Question: Variance Analysis with Activity-Based Costing. Assume Spindle Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with

Variance Analysis with Activity-Based Costing. Assume Spindle Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter.

| Activity | Standard Rate | Standard Quantity per Unit Produced | Actual Costs | Actual Quantity |

| Indirect materials | $5 per yard | 14 yards per unit | $4,850,000 | 990,000 yards |

| Product testing | $3 per test minute | 10 minutes per unit | $2,000,000 | 650,000 test minutes |

| Indirect labor | $9 per direct labor hour | 6 hours per unit | $3,800,000 | 410,000 direct labor hours |

Required:

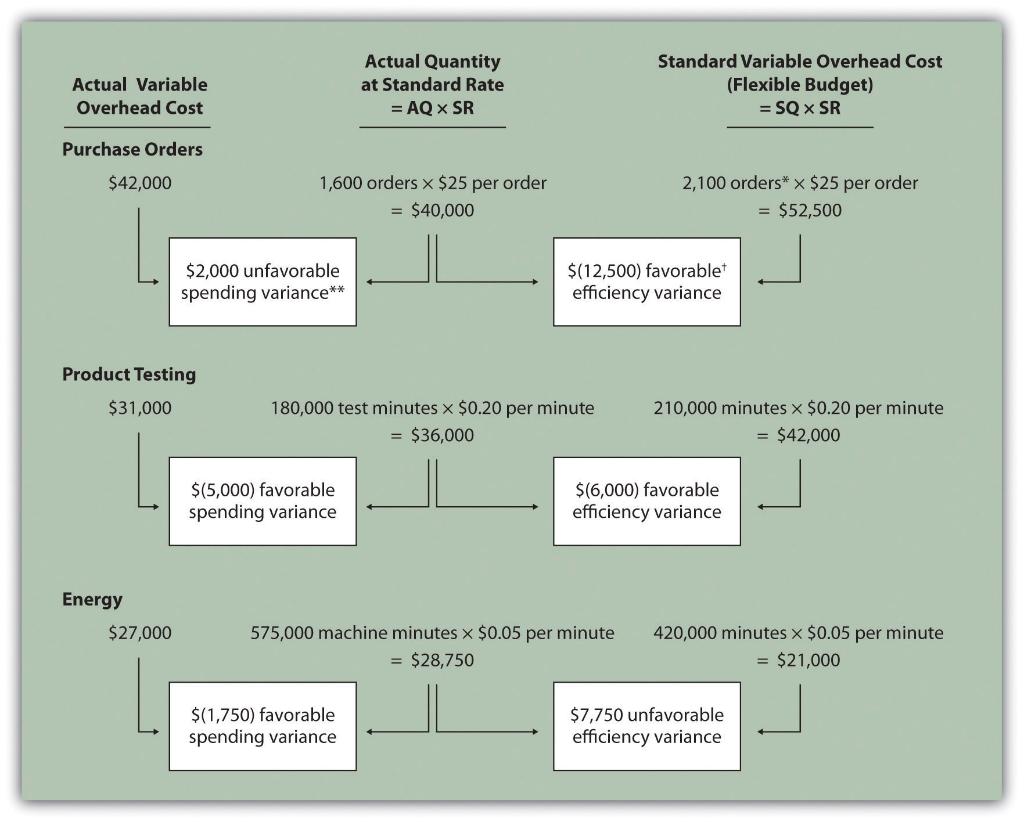

- Assume Spindle Company produced 70,000 units last quarter. Prepare a variance analysis using the format shown in Figure 4.11 Variable Overhead Variance Analysis for Jerrys Ice Cream Using Activity-Based Costing. Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances above 5 percent of the flexible budget amount for each activity. Identify the variances that should be investigated according to company policy. Show calculations to support your answer.

Format:

Standard Variable Overhead Cost (Flexible Budget) = SQ SR 2,100 orders $25 per order =$52,500 Product Testing 210,000 minutes $0.20 per minute =$36,000 =$42,000 effici =$40 \begin{tabular}{|l|} $(12,500) favorable \\ efficiency variance \end{tabular} Energy minutes $0.05 per minute 420,000 minutes $0.05 per minute =$28,750 =$21,000 \begin{tabular}{l} $7,750 unfavorable \\ efficiency variance \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts