Question: This is Question 1 a. Please show your work, do not just write down the answer. You do not have to derive formulas that are

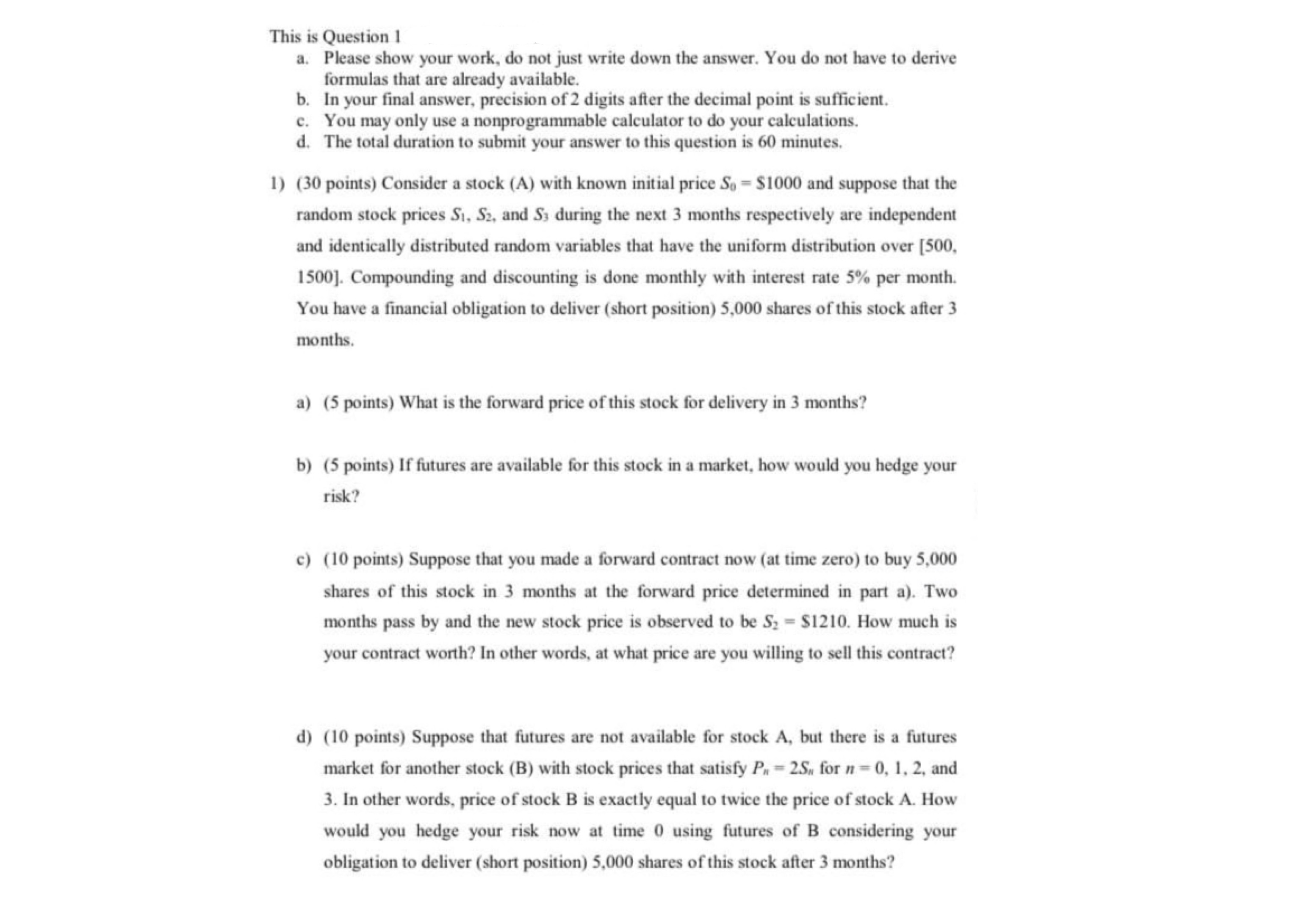

This is Question 1 a. Please show your work, do not just write down the answer. You do not have to derive formulas that are already available. b. In your final answer, precision of 2 digits after the decimal point is sufficient. c. You may only use a nonprogrammable calculator to do your calculations. d. The total duration to submit your answer to this question is 60 minutes. 1) (30 points) Consider a stock (A) with known initial price S0=$1000 and suppose that the random stock prices S1,S2, and S3 during the next 3 months respectively are independent and identically distributed random variables that have the uniform distribution over [500, 1500]. Compounding and discounting is done monthly with interest rate 5% per month. You have a financial obligation to deliver (short position) 5,000 shares of this stock after 3 months. a) (5 points) What is the forward price of this stock for delivery in 3 months? b) (5 points) If futures are available for this stock in a market, how would you hedge your risk? c) (10 points) Suppose that you made a forward contract now (at time zero) to buy 5,000 shares of this stock in 3 months at the forward price determined in part a). Two months pass by and the new stock price is observed to be S2=$1210. How much is your contract worth? In other words, at what price are you willing to sell this contract? d) (10 points) Suppose that futures are not available for stock A, but there is a futures market for another stock (B) with stock prices that satisfy Pn=2SN for n=0,1,2, and 3. In other words, price of stock B is exactly equal to twice the price of stock A. How would you hedge your risk now at time 0 using futures of B considering your obligation to deliver (short position) 5,000 shares of this stock after 3 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts