Question: This is ONE, multi-step question. Please show all steps and specify which part of the problem is being answered. If using excel, please list all

This is ONE, multi-step question. Please show all steps and specify which part of the problem is being answered. If using excel, please list all steps/ formulas. (screenshots are also helpful!)

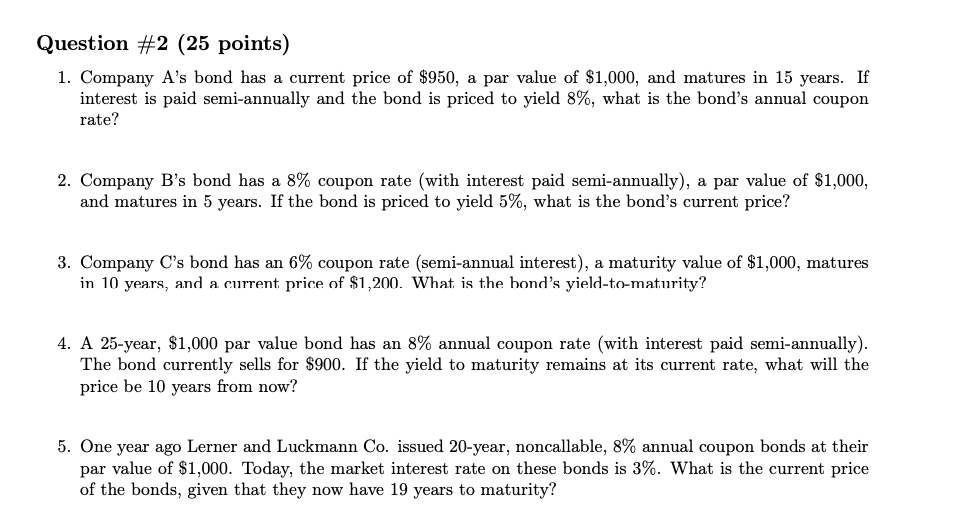

Question #2 (25 points) 1. Company A's bond has a current price of $950, a par value of $1,000, and matures in 15 years. If interest is paid semi-annually and the bond is priced to yield 8%, what is the bond's annual coupon rate? 2. Company B's bond has a 8% coupon rate (with interest paid semi-annually), a par value of $1,000, and matures in 5 years. If the bond is priced to yield 5%, what is the bond's current price? 3. Company C's bond has an 6% coupon rate (semi-annual interest), a maturity value of $1,000, matures in 10 years, and a current price of $1,200. What is the bond's yield-to-maturity? 4. A 25-year, $1,000 par value bond has an 8% annual coupon rate (with interest paid semi-annually). The bond currently sells for $900. If the yield to maturity remains at its current rate, what will the price be 10 years from now? 5. One year ago Lerner and Luckmann Co. issued 20-year, noncallable, 8% annual coupon bonds at their par value of $1,000. Today, the market interest rate on these bonds is 3%. What is the current price of the bonds, given that they now have 19 years to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts