Question: This is the same question, question 2 include ( i and ii ), answer all please, thanks. Case 1 (50 marks) The Assessment Year would

This is the same question, question 2 include ( i and ii ), answer all please, thanks.

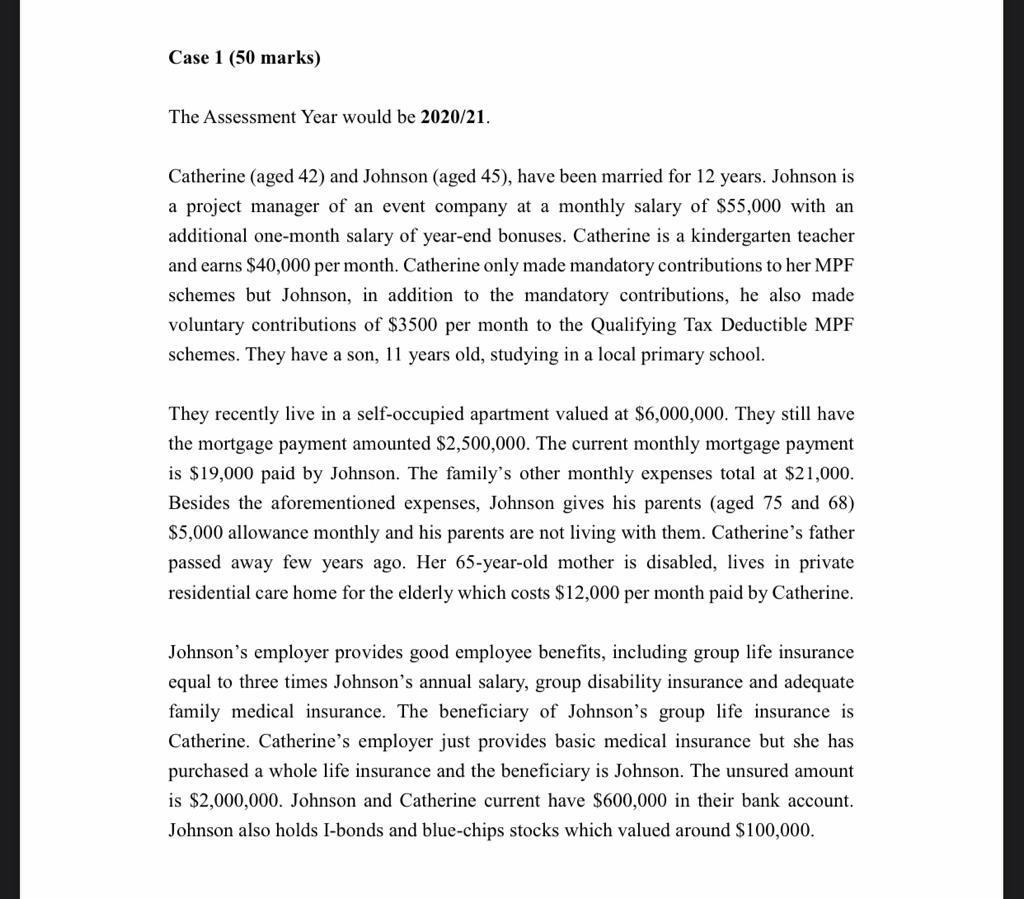

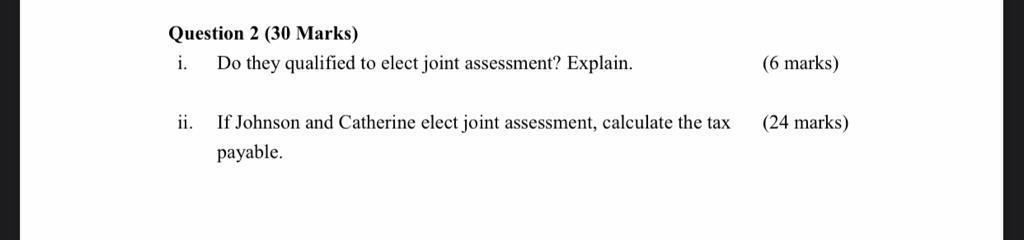

Case 1 (50 marks) The Assessment Year would be 2020/21. Catherine (aged 42) and Johnson (aged 45), have been married for 12 years. Johnson is a project manager of an event company at a monthly salary of $55,000 with an additional one-month salary of year-end bonuses. Catherine is a kindergarten teacher and earns $40,000 per month. Catherine only made mandatory contributions to her MPF schemes but Johnson, in addition to the mandatory contributions, he also made voluntary contributions of $3500 per month to the Qualifying Tax Deductible MPF schemes. They have a son, 11 years old, studying in a local primary school. They recently live in a self-occupied apartment valued at $6,000,000. They still have the mortgage payment amounted $2,500,000. The current monthly mortgage payment is $19,000 paid by Johnson. The family's other monthly expenses total at $21,000. Besides the aforementioned expenses, Johnson gives his parents (aged 75 and 68) $5,000 allowance monthly and his parents are not living with them. Catherine's father passed away few years ago. Her 65-year-old mother is disabled, lives in private residential care home for the elderly which costs $12,000 per month paid by Catherine. Johnson's employer provides good employee benefits, including group life insurance equal to three times Johnson's annual salary, group disability insurance and adequate family medical insurance. The beneficiary of Johnson's group life insurance is Catherine. Catherine's employer just provides basic medical insurance but she has purchased a whole life insurance and the beneficiary is Johnson. The unsured amount is $2,000,000. Johnson and Catherine current have $600,000 in their bank account. Johnson also holds I-bonds and blue-chips stocks which valued around $100,000. Question 2 (30 Marks) i. Do they qualified to elect joint assessment? Explain. (6 marks) ii. (24 marks) If Johnson and Catherine elect joint assessment, calculate the tax payable. Case 1 (50 marks) The Assessment Year would be 2020/21. Catherine (aged 42) and Johnson (aged 45), have been married for 12 years. Johnson is a project manager of an event company at a monthly salary of $55,000 with an additional one-month salary of year-end bonuses. Catherine is a kindergarten teacher and earns $40,000 per month. Catherine only made mandatory contributions to her MPF schemes but Johnson, in addition to the mandatory contributions, he also made voluntary contributions of $3500 per month to the Qualifying Tax Deductible MPF schemes. They have a son, 11 years old, studying in a local primary school. They recently live in a self-occupied apartment valued at $6,000,000. They still have the mortgage payment amounted $2,500,000. The current monthly mortgage payment is $19,000 paid by Johnson. The family's other monthly expenses total at $21,000. Besides the aforementioned expenses, Johnson gives his parents (aged 75 and 68) $5,000 allowance monthly and his parents are not living with them. Catherine's father passed away few years ago. Her 65-year-old mother is disabled, lives in private residential care home for the elderly which costs $12,000 per month paid by Catherine. Johnson's employer provides good employee benefits, including group life insurance equal to three times Johnson's annual salary, group disability insurance and adequate family medical insurance. The beneficiary of Johnson's group life insurance is Catherine. Catherine's employer just provides basic medical insurance but she has purchased a whole life insurance and the beneficiary is Johnson. The unsured amount is $2,000,000. Johnson and Catherine current have $600,000 in their bank account. Johnson also holds I-bonds and blue-chips stocks which valued around $100,000. Question 2 (30 Marks) i. Do they qualified to elect joint assessment? Explain. (6 marks) ii. (24 marks) If Johnson and Catherine elect joint assessment, calculate the tax payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts