Question: this is not a homework assignment, it is a practice sheet so please answer all of them correctly for a Like... QUESTION 1 Determine the

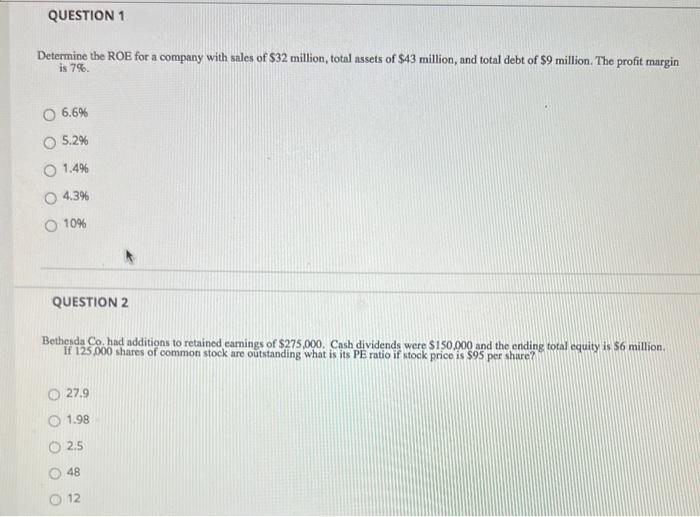

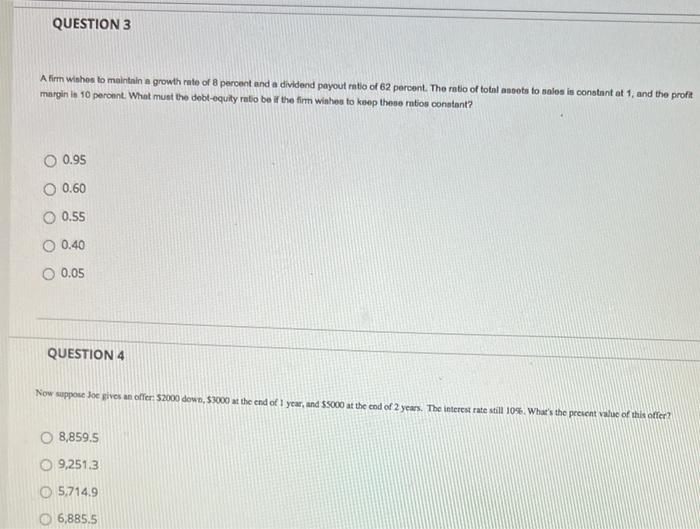

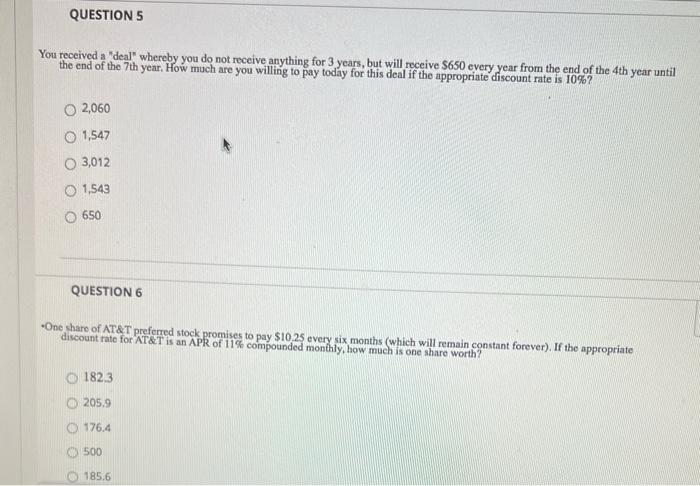

QUESTION 1 Determine the ROE for a company with sales of $32 million, total assets of $43 million, and total debt of $9 million. The profit margin is 7% 6.6% 5.2% 1.4% O 4.3% 10% QUESTION 2 Bethesda Co had additions to retained earnings of $275,000 Cash dividends were $150,000 and the ending total equity is $6 million. If 125.000 shares of common stock are outstanding what is its PE ratio if stock price is $95 per share? 27.9 O 1.98 2.5 48 12 QUESTION 3 A firm wishes to maintain a growth rate of 8 percent and a dividend payout ratio of 62 percent. The ratio of total assets to sales is constant at 1, and the profit margin in 10 peront. What must the debt-equity ratio boil the firm wishes to keep these ratios constant? O 0.95 O 0.60 O 0.55 O 0.40 0.05 QUESTION 4 Now suppose Joe gives we offer S2000 down, $3000 at the end of 1 year, and $5000 at the end of 2 years. The interest rate still 106. What's the present value of this offer? 8,859.5 9,251.3 O 5,714.9 6,885.5 QUESTIONS You received a 'deal' whereby you do not receive anything for 3 years, but will receive $650 every year from the end of the 4th year until the end of the 7th year. How much are you willing to pay today for this deal if the appropriate discount rate is 10%? 2,060 O 1,547 3,012 O 1,543 650 QUESTION 6 -One share of AT&T preferred stock promises to pay $10,25 every six months (which will remain constant forever). If the appropriate discount rate for AT&T is an APR of 11% compounded monthly, how much is one share worth? 182.3 205.9 176.4 500 185.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts