Question: This is the 3rd time im posting this question, everytime gave me a wrong answer. please I hope to get a correct answer thus time.

![thus time. Thanks. [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9ab6bf3628_80366e9ab6ba2208.jpg)

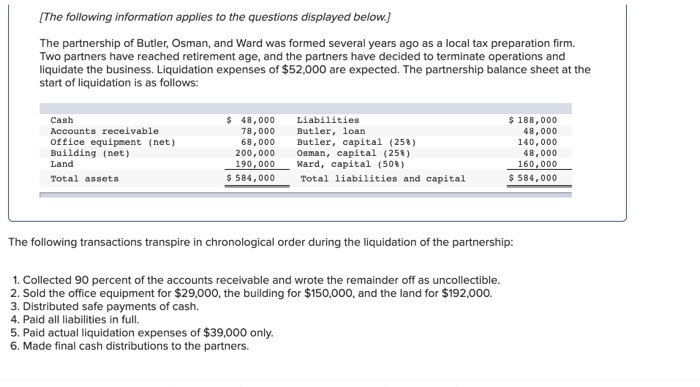

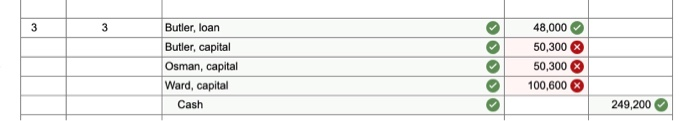

[The following information applies to the questions displayed below.] The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $52,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash Accounts receivable office equipment (net) Building (net) Land Total assets $ 48,000 78,000 68,000 200,000 190,000 $ 584,000 Liabilities Butler, loan Butler, capital (258) Osman, capital (258) Ward, capital (508) Total liabilities and capital $ 188,000 48,000 140,000 48,000 160,000 $ 584,000 The following transactions transpire in chronological order during the liquidation of the partnership: 1. Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. 2. Sold the office equipment for $29,000, the building for $150,000, and the land for $192,000. 3. Distributed safe payments of cash. 4. Paid all liabilities in full. 5. Paid actual liquidation expenses of $39,000 only. 6. Made final cash distributions to the partners. 3 3 >I Butler, loan Butler, capital Osman, capital Ward, capital Cash >> 48,000 50,300 50,300 100,600 249,200 $150,000, and the land for $192, 3 Distributed safe payments of cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts