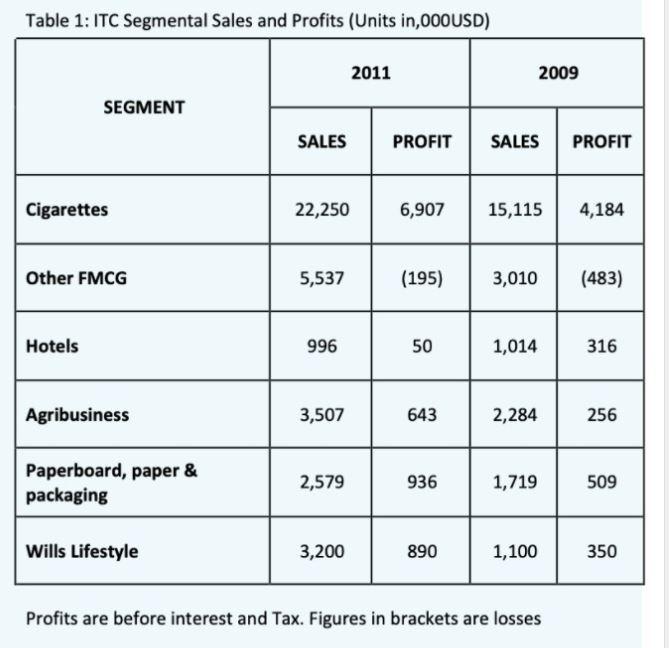

Question: This is the complete question Read the case study below ITCS DIVERSE PORTFOLIO. The data in Table 1 is also part of the case study.

This is the complete question

Read the case study below ITCS DIVERSE PORTFOLIO. The data in Table 1 is also part of the case study. After reading both the case study text and the table - answer the questions in the text field provided and please make sure to number your responses.

1. Where do each of ITCs individual SBUs fit in terms of the BCG matrix justify your choices? (7 marks)

2. Identify and discuss the value of the various synergies in the ITC business. (3 marks)

Case Study -

ITCs diverse portfolio

ITC is one of Indias largest consumer goods companies, with an increasingly diversified product portfolio. Its Chairman, Y.C. Deveshwar, describes its strategy thus: It is ITCs endeavor to continuously explore opportunities for growth by synergising and blending its multiple core competences to create new epicentres of growth. The employees of ITC are inspired by the vision of growing ITC into one of Indias premier institutions and are willing to go the extra mile to generate value for the economy, in the process creating growing value for the shareholders.

Founded in 1910 as the Imperial Tobacco Company of India, with brands such as Wills, Gold Cut and John Players, ITC continued its consistent growth and now holds about two thirds of the market for cigarettes in India, with Philip Morris and BAT distant seconds with about 13 per cent each. However, cigarettes in India are highly discouraged by the Indian government, and increasingly heavily taxed.

ITC has a long diversification history. In the 1920s, ITC set up a paperboard, packaging and printing business originally to supply its cigarette business. By 2012, this was Indias largest packaging solutions provider. However, in this same year Australia announced that cigarette manufacturers have to sell their produce in drab green packages with graphic pictorial warnings. Market research done by the Public Health Foundation of India and Hriday, a health awareness NGO, showed more than 80 per cent of people felt plain packaging would help reduce the attractiveness and appeal of tobacco products. Indias Health Ministry officials warned such initiatives may be used in the future. This did not bode well for future growth.

In 1975, ITC entered the hotel business, becoming the countrys 4th largest operator with over 100 hotels by 2009, ranging from deluxe to economy in a market dominated by Oyo Hotels and Homes which ranks among the largest hotel chains in the world.

The early twenty-first century saw many new diversification initiatives, especially in the booming Fast-Moving Consumer Goods (FMCG) sector. Initially it started in the food business, with Sunfeast biscuits and Bingo snacks, the Aashirvaad wheat-flour business. By 2008 Aashirvaad reached 15% Indian market share, Sunfeast 12% and Bingo with 11 % respectively. ITCs own long-established Agribusinesses, were an important source of supply and financing for these initiatives. By 2008 Aashirvaad reached over 50 per cent Indian market share, and Sunfeast and Bingo had 12 and 11 per cent respectively.

At the same time, ITC took advantage of the strong brand values of its Wills cigarettes to launch Wills Lifestyle, a range of upmarket clothing stores, with its own designs. In 2009, Wills Lifestyle was recognised as Indias Most Admired Fashion Brand of the Year. ITC continued its growth by launching its personal care business, again using its cigarette brand names, for example Essenza Di Wills (fragrances) and Fiama Di Wills (hair and skin care). However, ITCs lifestyle brands are up against some very strong competitors in the lifestyle space, who led by Monte Carlo effectively control the lions share of the Indian market.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts