Question: This is the THIRD TIME posting this question. The answer given by the expert HAS NOTHING TO DO WITH THE GIVE TASK! See for yourself!!

This is the THIRD TIME posting this question. The answer given by the expert HAS NOTHING TO DO WITH THE GIVE TASK! See for yourself!!

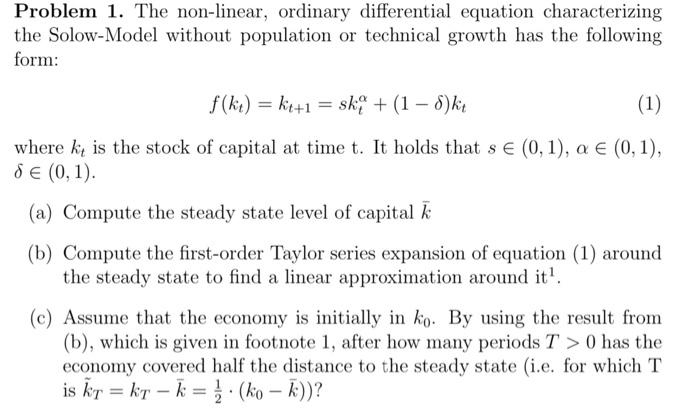

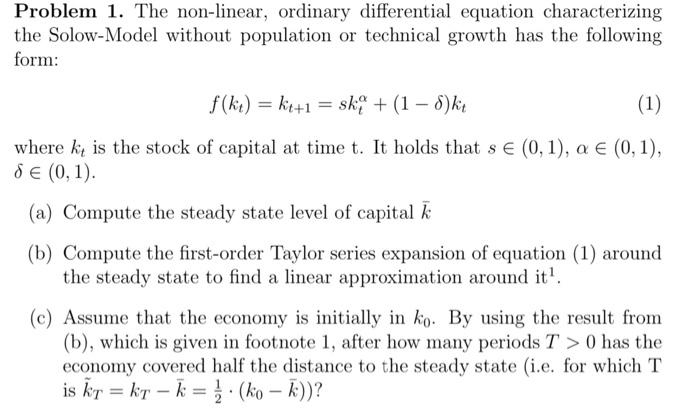

Problem 1. The non-linear, ordinary differential equation characterizing the Solow-Model without population or technical growth has the following form: f(kt)=kt+1=skt+(1)kt where kt is the stock of capital at time t. It holds that s(0,1),(0,1), (0,1) (a) Compute the steady state level of capital k (b) Compute the first-order Taylor series expansion of equation (1) around the steady state to find a linear approximation around it 1. (c) Assume that the economy is initially in k0. By using the result from (b), which is given in footnote 1 , after how many periods T>0 has the economy covered half the distance to the steady state (i.e. for which T is k~T=kTk=21(k0k)) ? (25 points) The stocks of Apple and Amazon are expected to have the following returns (%) depending on the state of the economy next year: (a) What are the expected returns of Apple and respectively Amazon for next year? (b) Which of the two stocks is riskier? (c) What is the expected return of a portfolio that is 80% invested in Apple and 20% invested in Amazon? (d) What is the risk of the portfolio that is 80% invested in Apple and20\%invested in Amazon? (e) Rank the three possible investments (1001% invested in either company or the portfolio) in the order of your preference. Justify. Explanation Please refer to solution in this step. (25 points) The stocks of Apple and Amazon are expected to have the following returns (1%) depending on the state of the economy next year: (a) What are the expected returns of Apple and respectively Amazon for next year? (b) Which of the two stocks is riskier? (c) What is the expected return of a portfolio that is 80% invested in Apple and20\%invested in Amazon? (d) What is the risk of the portfolio that is 80% invested in Apple and20\%invested in Amazon? (e) Rank the three possible investments (1001% invested in either company or the portfolio) in the order of your preference. Justify

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock