Question: This is the question and solution, but what's the N button on the calculator (Fx-82ms)? Problem 13.9. A stock price has an expected return of

This is the question and solution, but what's the N button on the calculator (Fx-82ms)?

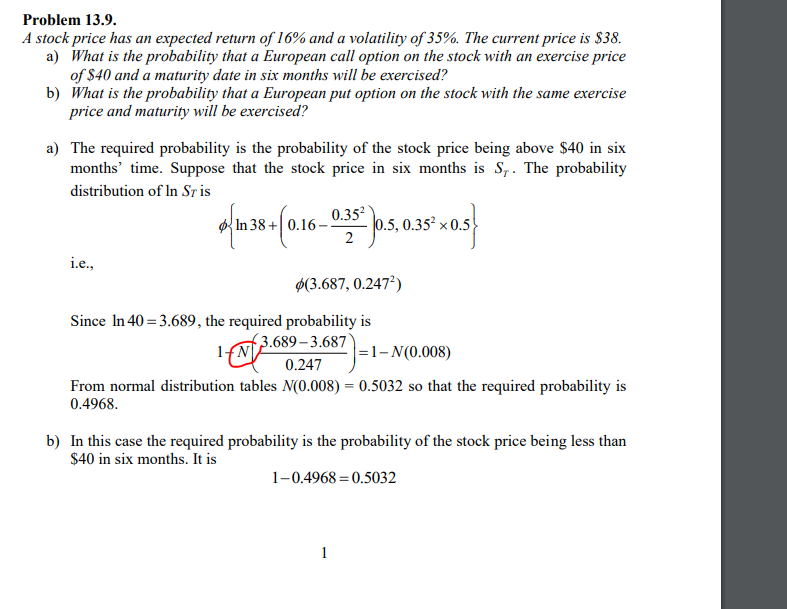

Problem 13.9. A stock price has an expected return of 16% and a volatility of 35%. The current price is $38. a) What is the probability that a European call option on the stock with an exercise price b) What is the probability that a European put option on the stock with the same exercise a) The required probability is the probability of the stock price being above S40 in six of S40 and a maturity date in six months will be exercised? price and maturity will be exercised? months' time. Suppose that the stock price in six months is S. The probability distribution of In ST is |In 38 +10.16-0352)0.5, 0.352 051 In 38+0.16 0.5, 0.352 x 0.5 i.e., (3687, 0247) Since In 40-3.689, the required probability is 689-3,687-1- N(0.008) From normal distribution tables N(0.008) 0.5032 so that the required probability is 0.4968 b) In this case the required probability is the probability of the stock price being less than $40 in six months. It is 1-0.4968 0.5032

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts