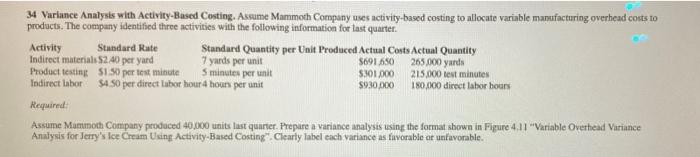

Question: (this is the format in 4.11) 34 Variance Analysis with Activity-Based Costing. Assume Mammoth Company uses activity-based costing to allocate variable manufacturing overhead costs to

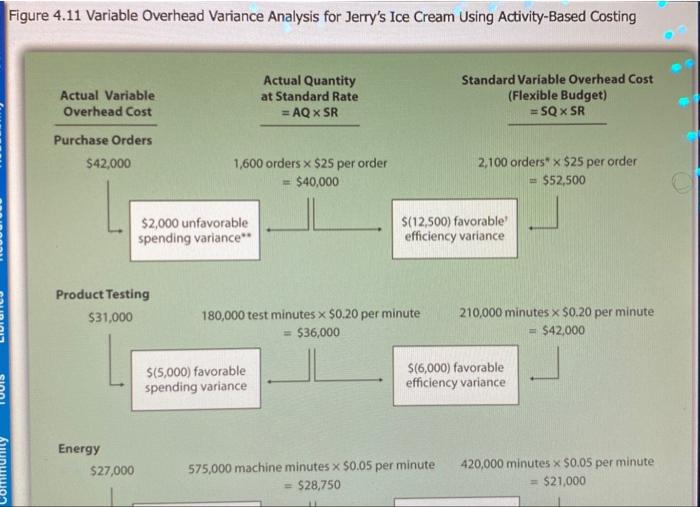

(this is the format in 4.11)

(this is the format in 4.11)

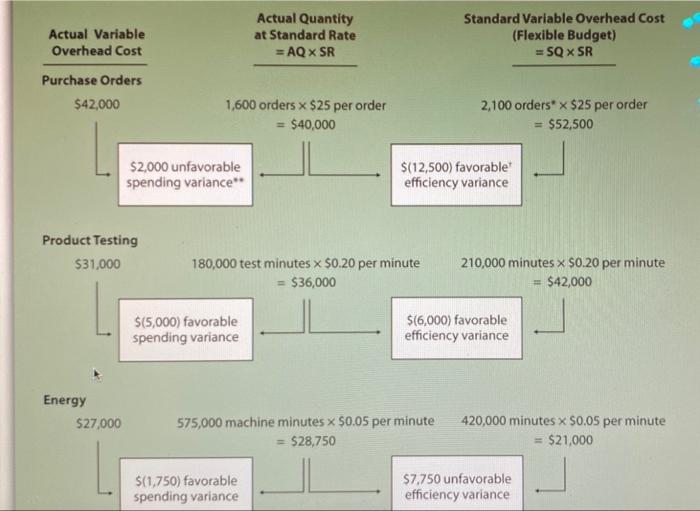

34 Variance Analysis with Activity-Based Costing. Assume Mammoth Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter. Activity Standard Rate Standard Quantity per Unit Produced Actual Costs Actual Quantity Indirect materials $2.40 per yard 7 yards per unit $691.650 265.000 yards Product testing 51.50 per test minute 5 minutes per unit S301.000 215.000 test minutes Indirect labor $4.50 per direct labor hour 4 hours per unit 5930.000 180.000 direct labor bours Required: Assume Mumunoth Company produced 40,000 units last quarter. Prepare a variance analysis using the format shown in Figure 4.11 "Variable Overhead Variance Analysis for Jerry's Ice Cream Using Activity-Based Costing. Clearly inbel cach variance as favorable at unfavorable. Actual Variable Overhead Cost Actual Quantity at Standard Rate = AQ X SR Standard Variable Overhead Cost (Flexible Budget) = SQ SR Purchase Orders $42.000 1,600 orders x $25 per order = $40,000 2,100 orders* * $25 per order = $52,500 $2,000 unfavorable spending variance" $(12,500) favorable efficiency variance Product Testing $31,000 180,000 test minutes x $0.20 per minute = $36,000 210,000 minutes x $0.20 per minute $42,000 $(5,000) favorable spending variance $(6,000) favorable efficiency variance Energy $27,000 575,000 machine minutes x 50.05 per minute = $28,750 420,000 minutes x $0.05 per minute = $21,000 $(1,750) favorable spending variance $7.750 unfavorable efficiency variance Figure 4.11 Variable Overhead Variance Analysis for Jerry's Ice Cream Using Activity-Based Costing Actual Variable Overhead Cost Actual Quantity at Standard Rate = AQ X SR Standard Variable Overhead Cost (Flexible Budget) =SQ SR Purchase Orders $42,000 1,600 orders x $25 per order = $40,000 2,100 orders" x $25 per order = $52,500 $2,000 unfavorable spending variance" $(12,500) favorable efficiency variance Product Testing $31,000 180,000 test minutes x $0.20 per minute = $36,000 210,000 minutes x $0.20 per minute $42.000 $(5,000) favorable spending variance $(6,000) favorable efficiency variance Energy $27,000 575,000 machine minutes x $0.05 per minute = $28,750 420,000 minutes x $0.05 per minute = $21.000 vom

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts