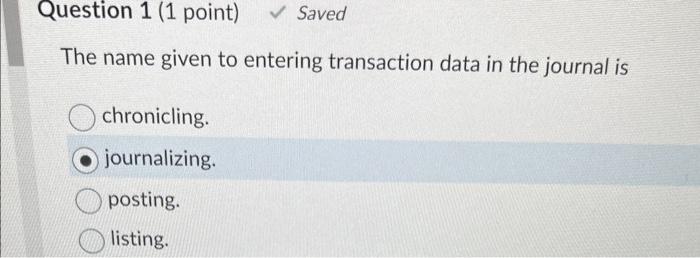

Question: this is only mutiole choice can you help me ? The name given to entering transaction data in the journal is chronicling. journalizing. posting. listing.

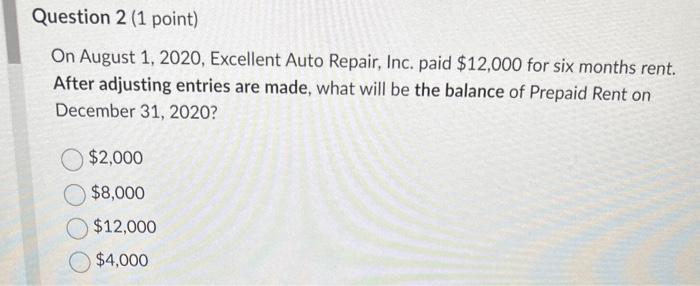

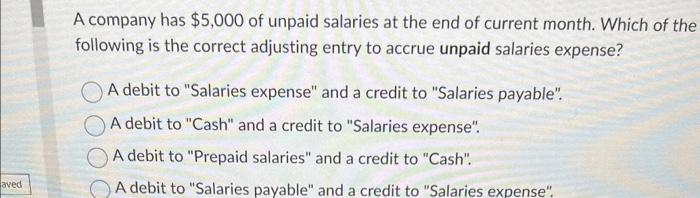

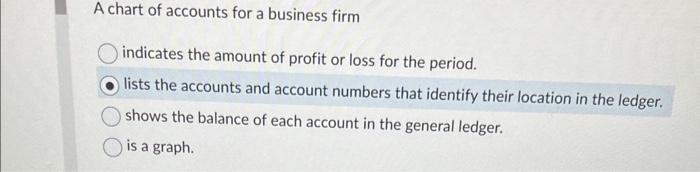

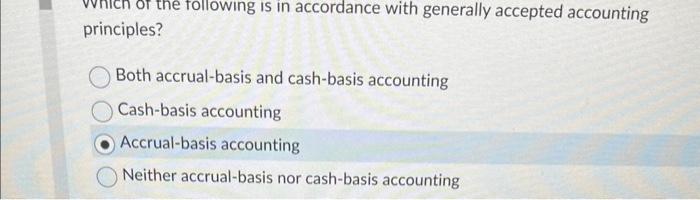

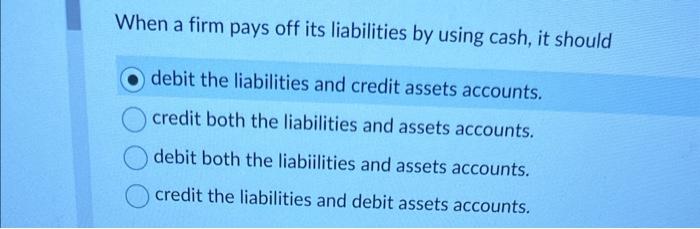

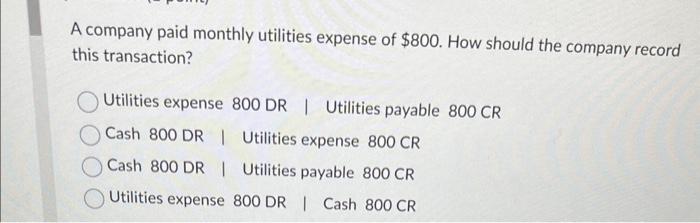

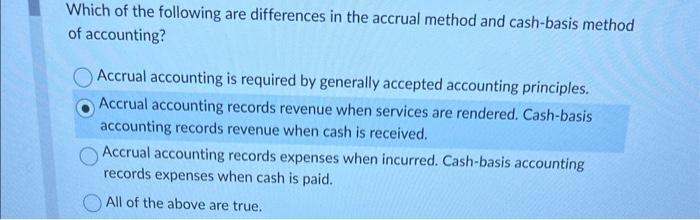

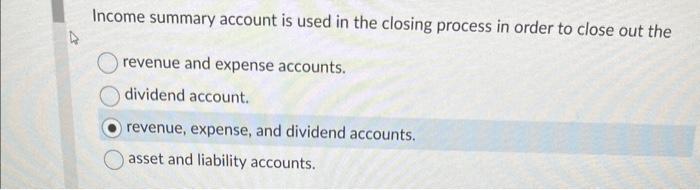

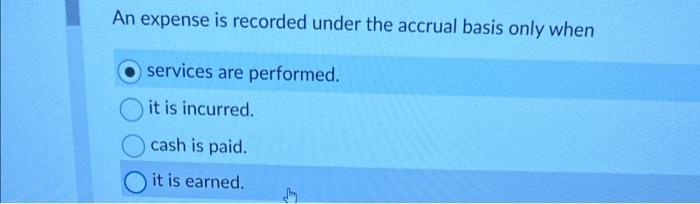

The name given to entering transaction data in the journal is chronicling. journalizing. posting. listing. On August 1, 2020, Excellent Auto Repair, Inc. paid $12,000 for six months rent. After adjusting entries are made, what will be the balance of Prepaid Rent on December 31, 2020? $2,000$8,000$12,000$4,000 A company has $5,000 of unpaid salaries at the end of current month. Which of the following is the correct adjusting entry to accrue unpaid salaries expense? A debit to "Salaries expense" and a credit to "Salaries payable". A debit to "Cash" and a credit to "Salaries expense". A debit to "Prepaid salaries" and a credit to "Cash". A debit to "Salaries payable" and a credit to "Salaries expense". A chart of accounts for a business firm indicates the amount of profit or loss for the period. lists the accounts and account numbers that identify their location in the ledger. shows the balance of each account in the general ledger. is a graph. principles? Both accrual-basis and cash-basis accounting Cash-basis accounting Accrual-basis accounting Neither accrual-basis nor cash-basis accounting When a firm pays off its liabilities by using cash, it should debit the liabilities and credit assets accounts. credit both the liabilities and assets accounts. debit both the liabiilities and assets accounts. credit the liabilities and debit assets accounts. A company paid monthly utilities expense of $800. How should the company record this transaction? Utilities expense 800DR | Utilities payable 800CR Cash 800DR I Utilities expense 800CR Cash 800DR I Utilities payable 800CR Utilities expense 800DR | Cash 800CR Which of the following are differences in the accrual method and cash-basis method of accounting? Accrual accounting is required by generally accepted accounting principles. Accrual accounting records revenue when services are rendered. Cash-basis accounting records revenue when cash is received. Accrual accounting records expenses when incurred. Cash-basis accounting records expenses when cash is paid. All of the above are true. Income summary account is used in the closing process in order to close out the revenue and expense accounts. dividend account. revenue, expense, and dividend accounts. asset and liability accounts. An expense is recorded under the accrual basis only when services are performed. it is incurred. cash is paid. it is earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts