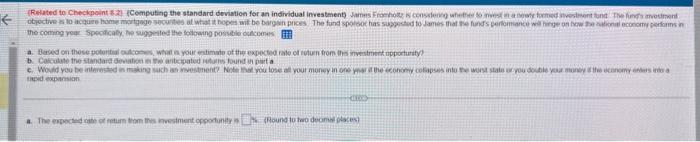

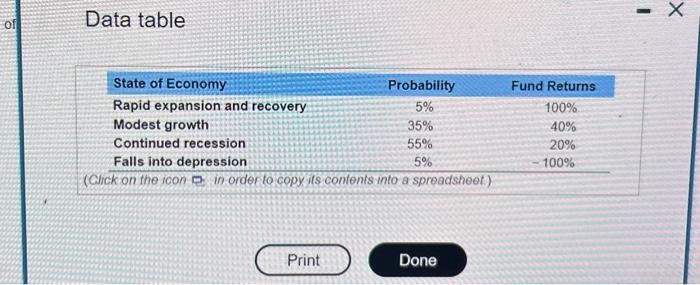

Question: this is one question. thank you, i will leave a thimbs up tapid expinsion Data table Data table (Related to Checkpoint 8.1) (Computing the portfolio

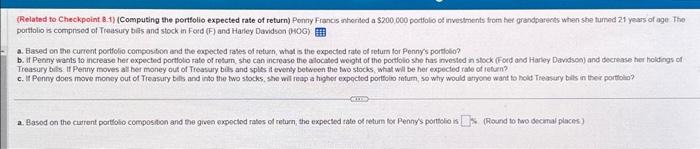

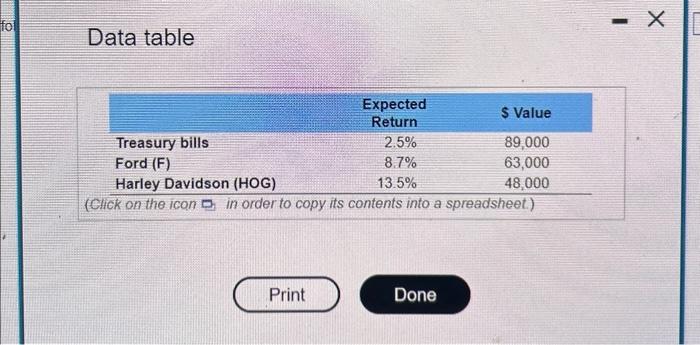

tapid expinsion Data table Data table (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis shorited a $200,000 portfolio of investments form ber grandparents when she turned 21 years of age The porttolio is comprisod of Treasury bes and stock in Ford (F) and Harley Damdson (0wOG) a. Fased on the current portfolio composition and the expectid rates of seturn, what is the expectod rate of retum for Pennys portlolio? Treasury bils. If Penny moves al ber money out of Treasury bils and splits it eventy between the fwo stocks, iwhat wil be her expected rabe of reburn? a. Basod on the current portiflio composition and the given expociod rates of return, the expected sate of retum lor Penny's porttolio is 1. (Round to two decinal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts