Question: this is the second time, I'm uploading this question. the first time i got the wrong answer! Question One: Prepare Income statement, owner's Equity and

this is the second time, I'm uploading this question. the first time i got the wrong answer!

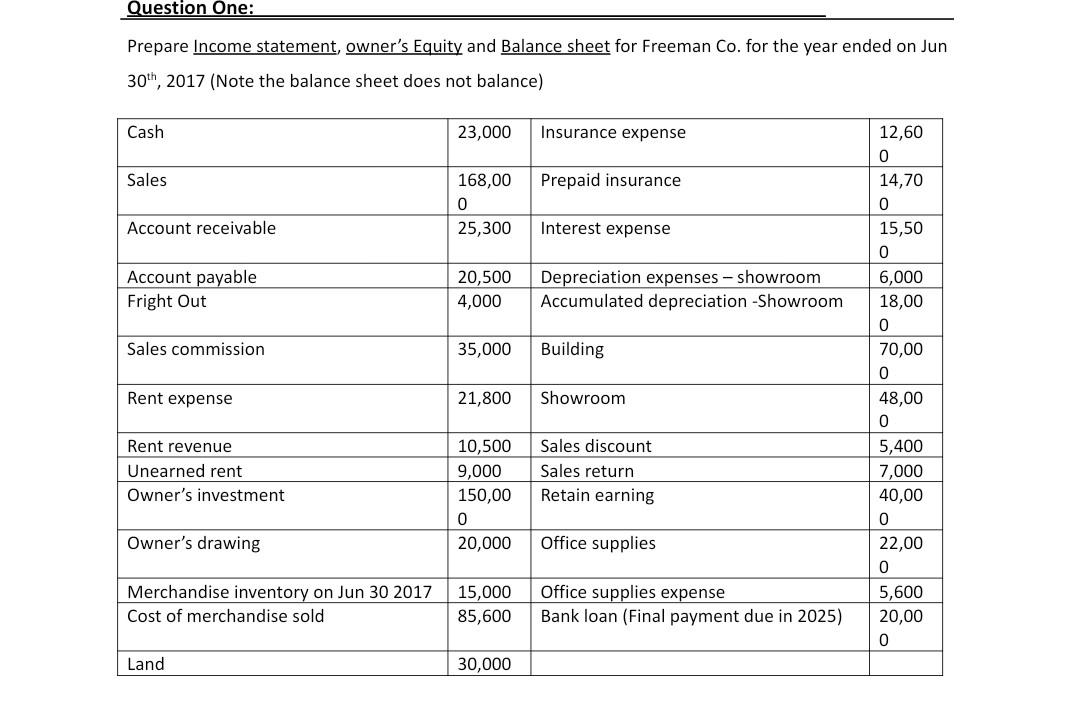

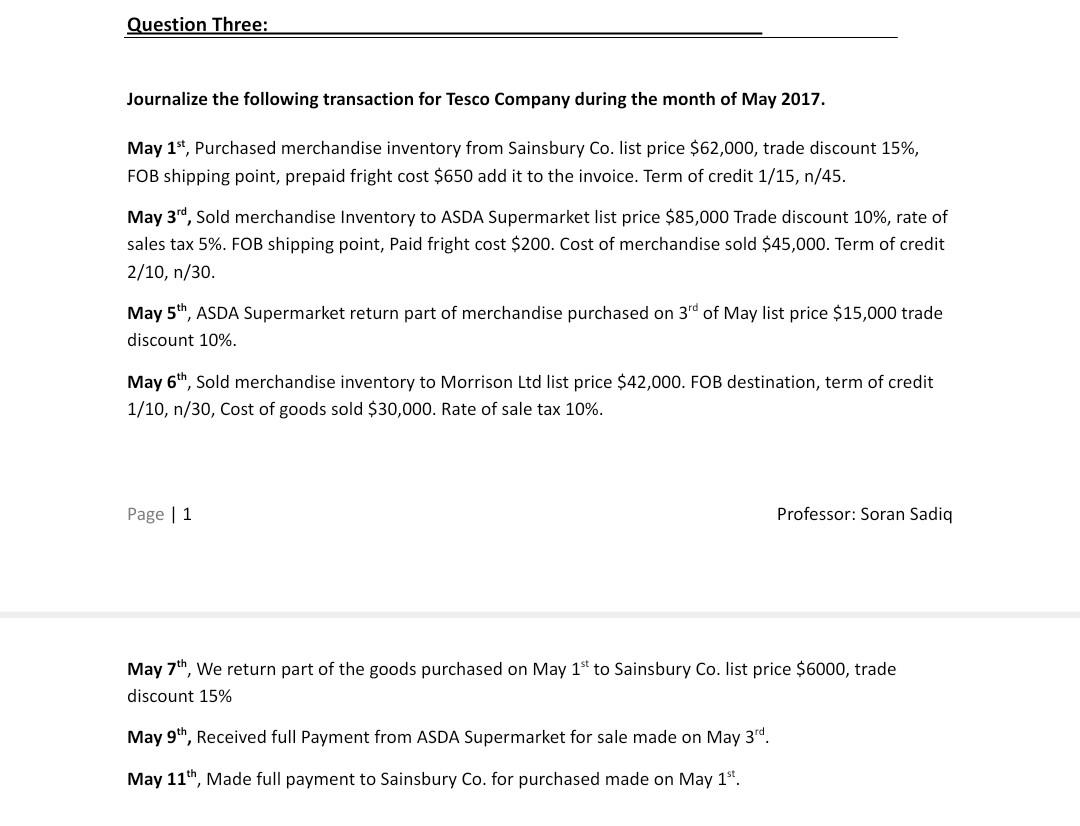

Question One: Prepare Income statement, owner's Equity and Balance sheet for Freeman Co. for the year ended on Jun 30th, 2017 (Note the balance sheet does not balance) Cash 23,000 Insurance expense Sales Prepaid insurance 168,00 0 25,300 Account receivable Interest expense Account payable Fright Out 20,500 4,000 Depreciation expenses - showroom Accumulated depreciation - Showroom Sales commission 35,000 Building 12,60 0 14,70 0 15,50 0 6,000 18,00 0 70,00 0 48,00 0 5,400 7,000 40,00 0 22,00 0 5,600 20,00 0 Rent expense 21,800 Showroom Rent revenue Unearned rent Owner's investment 10,500 9,000 150,00 0 Sales discount Sales return Retain earning Owner's drawing 20,000 Office supplies Merchandise inventory on Jun 30 2017 Cost of merchandise sold 15,000 85,600 Office supplies expense Bank loan (Final payment due in 2025) Land 30,000 Question Three: Journalize the following transaction for Tesco Company during the month of May 2017. May 1st, Purchased merchandise inventory from Sainsbury Co. list price $62,000, trade discount 15%, FOB shipping point, prepaid fright cost $650 add it to the invoice. Term of credit 1/15, n/45. May 3rd, Sold merchandise Inventory to ASDA Supermarket list price $85,000 Trade discount 10%, rate of sales tax 5%. FOB shipping point, Paid fright cost $200. Cost of merchandise sold $45,000. Term of credit 2/10, n/30. May 5th, ASDA Supermarket return part of merchandise purchased on 3rd of May list price $15,000 trade discount 10%. May 6th, Sold merchandise inventory to Morrison Ltd list price $42,000. FOB destination, term of credit 1/10, n/30, Cost of goods sold $30,000. Rate of sale tax 10%. Page 1 Professor: Soran Sadiq May 7th, We return part of the goods purchased on May 1st to Sainsbury Co. list price $6000, trade discount 15% May 9th, Received full Payment from ASDA Supermarket for sale made on May 3rd. May 11th, Made full payment to Sainsbury Co. for purchased made on May 1st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts