Question: This is problem 3 out of the 4 problems. This problem is worth 15 points. Show your work for credits. No credits will be given

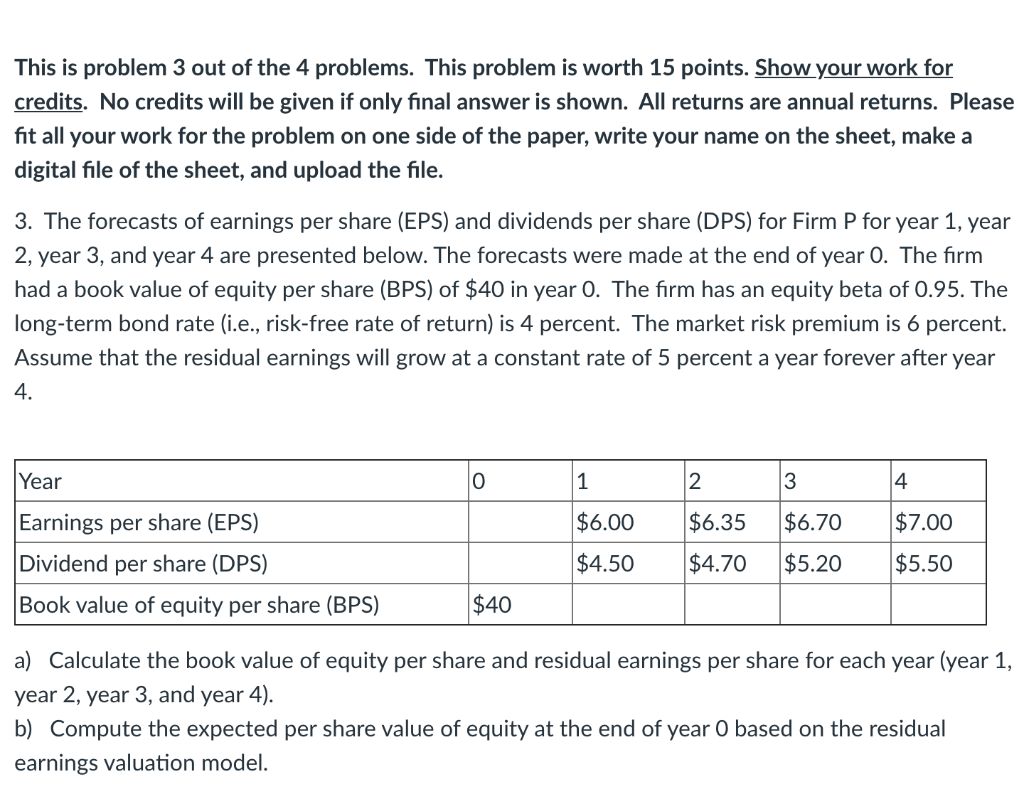

This is problem 3 out of the 4 problems. This problem is worth 15 points. Show your work for credits. No credits will be given if only final answer is shown. All returns are annual returns. Please fit all your work for the problem on one side of the paper, write your name on the sheet, make a digital file of the sheet, and upload the file. 3. The forecasts of earnings per share (EPS) and dividends per share (DPS) for Firm P for year 1, year 2, year 3, and year 4 are presented below. The forecasts were made at the end of year 0. The firm had a book value of equity per share (BPS) of $40 in year 0. The firm has an equity beta of 0.95. The long-term bond rate (i.e., risk-free rate of return) is 4 percent. The market risk premium is 6 percent. Assume that the residual earnings will grow a constant rate of 5 percent a year forever after year 4. Year 0 1 2 3 4 $6.00 $6.35 $6.70 $7.00 Earnings per share (EPS) Dividend per share (DPS) Book value of equity per share (BPS) $4.50 $4.70 $5.20 $5.50 $40 a) Calculate the book value of equity per share and residual earnings per share for each year (year 1, year 2, year 3, and year 4). b) Compute the expected per share value of equity at the end of year 0 based on the residual earnings valuation model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts