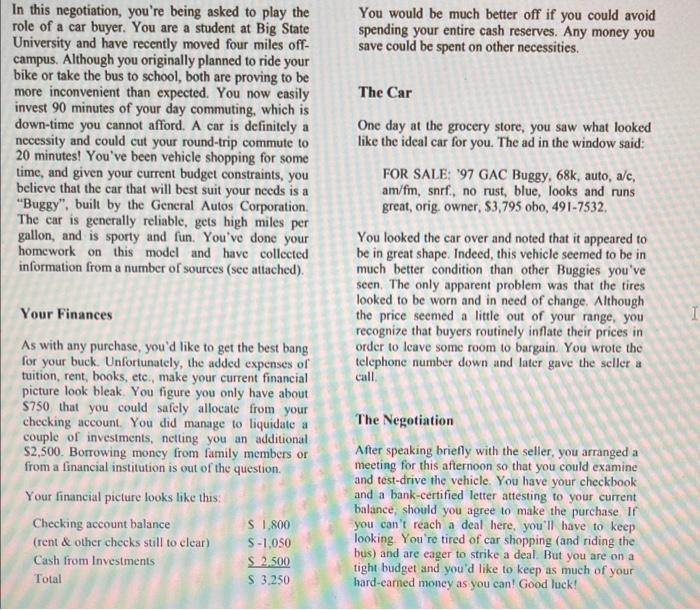

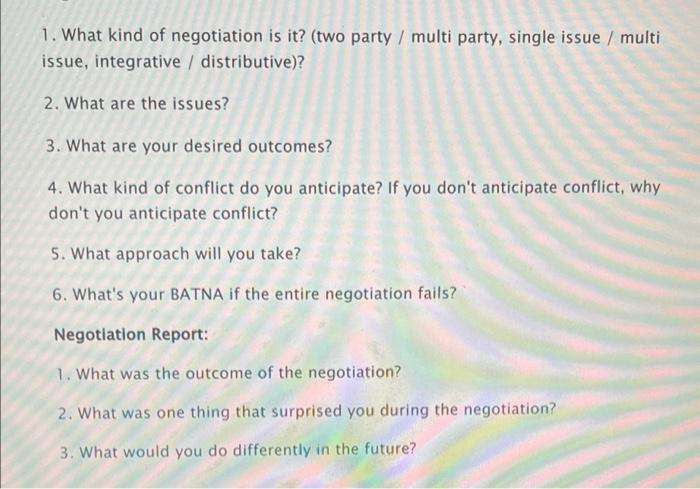

You would be much better off if you could avoid spending your entire cash reserves. Any money you save could be spent on other necessities. The Car In this negotiation, you're being asked to play the role of a car buyer. You are a student at Big State University and have recently moved four miles off- campus. Although you originally planned to ride your bike or take the bus to school, both are proving to be more inconvenient than expected. You now easily invest 90 minutes of your day commuting, which is down-time you cannot afford. A car is definitely a necessity and could cut your round-trip commute to 20 minutes! You've been vehicle shopping for some time, and given your current budget constraints, you believe that the car that will best suit your needs is a "Buggy", built by the General Autos Corporation, The car is generally reliable, gets high miles per gallon, and is sporty and fun. You've done your homework on this model and have collected information from a number of sources (see attached). One day at the grocery store, you saw what looked like the ideal car for you. The ad in the window said: FOR SALE: 97 GAC Buggy, 68k, auto, a/c, am/fm, snrf, no rust, blue, looks and runs great, orig. owner, 83,795 obo, 491-7532. You looked the car over and noted that it appeared to be in great shape. Indeed, this vehicle seemed to be in much better condition than other Buggies you've seen. The only apparent problem was that the tires looked to be worn and in need of change. Although the price seemed a little out of your range, you recognize that buyers routinely inflate their prices in order to Icave some room to bargain. You wrote the telephone number down and later gave the seller a call Your Finances As with any purchase, you'd like to get the best bang for your buck. Unfortunately, the added expenses of tuition, rent, books, etc., make your current financial picture look bleak You figure you only have about $750 that you could safely allocate from your checking account. You did manage to liquidate a couple of investments, nelling you an additional $2,500. Borrowing money from family members or from a financial institution is out of the question. Your financial picture looks like thus: Checking account balance S 1,800 (rent & other checks still to clear) S-1,050 Cash from Investments $ 2.500 Total S 3.250 The Negotiation After speaking briefly with the seller, you arranged a meeting for this afternoon so that you could examine and test-drive the vehicle. You have your checkbook and a bank-certified letter attesting to your current balance, should you agree to make the purchase of you can't reach a deal here, you'll have to keep looking You're tired of car shopping and riding the bus) and are eager to strike a deal. But you are on a tight budget and you'd like to keep as much of your hard-earned money as you can! Good luck! 1. What kind of negotiation is it? (two party / multi party, single issue / multi issue, integrative distributive)? 2. What are the issues? 3. What are your desired outcomes? 4. What kind of conflict do you anticipate? If you don't anticipate conflict, why don't you anticipate conflict? 5. What approach will you take? 6. What's your BATNA if the entire negotiation fails? Negotiation Report: 1. What was the outcome of the negotiation? 2. What was one thing that surprised you during the negotiation? 3. What would you do differently in the future

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock