Question: . this is the answer for the first 4 parts i need the answer for the rest b. The optimistic approach Maximax calls for the

.

.

this is the answer for the first 4 parts

i need the answer for the rest

b. The optimistic approach Maximax calls for the maximum value of maximum values under each alternative which is Max [ 500,0] =500 which corresonds to drill.

Conservative approach Maximin calls for minimum value of maximum values under each alternative which is

Max [ 0,-100] =0 which corresonds to No drill.

Minimax regret table

| Oil | Dry | |

| Drill | 0 | 100 |

| No drill | 500 |

Minimax regret means Minimum value of maximum regret under each alternative which is

Min [ 100,500] =100 which corresponds to Drill

c EV criteria for Drill = 0.45x500+0.55x(-100) =170

EV criteria for No drill = 0

Drill is the right choice.

d. EVPI = EV with PI - EV without PI

= 0.45x500+0.55x0 = 225

EV without PI =170

EVPI =225-170 =55

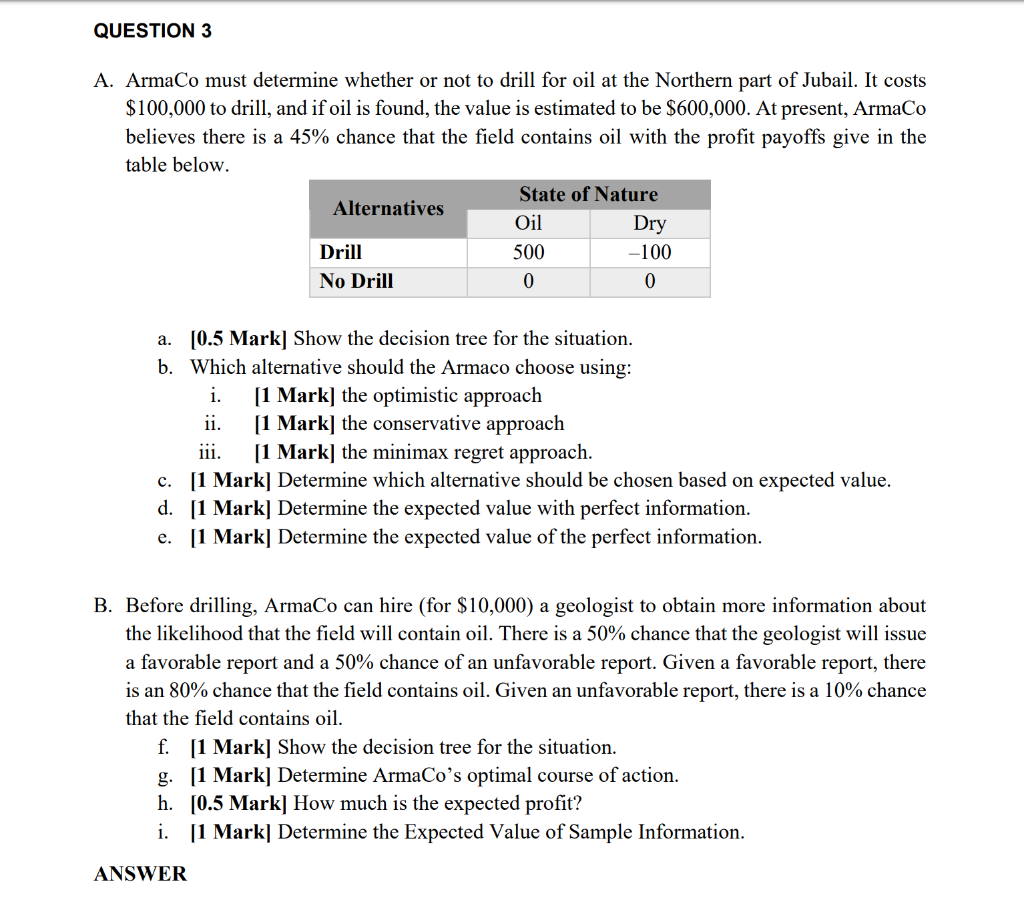

QUESTION 3 A. ArmaCo must determine whether or not to drill for oil at the Northern part of Jubail. It costs $100,000 to drill, and if oil is found, the value is estimated to be $600,000. At present, ArmaCo believes there is a 45% chance that the field contains oil with the profit payoffs give in the table below. State of Nature Alternatives Oil Dry Drill -100 No Drill 0 500 0 a. [0.5 Mark] Show the decision tree for the situation. b. Which alternative should the Armaco choose using: i. [1 Mark] the optimistic approach ii. [1 Mark] the conservative approach iii. [1 Mark] the minimax regret approach. c. [1 Mark] Determine which alternative should be chosen based on expected value. d. [1 Mark] Determine the expected value with perfect information. e. [1 Mark] Determine the expected value of the perfect information. B. Before drilling, ArmaCo can hire (for $10,000) a geologist to obtain more information about the likelihood that the field will contain oil. There is a 50% chance that the geologist will issue a favorable report and a 50% chance of an unfavorable report. Given a favorable report, there is an 80% chance that the field contains oil. Given an unfavorable report, there is a 10% chance that the field contains oil. f. [1 Mark] Show the decision tree for the situation. g. [1 Mark] Determine ArmaCo's optimal course of action. h. [0.5 Mark] How much is the expected profit? i. [1 Mark] Determine the Expected Value of Sample Information. ANSWER oil so oooo ;Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts