Question: *** This is one question with multiple parts The following transactions pertain to Smith Training Company for Year 1: January 30Established the business when it

*** This is one question with multiple parts

The following transactions pertain to Smith Training Company for Year 1:

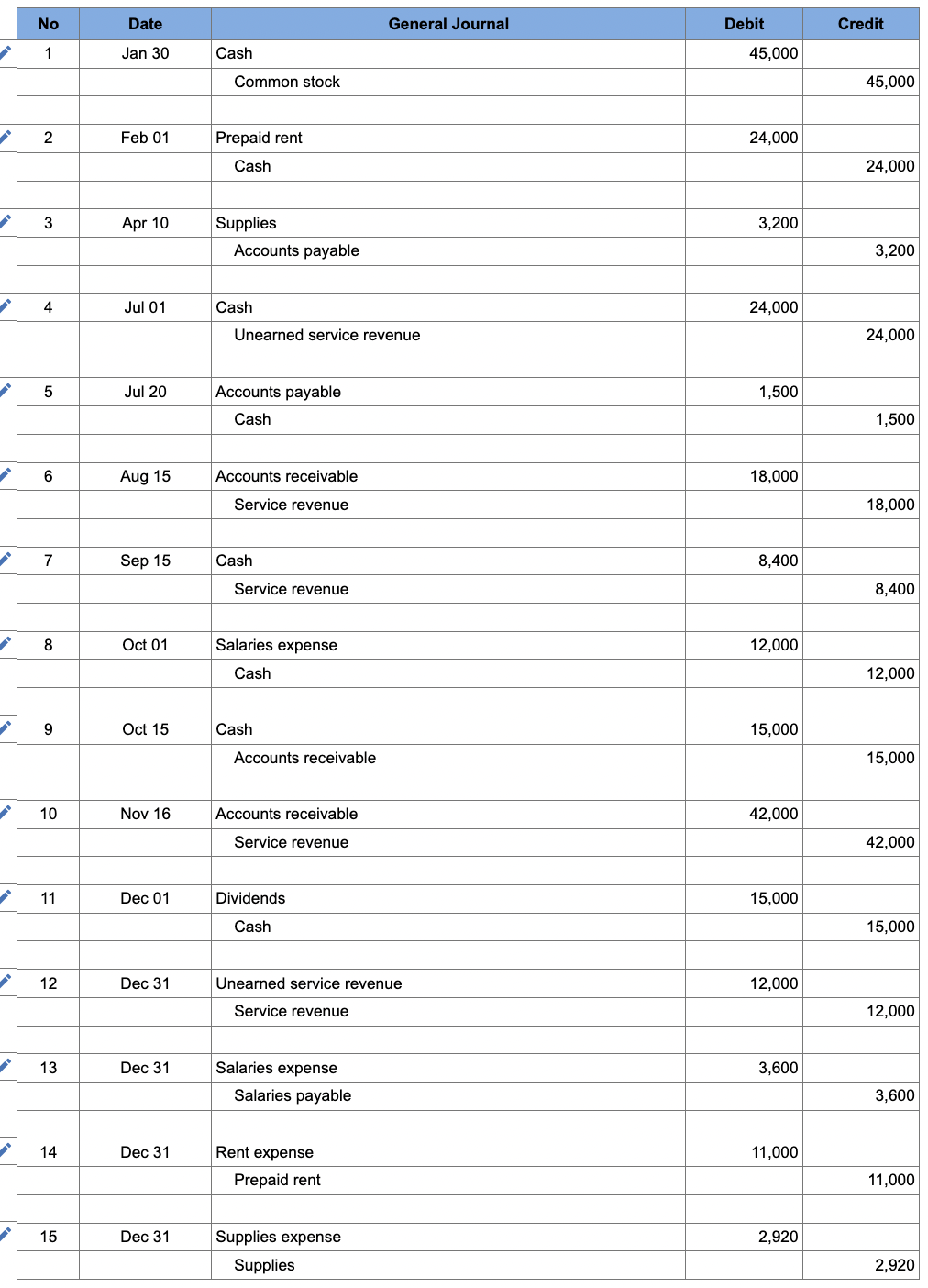

January 30Established the business when it acquired $45,000 cash from the issue of common stock.February 1Paid rent for office space for two years, $24,000 cash.April 10Purchased $3,200 of supplies on account.July 1Received $24,000 cash in advance for services to be provided over the next year.July 20Paid $1,500 of the accounts payable from April 10.August 15Billed a customer $18,000 for services provided during August.September 15Completed a job and received $8,400 cash for services rendered.October 1Paid employee salaries of $12,000 cash.October 15Received $15,000 cash from accounts receivable.November 16Billed customers $42,000 for services rendered on account.December 1Paid a dividend of $15,000 cash to the stockholders.December 31Adjusted records to recognize the services provided on the contract of July 1.December 31Recorded $3,600 of accrued salaries as of December 31.December 31Recorded the rent expense for the year. (See February 1.)December 31Physically counted supplies; $280 was on hand at the end of the period.

Required a. Record the preceding transactions in the general journal.

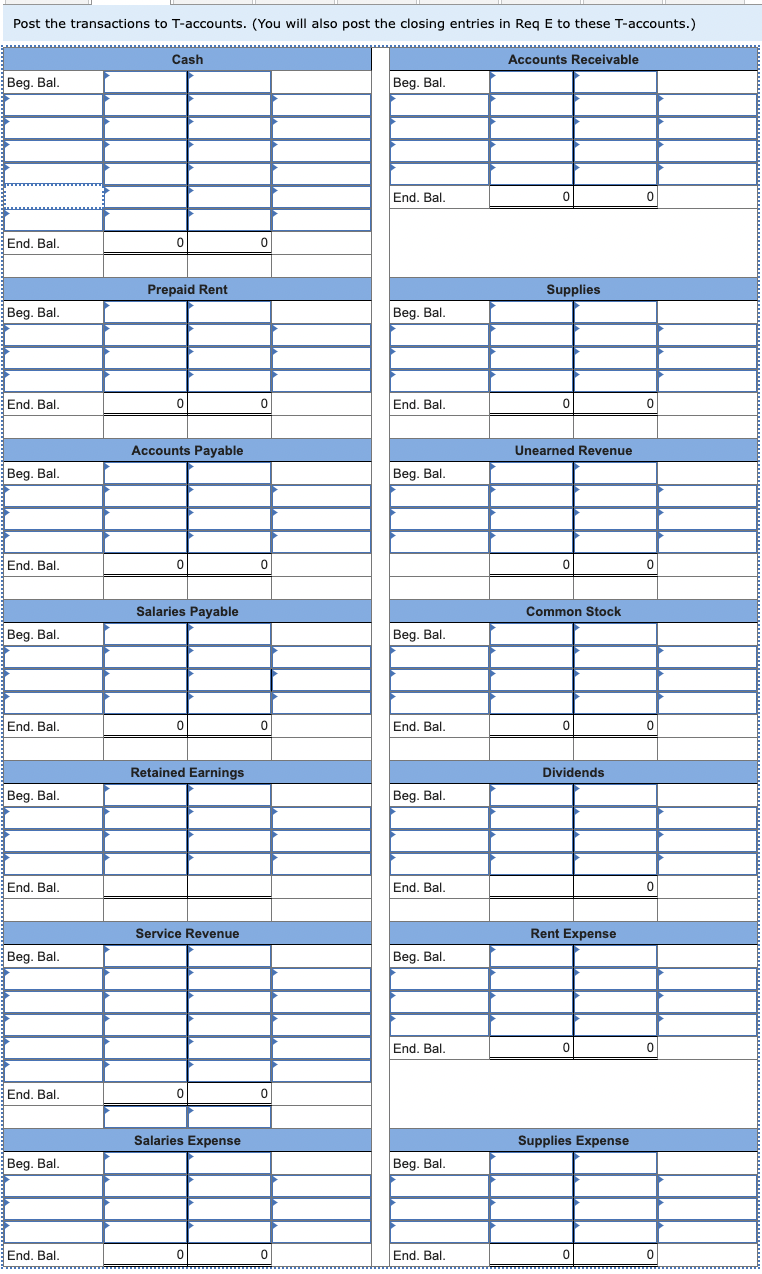

b. Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.)

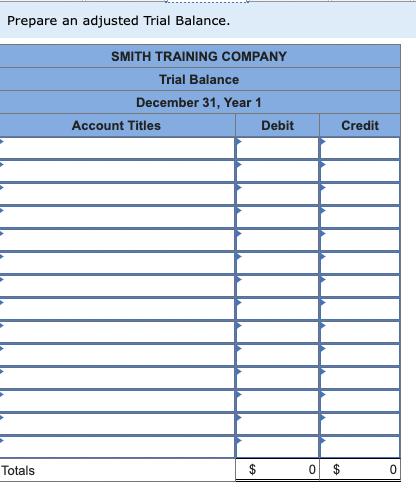

c. Prepare an adjusted Trial Balance.

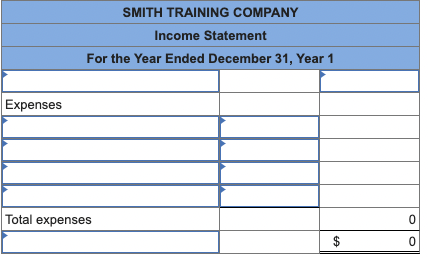

d-1. Prepare an income statement for Year 1.

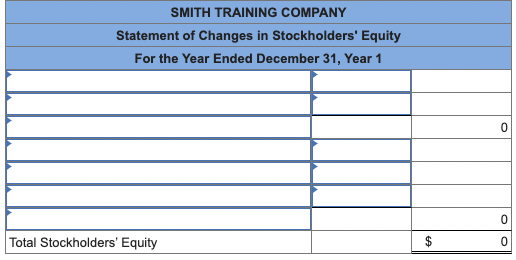

d-2. Prepare a statement of changes in stockholders equity for Year 1.

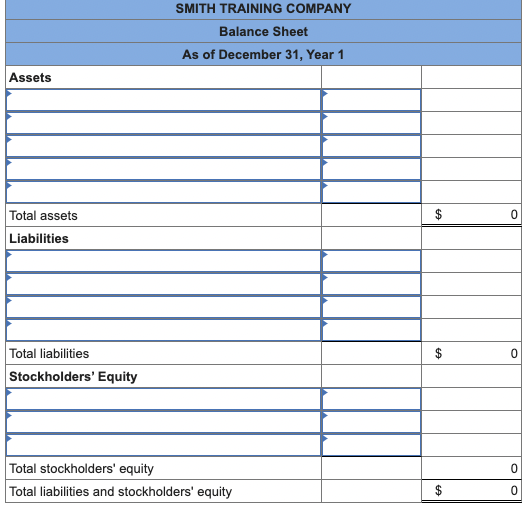

d-3. Prepare a balance sheet for Year 1.

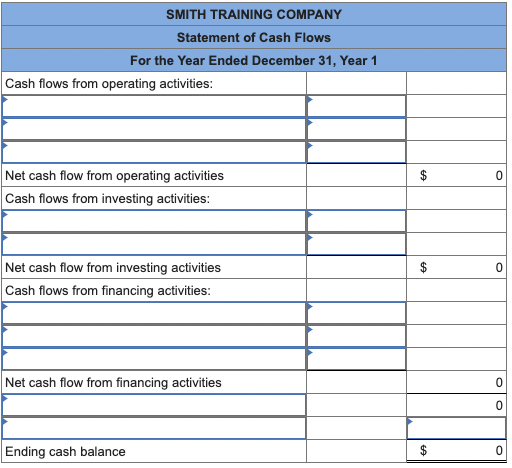

d-4. Prepare a statement of cash flows for Year 1.

e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal.

f. Prepare a post-closing trial balance for December 31, Year 1.

SMITH TRAINING COMPANY Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 SMITH TRAINING COMPANY Balance Sheet As of December 31, Year 1 \begin{tabular}{|l|l|l|} \hline Assets & & \\ \hline & & \\ \hline & & \\ \hline & & $ \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total liabilities & & \\ \hline Stockholders' Equity & & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline \end{tabular} Post the transactions to T-accounts. (You will also post the closing entries in Req E to these T-accounts.) SMITH TRAINING COMPANY Income Statement For the Year Ended December 31, Year 1 Prepare an adjusted Trial Balance. SMITH TRAINING COMPANY Trial Balance December 31, Year 1 \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ SMITH TRAINING COMPANY } \\ \hline \multicolumn{1}{|c|}{ Sor the Year Ended December 31, Year 1 } \\ \hline Cash flows from operating activities: & & \\ \hline & & \\ \hline & & $ \\ \hline Net cash flow from operating activities & & \\ \hline Cash flows from investing activities: & & \\ \hline & & \\ \hline Net cash flow from investing activities & & \\ \hline Cash flows from financing activities: & & \\ \hline & & \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts