Question: This is only one question. Please fill in all blue blanks. Bottom portion or part b. has options to choose from for each blank. 1.

This is only one question. Please fill in all blue blanks.

Bottom portion or part b. has options to choose from for each blank.

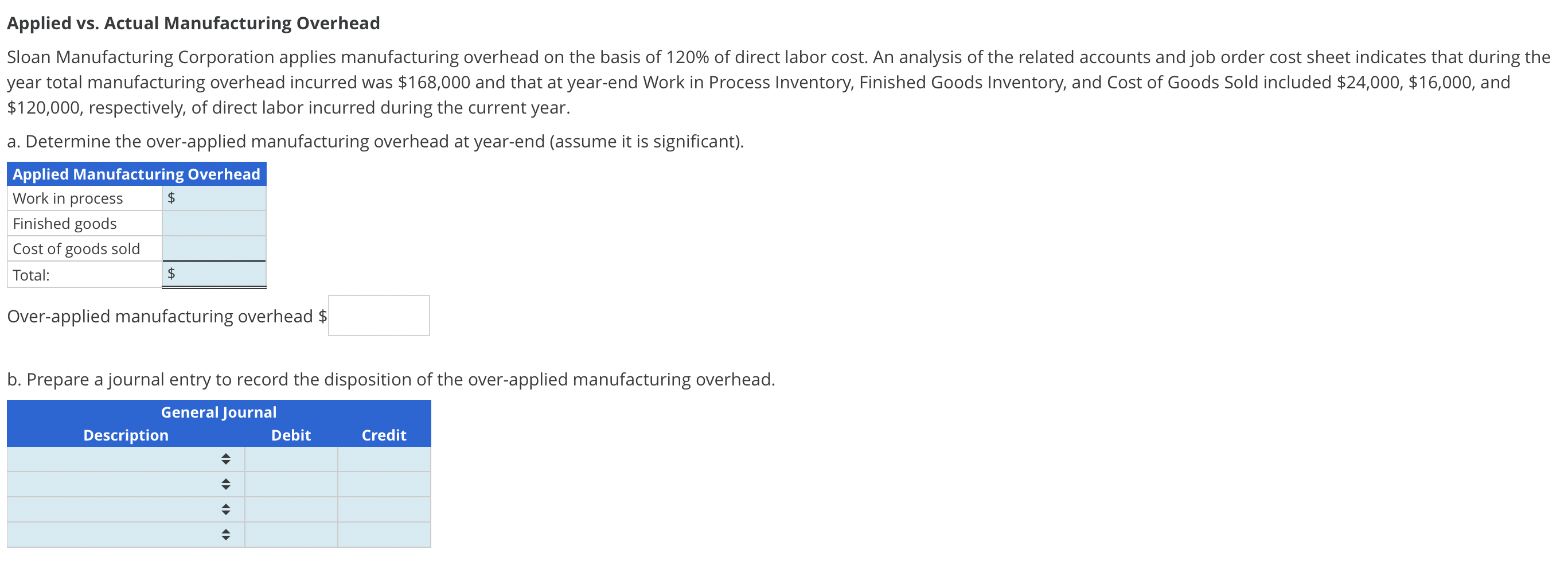

1. The options for the first blank under "description" are: Cost of goods sold, finished goods inventory, manufacturing overhead, & work in process inventory.

2. The options for the second box down are: Manufacturing overhead, wages expense, wages payable, & work in process inventory.

3. The options for third box down: Finished goods inventory, manufacturing overhead, wages expense, & wages payable.

4. The options for the last box: Cost of goods sold, manufacturing overhead, wages expense, & wages payable.

Applied vs. Actual Manufacturing Overhead $120,000, respectively, of direct labor incurred during the current year. a. Determine the over-applied manufacturing overhead at year-end (assume it is significant). Over-applied manufacturing overhead $ b. Prepare a journal entry to record the disposition of the over-applied manufacturing overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts