Question: This is Question This is Answer Format Only put up values for answer No need to explain but answer must be right. (Reconciliation of taxable

This is Question

This is Answer Format

Only put up values for answer

No need to explain but answer must be right.

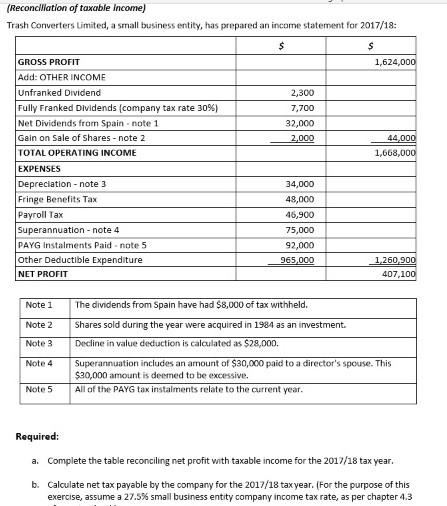

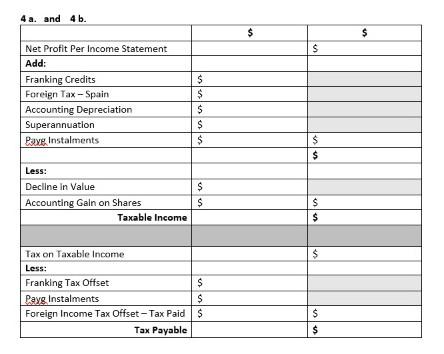

(Reconciliation of taxable income) Trash Converters Limited, a small business entity, has prepared an income statement for 2017/18 $ s GROSS PROFIT 1,624,000 Add: OTHER INCOME Unfranked Dividend 2,300 Fully Franked Dividends company tax rate 30%) 7,700 Net Dividends from Spain. note 1 32,000 Gain on Sale of shares - note 2 2,000 44,000 TOTAL OPERATING INCOME 1,668,000 EXPENSES Depreciation - note 3 34,000 Fringe Benefits Tax 48,000 Payroll Tax 46,900 Superannuation - note 4 75,000 PAYG Instalments Paid - note 5 92,000 Other Deductible Expenditure 965.000 1.260.900 NET PROFIT 407,100 Note 1 The dividends from Spain have had $8,000 of tax withheld. Note 2 Shares sold during the year were acquired in 1984 as an investment. Decline in value deduction is calculated as $28,000. Note 3 Note 4 Superannuation includes an amount of $30,000 paid to a director's spouse. This $30,000 amount is deemed to be excessive. All of the PAYG tax instalments relate to the current year. Note 5 Required: a. Complete the table reconciling net profit with taxable income for the 2017/18 tax year. b. Calculate net tax payable by the company for the 2017/18 tax year. (For the purpose of this exercise, assume a 27.5% small business entity company income tax rate, as per chapter 4.3 a. and 4 b. $ $ $ $ $ Net Profit Per Income Statement Add: Franking Credits Foreign Tax -- Spain Accounting Depreciation Superannuation Pave Instalments $ $ $ $ $ un $ $ Less: Decline in Value Accounting Gain on Shares Taxable income $ $ $ $ $ $ Tax on Taxable income Less: Franking Tax Offset $ Payg Instalments $ Foreign Income Tax Offset - Tax Paid S Tax Payable un $ $ (Reconciliation of taxable income) Trash Converters Limited, a small business entity, has prepared an income statement for 2017/18 $ s GROSS PROFIT 1,624,000 Add: OTHER INCOME Unfranked Dividend 2,300 Fully Franked Dividends company tax rate 30%) 7,700 Net Dividends from Spain. note 1 32,000 Gain on Sale of shares - note 2 2,000 44,000 TOTAL OPERATING INCOME 1,668,000 EXPENSES Depreciation - note 3 34,000 Fringe Benefits Tax 48,000 Payroll Tax 46,900 Superannuation - note 4 75,000 PAYG Instalments Paid - note 5 92,000 Other Deductible Expenditure 965.000 1.260.900 NET PROFIT 407,100 Note 1 The dividends from Spain have had $8,000 of tax withheld. Note 2 Shares sold during the year were acquired in 1984 as an investment. Decline in value deduction is calculated as $28,000. Note 3 Note 4 Superannuation includes an amount of $30,000 paid to a director's spouse. This $30,000 amount is deemed to be excessive. All of the PAYG tax instalments relate to the current year. Note 5 Required: a. Complete the table reconciling net profit with taxable income for the 2017/18 tax year. b. Calculate net tax payable by the company for the 2017/18 tax year. (For the purpose of this exercise, assume a 27.5% small business entity company income tax rate, as per chapter 4.3 a. and 4 b. $ $ $ $ $ Net Profit Per Income Statement Add: Franking Credits Foreign Tax -- Spain Accounting Depreciation Superannuation Pave Instalments $ $ $ $ $ un $ $ Less: Decline in Value Accounting Gain on Shares Taxable income $ $ $ $ $ $ Tax on Taxable income Less: Franking Tax Offset $ Payg Instalments $ Foreign Income Tax Offset - Tax Paid S Tax Payable un $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts