Question: this is the only information given. please solve 1) Star Company is considering the purchase of an equipment for $64,000. It is expected to have

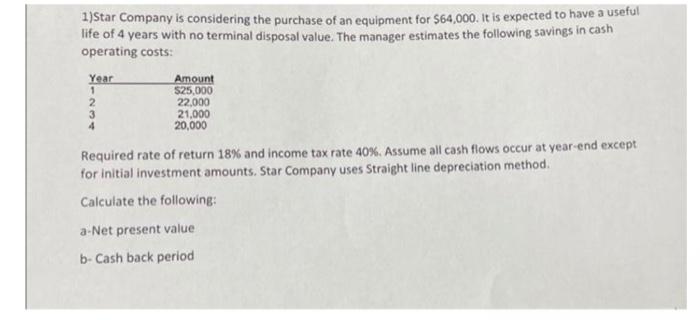

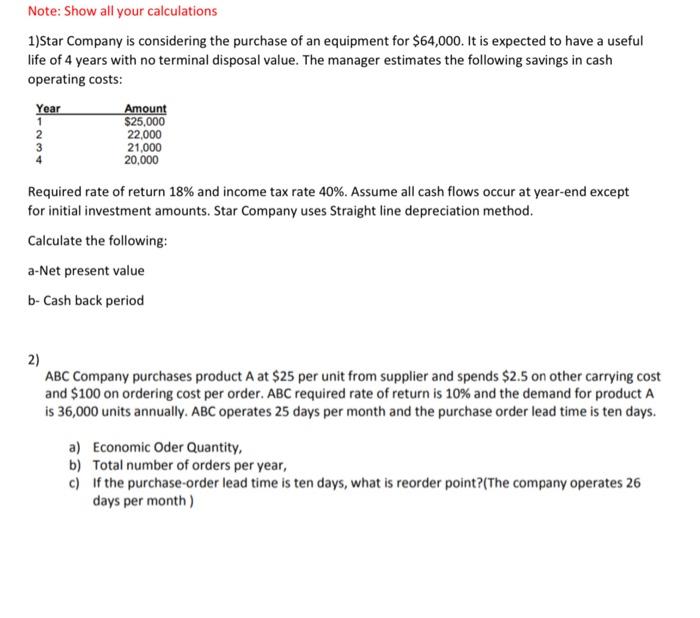

1) Star Company is considering the purchase of an equipment for $64,000. It is expected to have a useful life of 4 years with no terminal disposal value. The manager estimates the following savings in cash operating costs: Required rate of return 18% and income tax rate 40%. Assume all cash flows occur at year-end except for initial investment amounts. Star Company uses Straight line depreciation method. Calculate the following: a-Net present value b- Cash back period Note: Show all your calculations 1)Star Company is considering the purchase of an equipment for $64,000. It is expected to have a useful life of 4 years with no terminal disposal value. The manager estimates the following savings in cash operating costs: Required rate of return 18% and income tax rate 40%. Assume all cash flows occur at year-end except for initial investment amounts. Star Company uses Straight line depreciation method. Calculate the following: a-Net present value b- Cash back period 2) ABC Company purchases product A at $25 per unit from supplier and spends $2.5 on other carrying cost and $100 on ordering cost per order. ABC required rate of return is 10% and the demand for product A is 36,000 units annually. ABC operates 25 days per month and the purchase order lead time is ten days. a) Economic Oder Quantity, b) Total number of orders per year, c) If the purchase-order lead time is ten days, what is reorder point?(The company operates 26 days per month )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts