Question: please help with parts A , B , & C for Question #2 and #3. 2. (Growing annuities in finite period) The current (just- paid)

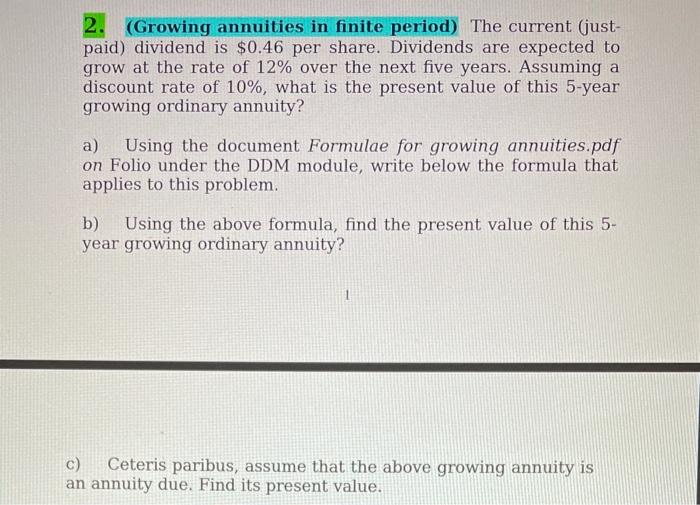

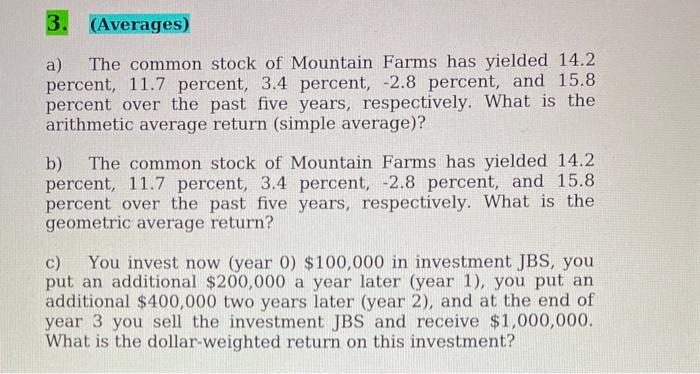

2. (Growing annuities in finite period) The current (just- paid) dividend is $0.46 per share. Dividends are expected to grow at the rate of 12% over the next five years. Assuming a discount rate of 10%, what is the present value of this 5-year growing ordinary annuity? a) Using the document Formulae for growing annuities.pdf on Folio under the DDM module, write below the formula that applies to this problem. b) Using the above formula, find the present value of this 5- year growing ordinary annuity? 1 c) Ceteris paribus, assume that the above growing annuity is an annuity due. Find its present value. 3. (Averages) a) The common stock of Mountain Farms has yielded 14.2 percent, 11.7 percent, 3.4 percent, -2.8 percent, and 15.8 percent over the past five years, respectively. What is the arithmetic average return (simple average)? b) The common stock of Mountain Farms has yielded 14.2 percent, 11.7 percent, 3.4 percent, -2.8 percent, and 15.8 percent over the past five years, respectively. What is the geometric average return? c) You invest now (year 0) $100,000 in investment JBS, you put an additional $200,000 a year later (year 1), you put an additional $400,000 two years later (year 2), and at the end of year 3 you sell the investment JBS and receive $1,000,000. What is the dollar-weighted return on this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts