Question: this is one question can you please help me Part one Net Income Marcus Corp. has to construct a new factory to produce the GPS

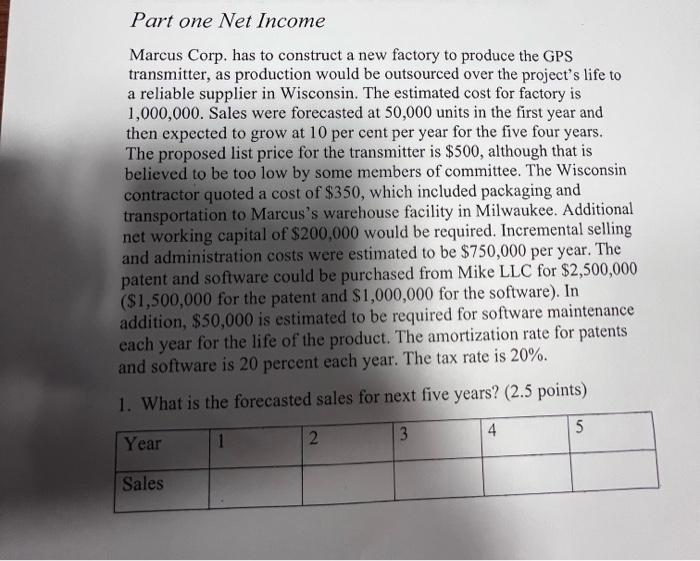

Part one Net Income Marcus Corp. has to construct a new factory to produce the GPS transmitter, as production would be outsourced over the project's life to a reliable supplier in Wisconsin. The estimated cost for factory is 1,000,000. Sales were forecasted at 50,000 units in the first year and then expected to grow at 10 per cent per year for the five four years. The proposed list price for the transmitter is $500, although that is believed to be too low by some members of committee. The Wisconsin contractor quoted a cost of $350, which included packaging and transportation to Marcus's warehouse facility in Milwaukee. Additional net working capital of $200,000 would be required. Incremental selling and administration costs were estimated to be $750,000 per year. The patent and software could be purchased from Mike LLC for $2,500,000 ($1,500,000 for the patent and $1,000,000 for the software). In addition, $50,000 is estimated to be required for software maintenance each year for the life of the product. The amortization rate for patents and software is 20 percent each year. The tax rate is 20%. 1. What is the forecasted sales for next five years? (2.5 points) 3 Year 5 4 2 Sales 2. What is the initial investment outlay (t=0)? (2 points) 3. Calculate the net income for the second year. (5.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts