Question: This is the complete question, thanks ! QUESTION 1 On January 1, 20,19 you had the following information from the financial pages of a local

This is the complete question, thanks !

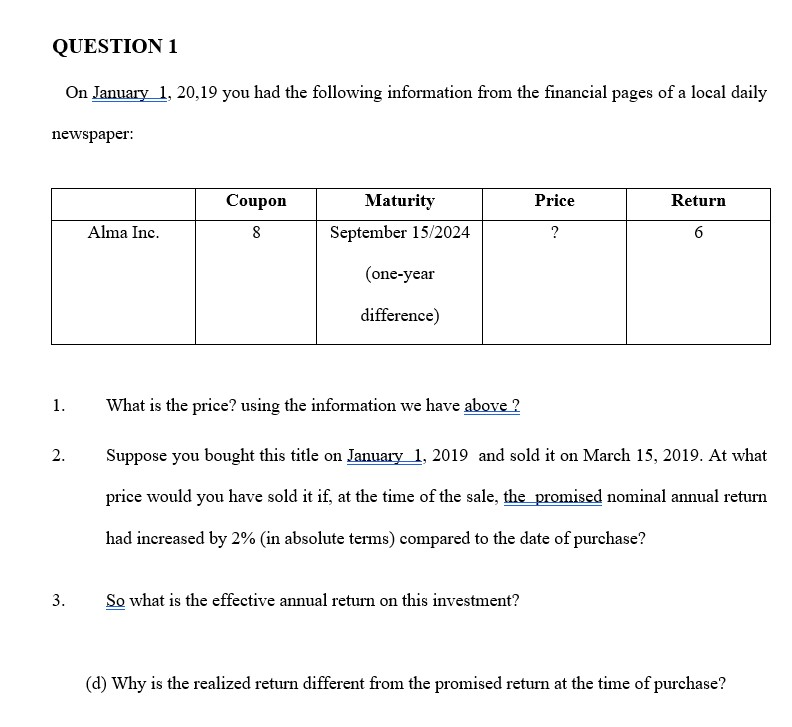

QUESTION 1 On January 1, 20,19 you had the following information from the financial pages of a local daily newspaper: Coupon Price Return Maturity September 15/2024 Alma Inc. 8 ? 6 (one-year difference) 1. What is the price? using the information we have above ? 2. Suppose you bought this title on January 1, 2019 and sold it on March 15, 2019. At what price would you have sold it if, at the time of the sale, the promised nominal annual return had increased by 2% (in absolute terms) compared to the date of purchase? 3. So what is the effective annual return on this investment? (d) Why is the realized return different from the promised return at the time of purchase? QUESTION 1 On January 1, 20,19 you had the following information from the financial pages of a local daily newspaper: Coupon Price Return Maturity September 15/2024 Alma Inc. 8 ? 6 (one-year difference) 1. What is the price? using the information we have above ? 2. Suppose you bought this title on January 1, 2019 and sold it on March 15, 2019. At what price would you have sold it if, at the time of the sale, the promised nominal annual return had increased by 2% (in absolute terms) compared to the date of purchase? 3. So what is the effective annual return on this investment? (d) Why is the realized return different from the promised return at the time of purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts