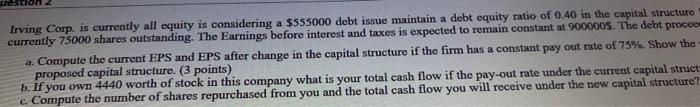

Question: this is one question i hope u answer Irving Corp. is currently all equity is considering a $555000 debt issue maintain a debt equity ratio

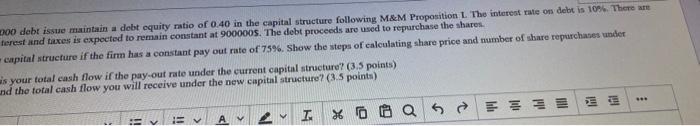

Irving Corp. is currently all equity is considering a $555000 debt issue maintain a debt equity ratio of 0.40 in the capital structure currently 75000 shares outstanding. The Earnings before interest and taxes is expected to remain constant at 900000s. The debt procee a. Compute the current EPS and EPS after change in the capital structure if the firm has a constant pay out rate of 75%. Show the proposed capital structure. (3 points) b. If you own 4440 worth of stock in this company what is your total cash flow if the pay-out rate under the current capital struct c. Compute the number of shares repurchased from you and the total cash flow you will receive under the new capital structure? 200 debt issue maintain a debt equity ratio of 0.40 in the capital structure following M&M Proposition L. The interest rate on debt is 10%. There are ferest and taxes is expected to remain constant at 900000s. The debt proceeds are used to repurchase the shares capital structure if the firm has a constant pay out rate of 75%. Show the steps of calculating share price and number of share repurchases under as your total cash flow if the pay-out rate under the current capital structure? (3.5 points) und the total cash flow you will receive under the new capital structure? (3.5 points) Q T. X 2 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts