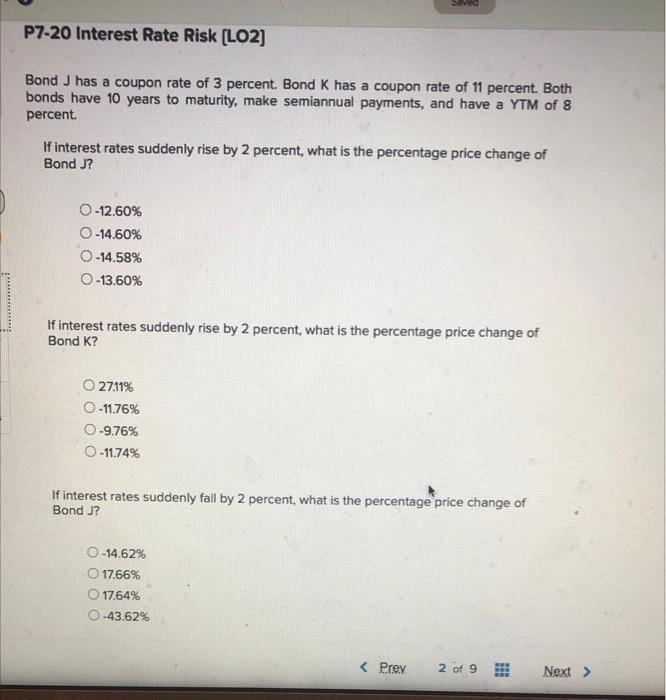

Question: this is one problem plz help plz show how to do on finance Calculator Seved P7-20 Interest Rate Risk (LO2) Bond J has a coupon

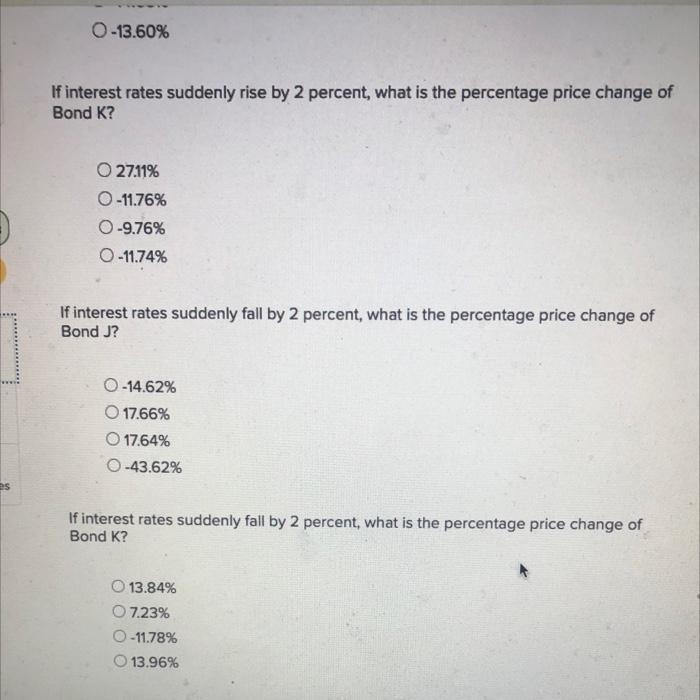

Seved P7-20 Interest Rate Risk (LO2) Bond J has a coupon rate of 3 percent. Bond K has a coupon rate of 11 percent. Both bonds have 10 years to maturity, make semiannual payments, and have a YTM of 8 percent If interest rates suddenly rise by 2 percent, what is the percentage price change of Bond J? 0-12.60% 0-14.60% 0-14.58% 0-13.60% If interest rates suddenly rise by 2 percent, what is the percentage price change of Bond K? 27.11% - 11.76% -9.76% -11.74% If interest rates suddenly fall by 2 percent, what is the percentage price change of Bond J? -14.62% 17.66% 17.64% 0-43.62% 0-13.60% If interest rates suddenly rise by 2 percent, what is the percentage price change of Bond K? O 27.11% 0-11.76% O-9.76% 0-11.74% If interest rates suddenly fall by 2 percent, what is the percentage price change of Bond J? 0-14.62% O 17.66% O 17.64% O-43.62% es If interest rates suddenly fall by 2 percent, what is the percentage price change of Bond K? O 13.84% O 7.23% -11.78% 13.96%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts