Question: THIS IS ONLY ONE QUESTION; IT JUST HAS A PART A AND B 4) Suppose you have $10,000, and you are offered an investment in

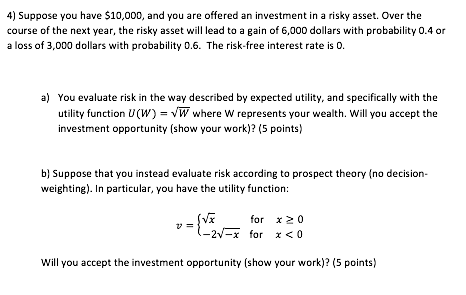

4) Suppose you have $10,000, and you are offered an investment in a risky asset. Over the course of the next year, the risky asset will lead to a gain of 6,000 dollars with probability 0.4 or a loss of 3,000 dollars with probability 0.6. The risk-free interest rate is 0. a) You evaluate risk in the way described by expected utility, and specifically with the utility function U(W) = VW where W represents your wealth. Will you accept the investment opportunity (show your work)? (5 points) b) Suppose that you instead evaluate risk according to prospect theory (no decision- weighting). In particular, you have the utility function: SVE for x 20 1-2-x for x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts