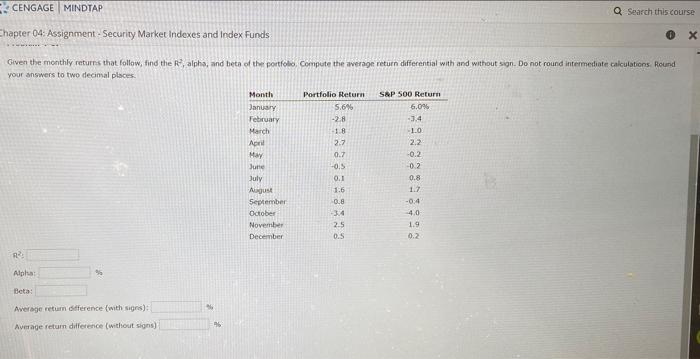

Question: CENGAGE MINDTAP Q Search this course Chapter 04: Assignment - Security Market Indexes and Index Funds Given the monthly returns that follow, find the alpha,

CENGAGE MINDTAP Q Search this course Chapter 04: Assignment - Security Market Indexes and Index Funds Given the monthly returns that follow, find the alpha, and beta of the portfolio Compute the average return differential with and without sign. Do not round intermediate calculations. Round your answers to two decimal places Month January February March April May June July AO September October November December Portfolio Return 5.6% -2.8 1 2.7 0.7 -0.5 0.1 1.6 0.8 -34 2.5 0.5 S&P SOO Return 6.0% -3.4 1.0 2.2 -0.2 0.2 0.8 1.2 -0.4 1.9 0.2 Alpha Beta: Average retum diference with signs): Average return difference (without signs) CENGAGE MINDTAP Q Search this course Chapter 04: Assignment - Security Market Indexes and Index Funds Given the monthly returns that follow, find the alpha, and beta of the portfolio Compute the average return differential with and without sign. Do not round intermediate calculations. Round your answers to two decimal places Month January February March April May June July AO September October November December Portfolio Return 5.6% -2.8 1 2.7 0.7 -0.5 0.1 1.6 0.8 -34 2.5 0.5 S&P SOO Return 6.0% -3.4 1.0 2.2 -0.2 0.2 0.8 1.2 -0.4 1.9 0.2 Alpha Beta: Average retum diference with signs): Average return difference (without signs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts