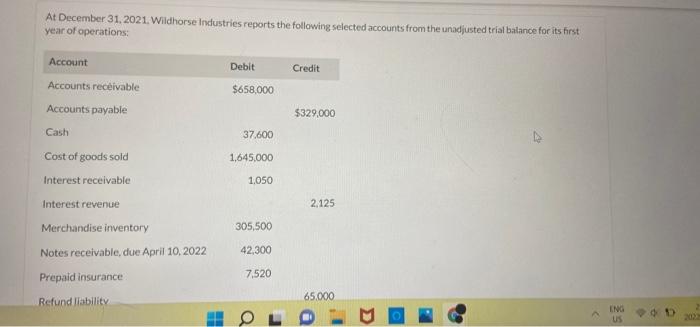

Question: this is the second time I have posted this At December 31, 2021. Wildhorse Industries reports the following selected accounts from the unadjusted trial balance

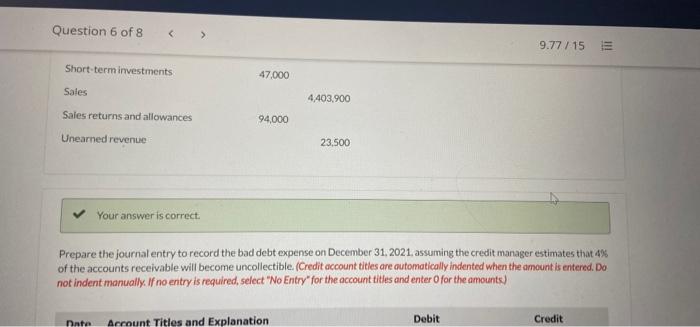

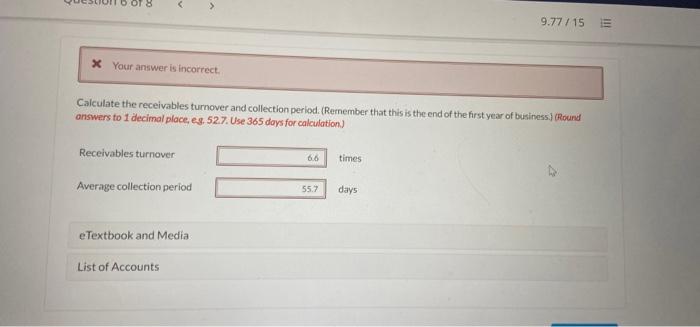

At December 31, 2021. Wildhorse Industries reports the following selected accounts from the unadjusted trial balance for its first year of operations Debit Credit $658,000 $329,000 37,600 Account Accounts receivable Accounts payable Cash Cost of goods sold Interest receivable Interest revenue Merchandise inventory 1,645.000 1.050 2.125 305,500 Notes receivable, due April 10, 2022 42.300 Prepaid insurance 7.520 65.000 Refund liability o ING US Question 6 of 8 9.77 / 15 111 Short-term investments 47.000 Sales 4,403,900 Sales returns and allowances 94,000 Unearned revenue 23.500 Your answer is correct. Prepare the journal entry to record the bad debt expense on December 31, 2021, assuming the credit manager estimates that 4% of the accounts receivable will become uncollectible. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Debit Account Titles and Explanation nnte Credit > 9.77/15 x Your answer is incorrect. Calculate the receivables turnover and collection period. (Remember that this is the end of the first year of business) Round answers to 1 decimal place, es. 52.7. Use 365 days for calculation) Receivables turnover 6.6 times Average collection period 55.7 days eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts