Question: this is the question before it, not much other info is given 9. The index to which an ARM is tied is forecasted as follows:

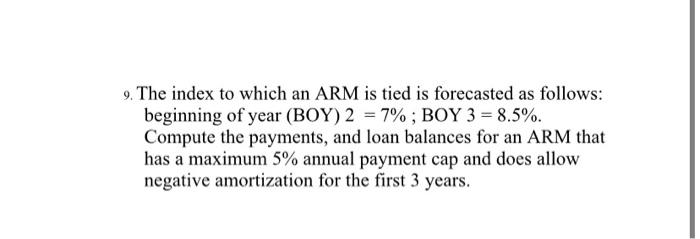

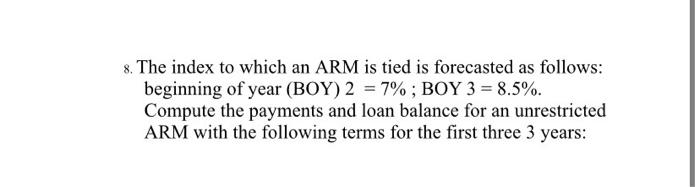

9. The index to which an ARM is tied is forecasted as follows: beginning of year (BOY)2 = 7%; BOY 3 = 8.5%. Compute the payments, and loan balances for an ARM that has a maximum 5% annual payment cap and does allow negative amortization for the first 3 years. 8. The index to which an ARM is tied is forecasted as follows: beginning of year (BOY)2 = 7%; BOY 3 = 8.5%. Compute the payments and loan balance for an unrestricted ARM with the following terms for the first three 3 years: 9. The index to which an ARM is tied is forecasted as follows: beginning of year (BOY)2 = 7%; BOY 3 = 8.5%. Compute the payments, and loan balances for an ARM that has a maximum 5% annual payment cap and does allow negative amortization for the first 3 years. 8. The index to which an ARM is tied is forecasted as follows: beginning of year (BOY)2 = 7%; BOY 3 = 8.5%. Compute the payments and loan balance for an unrestricted ARM with the following terms for the first three 3 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts