Question: This is problem 4 out of the 4 problems. This problem is worth 15 points. Show your work for credits. No credits will be given

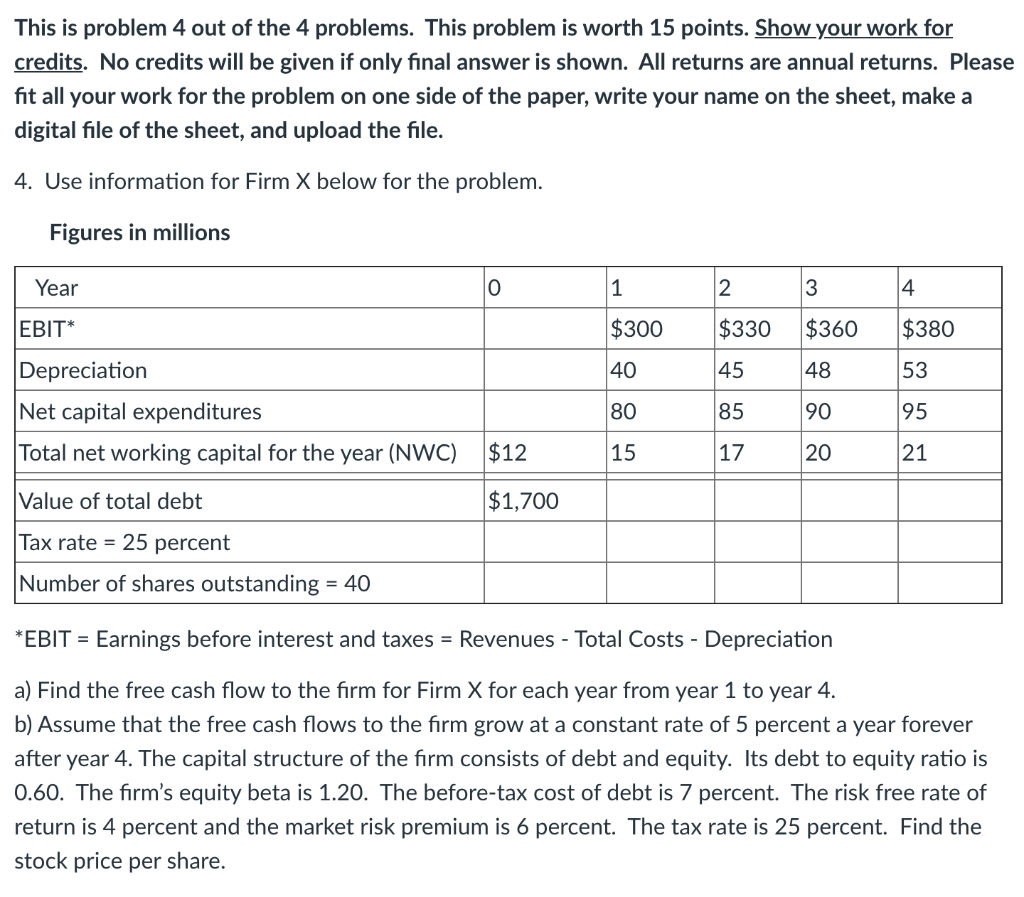

This is problem 4 out of the 4 problems. This problem is worth 15 points. Show your work for credits. No credits will be given if only final answer is shown. All returns are annual returns. Please fit all your work for the problem on one side of the paper, write your name on the sheet, make a digital file of the sheet, and upload the file. 4. Use information for Firm X below for the problem. Figures in millions Year 0 1 2 3 4 EBIT* $300 $330 $360 $380 40 45 48 53 Depreciation Net capital expenditures Total net working capital for the year (NWC) 80 85 90 95 $12 15 17 20 21 Value of total debt $1,700 Tax rate = 25 percent Number of shares outstanding = 40 *EBIT = Earnings before interest and taxes = Revenues - Total Costs - Depreciation a) Find the free cash flow to the firm for Firm X for each year from year 1 to year 4. b) Assume that the free cash flows to the firm grow at a constant rate of 5 percent a year forever after year 4. The capital structure of the firm consists of debt and equity. Its debt to equity ratio is 0.60. The firm's equity beta is 1.20. The before-tax cost of debt is 7 percent. The risk free rate of return is 4 percent and the market risk premium is 6 percent. The tax rate is 25 percent. Find the stock price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts