Question: This is one question. please answer my question. I know about chegg policy. I'm aware that you can only answer one question; this is one

This is one question. please answer my question. I know about chegg policy. I'm aware that you can only answer one question; this is one question.

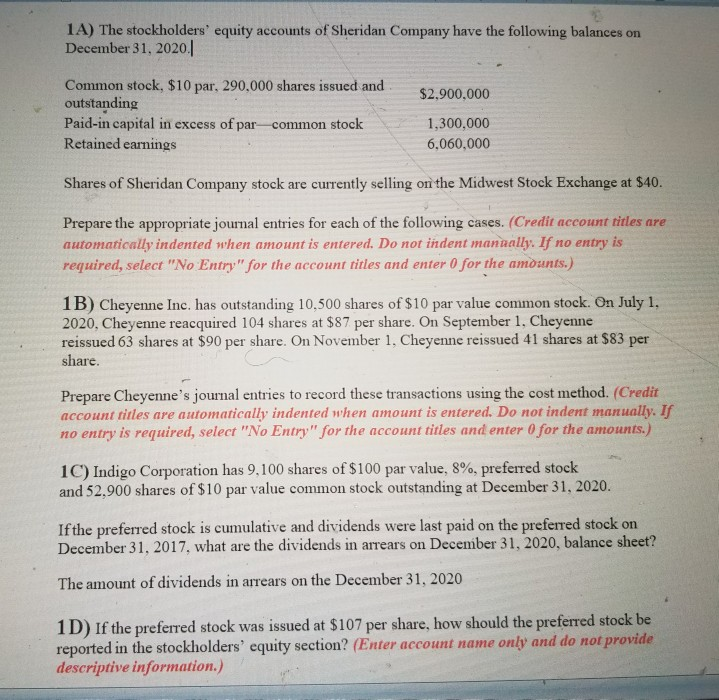

1A) The stockholders' equity accounts of Sheridan Company have the following balances on December 31, 2020.1 $2,900.000 Common stock, $10 par, 290,000 shares issued and outstanding Paid-in capital in excess of par-common stock Retained earnings 1,300,000 6,060,000 Shares of Sheridan Company stock are currently selling on the Midwest Stock Exchange at $40. Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 1B) Cheyenne Inc. has outstanding 10,500 shares of $10 par value common stock. On July 1, 2020, Cheyenne reacquired 104 shares at $87 per share. On September 1, Cheyenne reissued 63 shares at $90 per share. On November 1, Cheyenne reissued 41 shares at $83 per share. Prepare Cheyenne's journal entries to record these transactions using the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 1C) Indigo Corporation has 9,100 shares of $100 par value, 8%, preferred stock and 52,900 shares of $10 par value common stock outstanding at December 31, 2020. If the preferred stock is cumulative and dividends were last paid on the preferred stock on December 31, 2017, what are the dividends in arrears on December 31, 2020, balance sheet? The amount of dividends in arrears on the December 31, 2020 1D) If the preferred stock was issued at $107 per share, how should the preferred stock be reported in the stockholders' equity section? (Enter account name only and do not provide descriptive information.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts