Question: this is the question from strategic management. I need solution An EPS/EBIT analysis is one of the most widely used techniques for determining the extent

this is the question from strategic management. I need solution

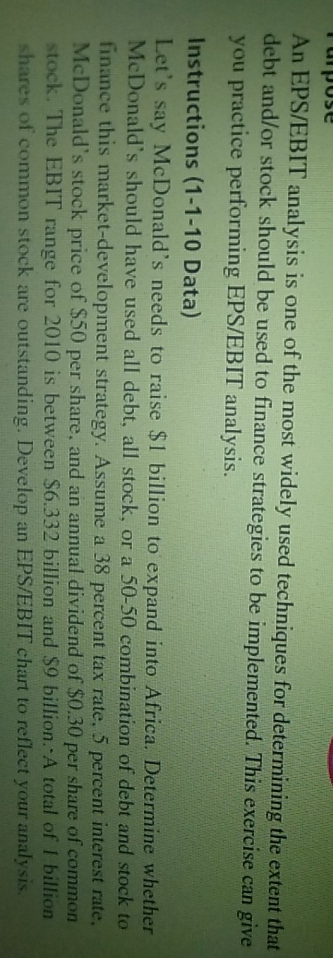

An EPS/EBIT analysis is one of the most widely used techniques for determining the extent that debt and/or stock should be used to finance strategies to be implemented. This exercise can give you practice performing EPS/EBIT analysis. Instructions (1-1-10 Data) Let's say Mcdonald's needs to raise $1 billion to expand into Africa. Determine whether McDonald's should have used all debt, all stock, or a 50-50 combination of debt and stock to finance this market-development strategy. Assume a 38 percent tax rate, 5 percent interest rate. Mcdonald's stock price of $50 per share, and an annual dividend of $0.30 per share of common stock. The EBIT range for 2010 is between $6.332 billion and $9 billion. - A total of I billion shares of common stock are outstanding. Develop an EPS/EBIT chart to reflect your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts