Question: This is the project Question 1-4 are solved as entries and I only need part five and please solve like the excel table provided ENTRIES

This is the project Question 1-4 are solved as entries and I only need part five and please solve like the excel table provided

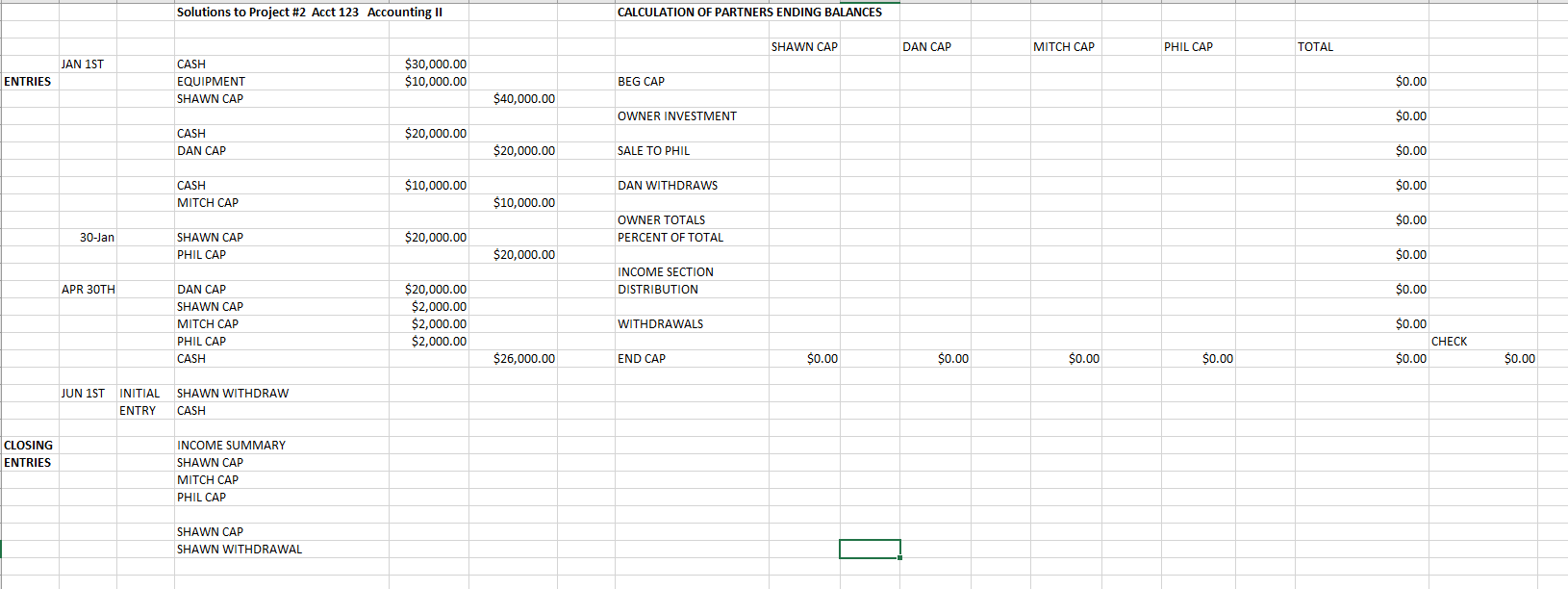

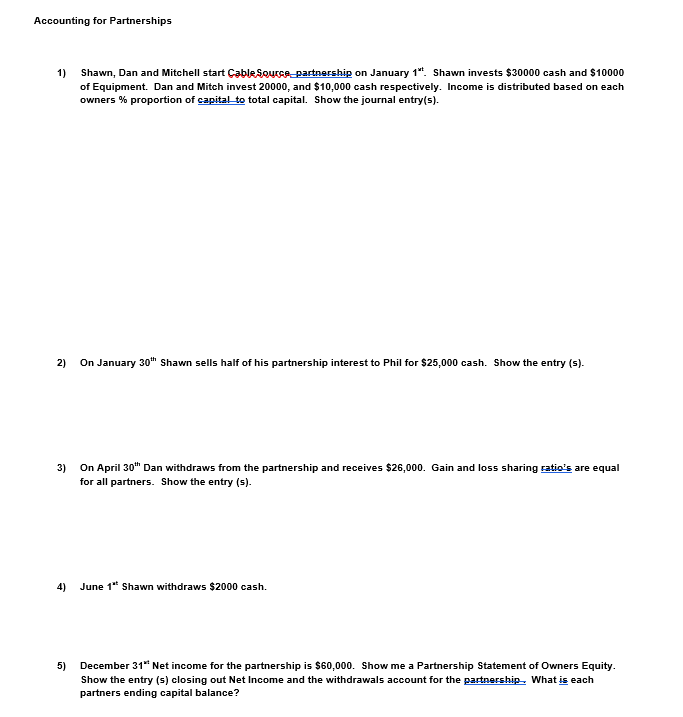

ENTRIES CLOSING ENTRIES JAN 1ST 30-Jan APR 30TH JUN 1ST INITIAL ENTRY Solutions to Project #2 Acct 123 Accounting II CASH EQUIPMENT SHAWN CAP CASH DAN CAP CASH MITCH CAP SHAWN CAP PHIL CAP DAN CAP SHAWN CAP MITCH CAP PHIL CAP CASH SHAWN WITHDRAW CASH INCOME SUMMARY SHAWN CAP MITCH CAP PHIL CAP SHAWN CAP SHAWN WITHDRAWAL $30,000.00 $10,000.00 $20,000.00 $10,000.00 $20,000.00 $20,000.00 $2,000.00 $2,000.00 $2,000.00 $40,000.00 $20,000.00 $10,000.00 $20,000.00 $26,000.00 CALCULATION OF PARTNERS ENDING BALANCES BEG CAP OWNER INVESTMENT SALE TO PHIL DAN WITHDRAWS OWNER TOTALS PERCENT OF TOTAL INCOME SECTION DISTRIBUTION WITHDRAWALS END CAP SHAWN CAP $0.00 DAN CAP $0.00 MITCH CAP $0.00 PHIL CAP $0.00 TOTAL $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 CHECK $0.00 Accounting for Partnerships 1) Shawn, Dan and Mitchell start Cable Source partnership on January 1t. Shawn invests $30000 cash and $10000 of Equipment. Dan and Mitch invest 20000, and $10,000 cash respectively. Income is distributed based on each owners % proportion of capital to total capital. Show the journal entry(s). 2) 3) On April 30th Dan withdraws from the partnership and receives $26,000. Gain and loss sharing ratio's are equal for all partners. Show the entry (s). 4) On January 30th Shawn sells half of his partnership interest to Phil for $25,000 cash. Show the entry (s). 5) June 1** Shawn withdraws $2000 cash. December 31** Net income for the partnership is $60,000. Show me a Partnership Statement of Owners Equity. Show the entry (s) closing out Net Income and the withdrawals account for the partnership. What is each partners ending capital balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts