Question: This is ONE question. Do not answer the questions in the article. Just fill out the table below. 2. What would the typical salesperson earn

This is ONE question. Do not answer the questions in the article. Just fill out the table below.

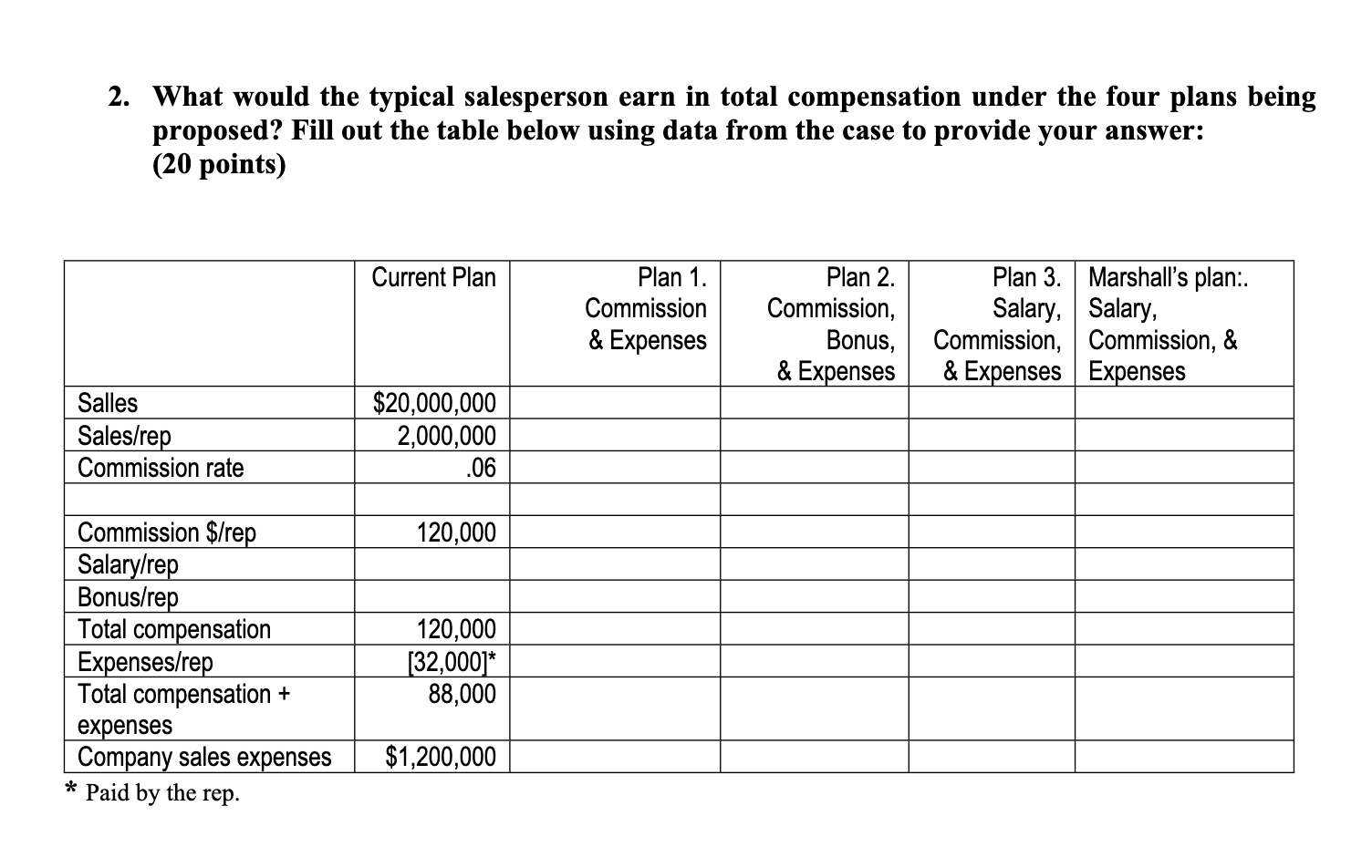

2. What would the typical salesperson earn in total compensation under the four plans being proposed? Fill out the table below using data from the case to provide your answer.

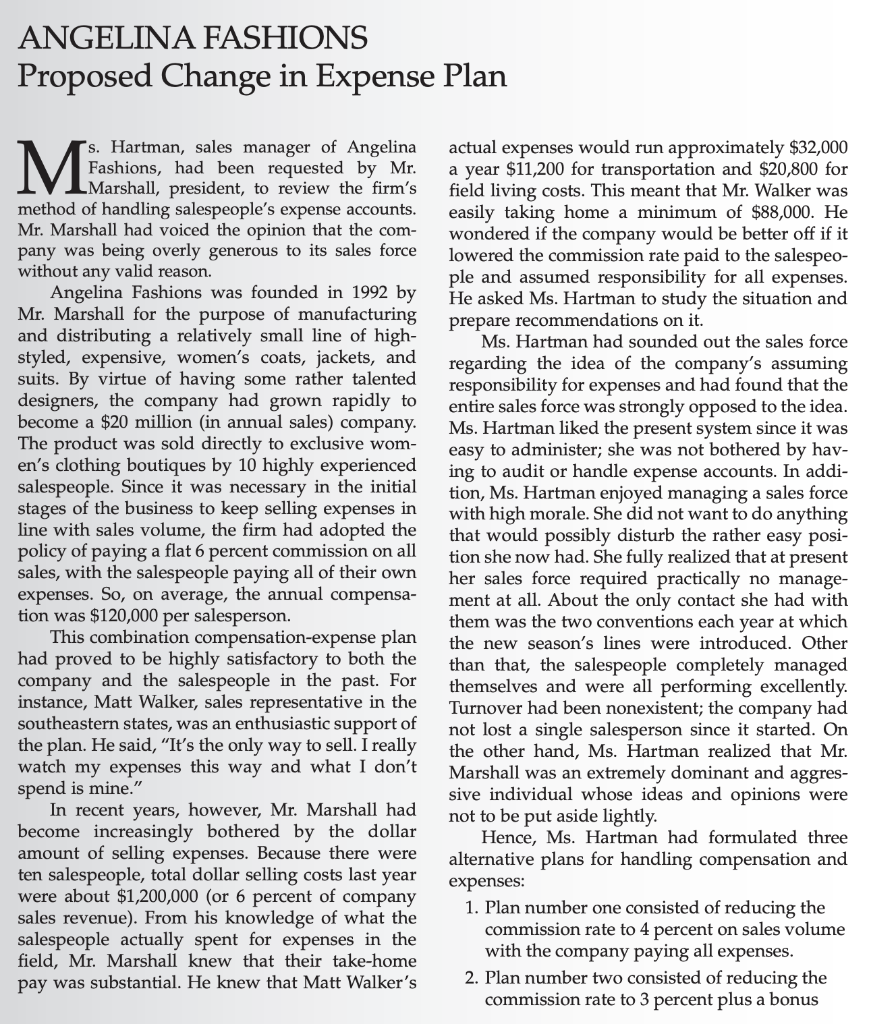

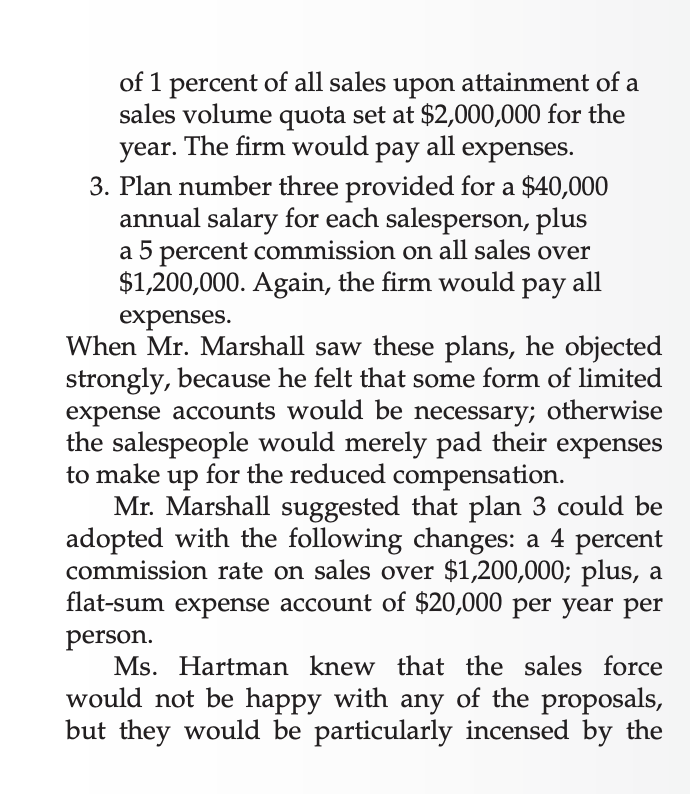

2. What would the typical salesperson earn in total compensation under the four plans being proposed? Fill out the table below using data from the case to provide your answer: (20 points) rasa by tne rep. ANGELINA FASHIONS Proposed Change in Expense Plan of 1 percent of all sales upon attainment of a sales volume quota set at $2,000,000 for the year. The firm would pay all expenses. 3. Plan number three provided for a $40,000 annual salary for each salesperson, plus a 5 percent commission on all sales over $1,200,000. Again, the firm would pay all expenses. When Mr. Marshall saw these plans, he objected strongly, because he felt that some form of limited expense accounts would be necessary; otherwise the salespeople would merely pad their expenses to make up for the reduced compensation. Mr. Marshall suggested that plan 3 could be adopted with the following changes: a 4 percent commission rate on sales over $1,200,000; plus, a flat-sum expense account of $20,000 per year per person. Ms. Hartman knew that the sales force would not be happy with any of the proposals, but they would be particularly incensed by the fixed-expense plan. Further, she knew that the salespeople gained some tax advantages from the present system and that they would not look kindly upon having those advantages discontinued. 2. What would the typical salesperson earn in total compensation under the four plans being proposed? Fill out the table below using data from the case to provide your answer: (20 points) rasa by tne rep. ANGELINA FASHIONS Proposed Change in Expense Plan of 1 percent of all sales upon attainment of a sales volume quota set at $2,000,000 for the year. The firm would pay all expenses. 3. Plan number three provided for a $40,000 annual salary for each salesperson, plus a 5 percent commission on all sales over $1,200,000. Again, the firm would pay all expenses. When Mr. Marshall saw these plans, he objected strongly, because he felt that some form of limited expense accounts would be necessary; otherwise the salespeople would merely pad their expenses to make up for the reduced compensation. Mr. Marshall suggested that plan 3 could be adopted with the following changes: a 4 percent commission rate on sales over $1,200,000; plus, a flat-sum expense account of $20,000 per year per person. Ms. Hartman knew that the sales force would not be happy with any of the proposals, but they would be particularly incensed by the fixed-expense plan. Further, she knew that the salespeople gained some tax advantages from the present system and that they would not look kindly upon having those advantages discontinued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts