Question: this is reading material and question. Every answer is about 150-300 words. You can answer any question, all is best. Question1:A winning strategy must pass

this is reading material and question. Every answer is about 150-300 words. You can answer any question, all is best.

Question1:A winning strategy must pass three tests. Identify by name each test, describe the test in detail, and use an example in each description that applies to Trek. In closing, your answer must make a clear determination if Trek has a winning strategy and why.

Question 2: What is a balanced score card? What are the arguments for and against adopting the balanced scorecard approach? Identify by name the four dimensions of performance indicators, and using Trek as an example, provide at least two examples of objectives that Trek could use on a balanced scorecard.

Question3: Identify five factors that tend to intensify competitive rivalry among an industry's member firms. Which of these factors do you believe are the strongest for TREK in the bicycle industry? Why

Question 4: What is a weighted competitive strength assessment? If you were a manager tasked with developing strategy at Trek what would you find insightful about a weighted competitive strength assessment? What are the key success factors (KSFs) for TREK and the industry that should be included in a weighted competitive strength assessment?

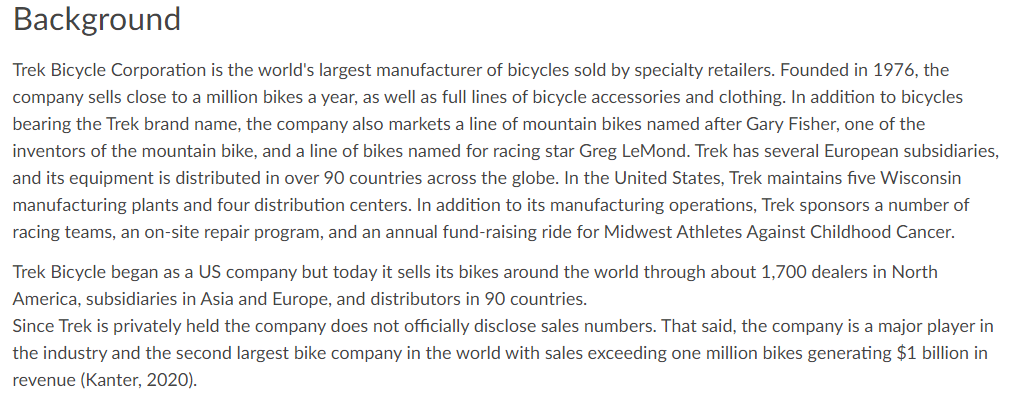

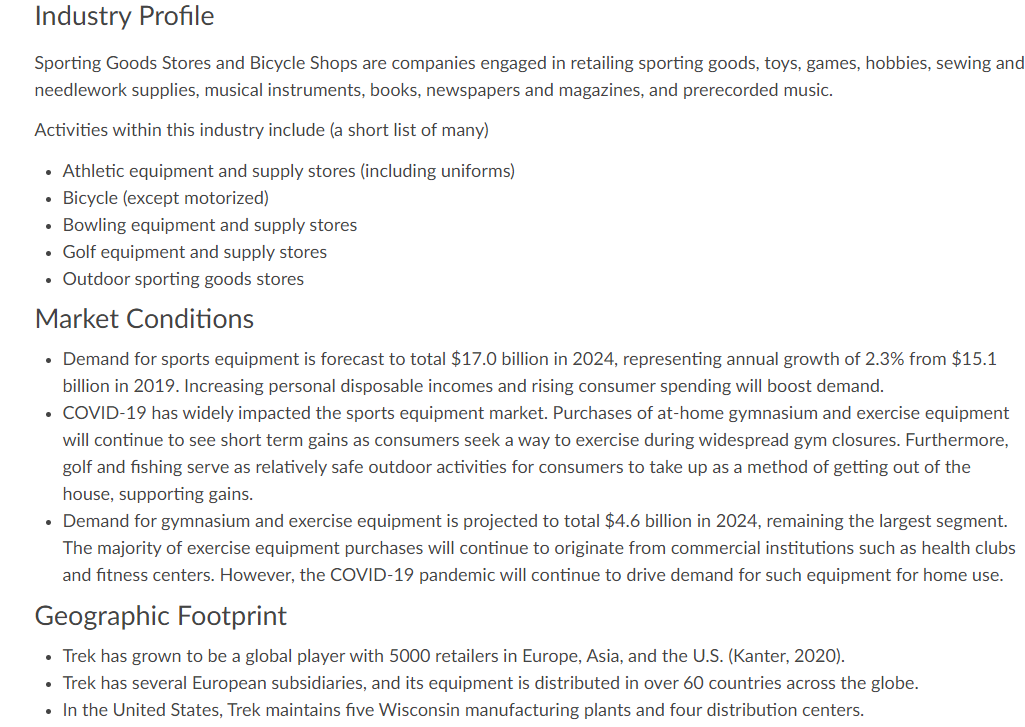

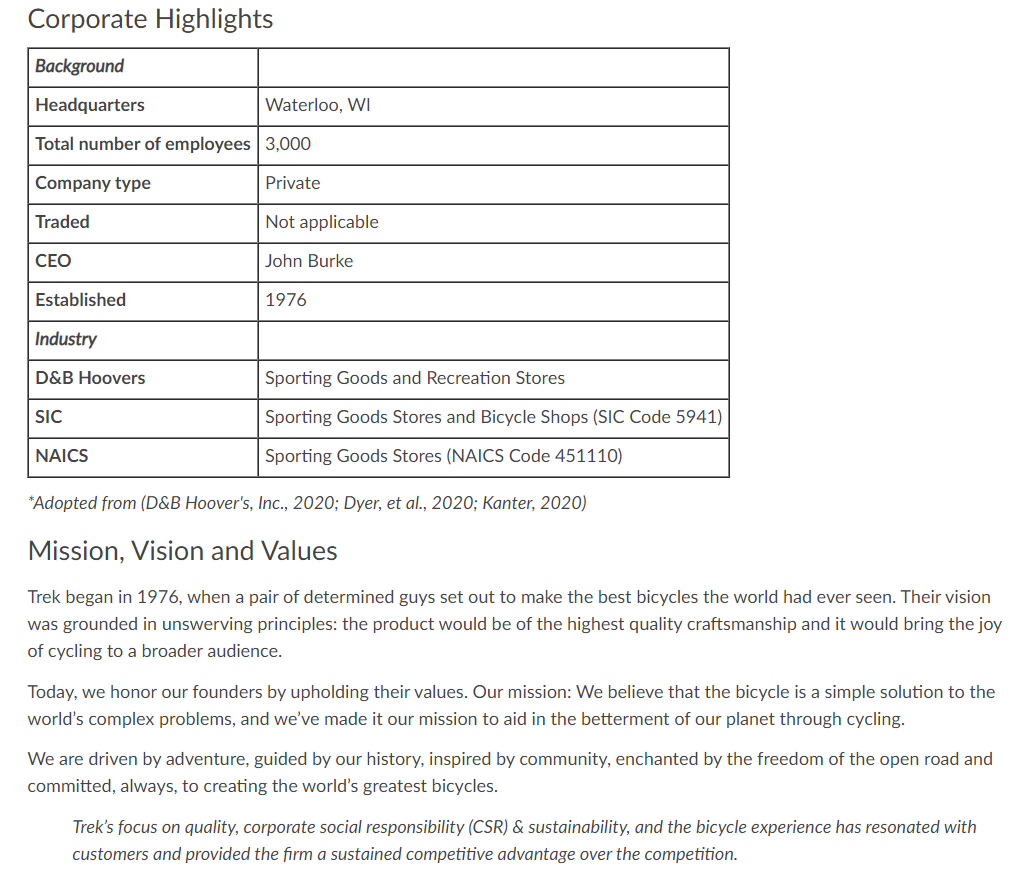

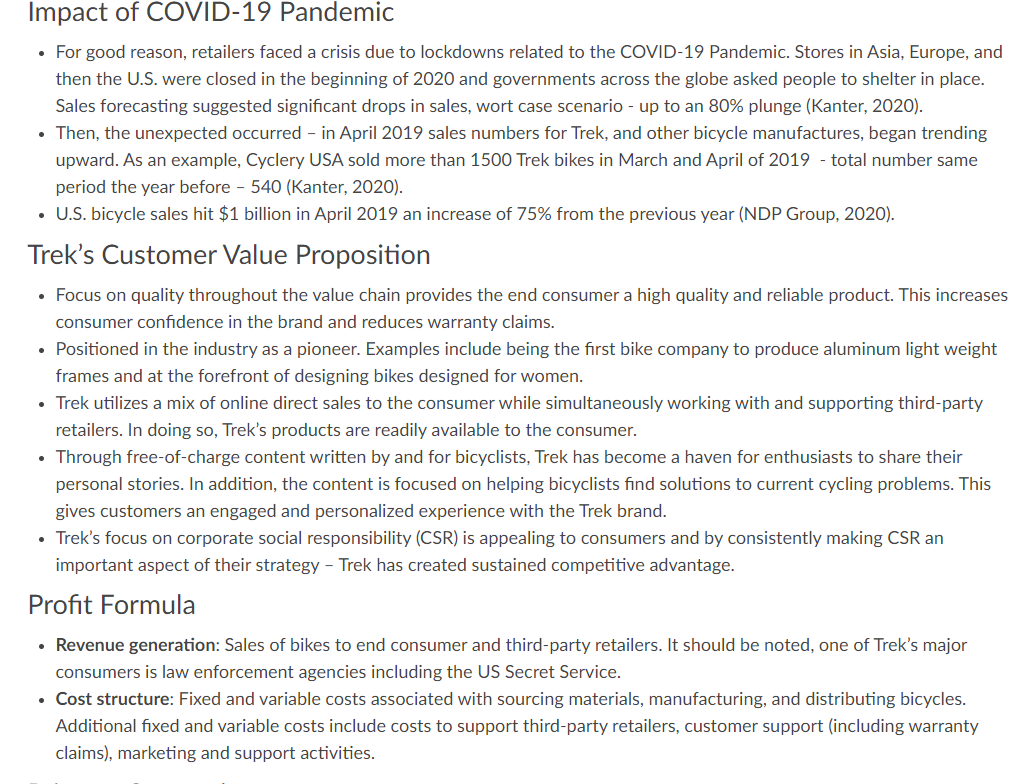

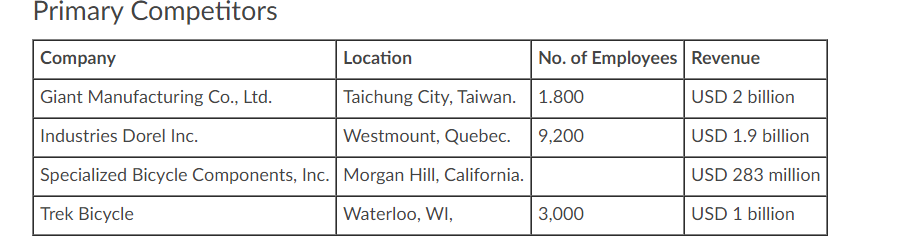

Background Trek Bicycle Corporation is the world's largest manufacturer of bicycles sold by specialty retailers. Founded in 1976, the company sells close to a million bikes a year, as well as full lines of bicycle accessories and clothing. In addition to bicycles bearing the Trek brand name, the company also markets a line of mountain bikes named after Gary Fisher, one of the inventors of the mountain bike, and a line of bikes named for racing star Greg LeMond. Trek has several European subsidiaries, and its equipment is distributed in over 90 countries across the globe. In the United States, Trek maintains five Wisconsin manufacturing plants and four distribution centers. In addition to its manufacturing operations, Trek sponsors a number of racing teams, an on-site repair program, and an annual fund-raising ride for Midwest Athletes Against Childhood Cancer. Trek Bicycle began as a US company but today it sells its bikes around the world through about 1,700 dealers in North America, subsidiaries in Asia and Europe, and distributors in 90 countries. Since Trek is privately held the company does not officially disclose sales numbers. That said, the company is a major player in the industry and the second largest bike company in the world with sales exceeding one million bikes generating $1 billion in revenue (Kanter, 2020). Industry Profile Sporting Goods Stores and Bicycle Shops are companies engaged in retailing sporting goods, toys, games, hobbies, sewing and needlework supplies, musical instruments, books, newspapers and magazines, and prerecorded music. Activities within this industry include (a short list of many) Athletic equipment and supply stores (including uniforms) Bicycle (except motorized) Bowling equipment and supply stores Golf equipment and supply stores Outdoor sporting goods stores Market Conditions Demand for sports equipment is forecast to total $17.0 billion in 2024, representing annual growth of 2.3% from $15.1 billion in 2019. Increasing personal disposable incomes and rising consumer spending will boost demand. COVID-19 has widely impacted the sports equipment market. Purchases of at-home gymnasium and exercise equipment will continue to see short term gains as consumers seek a way to exercise during widespread gym closures. Furthermore, golf and fishing serve as relatively safe outdoor activities for consumers to take up as a method of getting out of the house, supporting gains. Demand for gymnasium and exercise equipment is projected to total $4.6 billion in 2024, remaining the largest segment. The majority of exercise equipment purchases will continue to originate from commercial institutions such as health clubs and fitness centers. However, the COVID-19 pandemic will continue to drive demand for such equipment for home use. Geographic Footprint Trek has grown to be a global player with 5000 retailers in Europe, Asia, and the U.S. (Kanter, 2020). Trek has several European subsidiaries, and its equipment is distributed in over 60 countries across the globe. In the United States, Trek maintains five Wisconsin manufacturing plants and four distribution centers. Corporate Highlights Background Headquarters Waterloo, WI Total number of employees 3,000 Company type Private Traded Not applicable CEO John Burke Established 1976 Industry D&B Hoovers Sporting Goods and Recreation Stores SIC Sporting Goods Stores and Bicycle Shops (SIC Code 5941) NAICS Sporting Goods Stores (NAICS Code 451110) *Adopted from (D&B Hoover's, Inc., 2020; Dyer, et al., 2020; Kanter, 2020) Mission, Vision and Values Trek began in 1976, when a pair of determined guys set out to make the best bicycles the world had ever seen. Their vision was grounded in unswerving principles: the product would be of the highest quality craftsmanship and it would bring the joy of cycling to a broader audience. Today, we honor our founders by upholding their values. Our mission: We believe that the bicycle is a simple solution to the world's complex problems, and we've made it our mission to aid in the betterment of our planet through cycling. We are driven by adventure, guided by our history, inspired by community, enchanted by the freedom of the open road and committed, always, to creating the world's greatest bicycles. Trek's focus on quality, corporate social responsibility (CSR) & sustainability, and the bicycle experience has resonated with customers and provided the firm a sustained competitive advantage over the competition. Impact of COVID-19 Pandemic For good reason, retailers faced a crisis due to lockdowns related to the COVID-19 Pandemic. Stores in Asia, Europe, and then the U.S. were closed in the beginning of 2020 and governments across the globe asked people to shelter in place. Sales forecasting suggested significant drops in sales, wort case scenario - up to an 80% plunge (Kanter, 2020). Then, the unexpected occurred - in April 2019 sales numbers for Trek, and other bicycle manufactures, began trending upward. As an example, Cyclery USA sold more than 1500 Trek bikes in March and April of 2019 - total number same period the year before 540 (Kanter, 2020). U.S. bicycle sales hit $1 billion in April 2019 an increase of 75% from the previous year (NDP Group, 2020). Trek's Customer Value Proposition Focus on quality throughout the value chain provides the end consumer a high quality and reliable product. This increases consumer confidence in the brand and reduces warranty claims. Positioned in the industry as a pioneer. Examples include being the first bike company to produce aluminum light weight frames and at the forefront of designing bikes designed for women. Trek utilizes a mix of online direct sales to the consumer while simultaneously working with and supporting third-party retailers. In doing so, Trek's products are readily available to the consumer. Through free-of-charge content written by and for bicyclists, Trek has become a haven for enthusiasts to share their personal stories. In addition, the content is focused on helping bicyclists find solutions to current cycling problems. This gives customers an engaged and personalized experience with the Trek brand. Trek's focus on corporate social responsibility (CSR) is appealing to consumers and by consistently making CSR an important aspect of their strategy - Trek has created sustained competitive advantage. Profit Formula Revenue generation: Sales of bikes to end consumer and third-party retailers. It should be noted, one of Trek's major consumers is law enforcement agencies including the US Secret Service. Cost structure: Fixed and variable costs associated with sourcing materials, manufacturing, and distributing bicycles. Additional fixed and variable costs include costs to support third-party retailers, customer support (including warranty claims), marketing and support activities. Primary Competitors Company Location No. of Employees Revenue 1.800 USD 2 billion Giant Manufacturing Co., Ltd. Taichung City, Taiwan. Industries Dorel Inc. Westmount, Quebec. Specialized Bicycle Components, Inc. Morgan Hill, California. 9,200 USD 1.9 billion USD 283 million Trek Bicycle Waterloo, WI, 3,000 USD 1 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts