Question: This is ONE, multi-step question. Please show all steps and specify which part of the problem is being answered. If using excel, please list all

This is ONE, multi-step question. Please show all steps and specify which part of the problem is being answered. If using excel, please list all steps/ formulas. (screenshots are also helpful!)

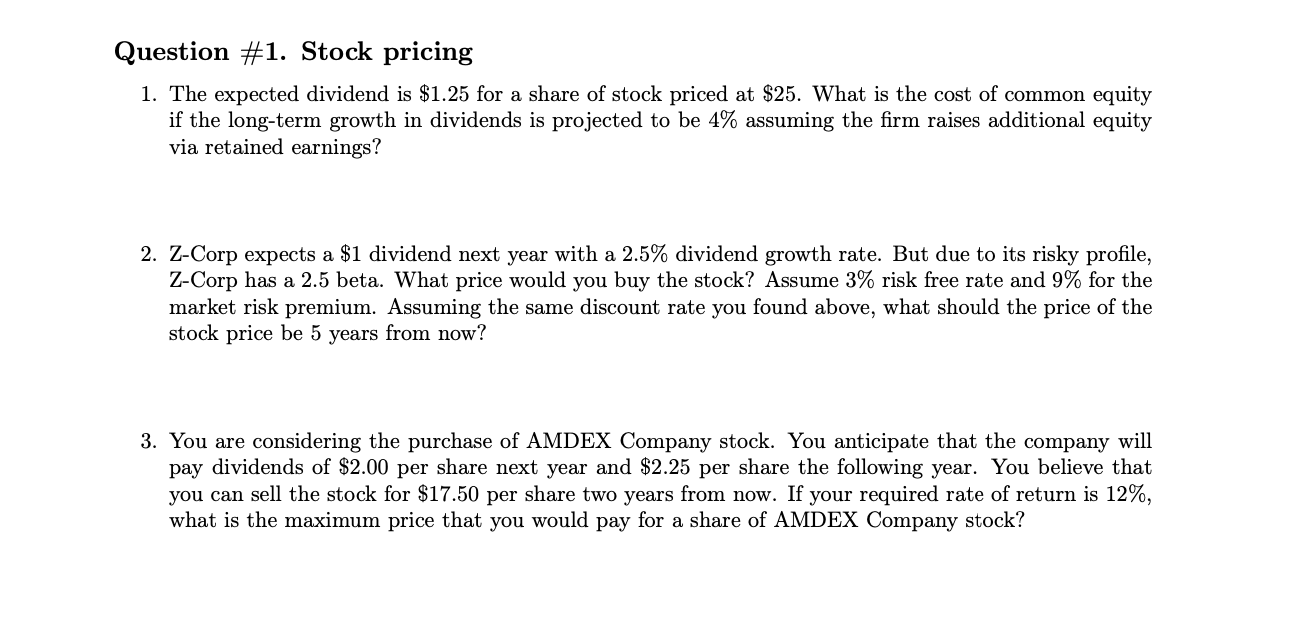

Question #1. Stock pricing 1. The expected dividend is $1.25 for a share of stock priced at $25. What is the cost of common equity if the long-term growth in dividends is projected to be 4% assuming the firm raises additional equity via retained earnings? 2. Z-Corp expects a $1 dividend next year with a 2.5% dividend growth rate. But due to its risky profile, Z-Corp has a 2.5 beta. What price would you buy the stock? Assume 3% risk free rate and 9% for the market risk premium. Assuming the same discount rate you found above, what should the price of the stock price be 5 years from now? 3. You are considering the purchase of AMDEX Company stock. You anticipate that the company will pay dividends of $2.00 per share next year and $2.25 per share the following year. You believe that you can sell the stock for $17.50 per share two years from now. If your required rate of return is 12%, what is the maximum price that you would pay for a share of AMDEX Company stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts