Question: This is the entire question Please show your work! Examine the following book value balance sheet for University Products Inc. The preferred stock currently sells

This is the entire question

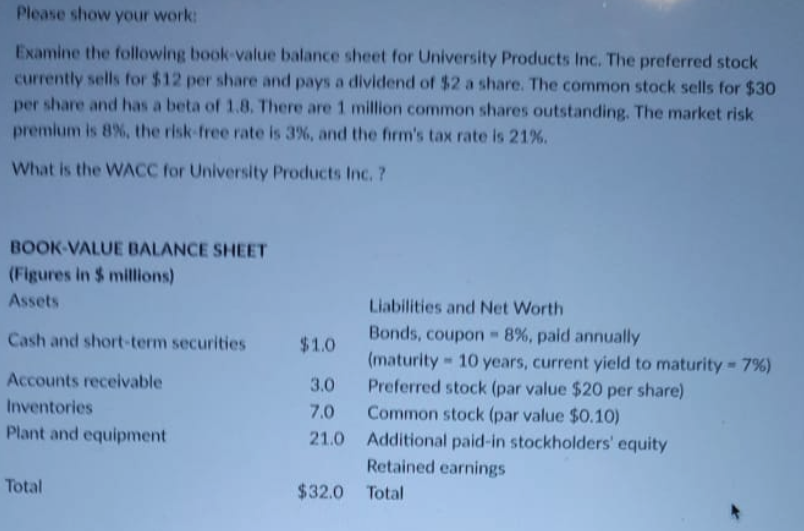

Please show your work! Examine the following book value balance sheet for University Products Inc. The preferred stock currently sells for $12 per share and pays a dividend of $2 a share. The common stock sells for $30 per share and has a beta of 1.8. There are 1 million common shares outstanding. The market risk premium is 8%, the risk-free rate is 3%, and the firm's tax rate is 21%. What is the WACC for University Products Inc.? BOOK VALUE BALANCE SHEET (Figures in $ millions) Assets Cash and short-term securities Accounts receivable Inventories Plant and equipment Liabilities and Net Worth Bonds, coupon - 8%, paid annually $1.0 (maturity - 10 years, current yield to maturity - 7%) 3.0 Preferred stock (par value $20 per share) 7.0 Common stock (par value $0.10) 21.0 Additional paid-in stockholders' equity Retained earnings $32.0 Total Total Please show your work! Examine the following book value balance sheet for University Products Inc. The preferred stock currently sells for $12 per share and pays a dividend of $2 a share. The common stock sells for $30 per share and has a beta of 1.8. There are 1 million common shares outstanding. The market risk premium is 8%, the risk-free rate is 3%, and the firm's tax rate is 21%. What is the WACC for University Products Inc.? BOOK VALUE BALANCE SHEET (Figures in $ millions) Assets Cash and short-term securities Accounts receivable Inventories Plant and equipment Liabilities and Net Worth Bonds, coupon - 8%, paid annually $1.0 (maturity - 10 years, current yield to maturity - 7%) 3.0 Preferred stock (par value $20 per share) 7.0 Common stock (par value $0.10) 21.0 Additional paid-in stockholders' equity Retained earnings $32.0 Total Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts