Question: This just needs to be answered plain and simple and stated on each how it was worked out. earning Outcomes: After completing the module, you

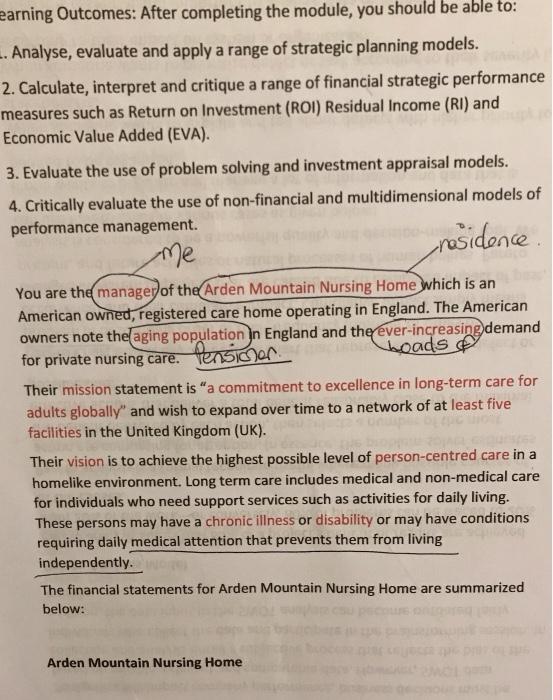

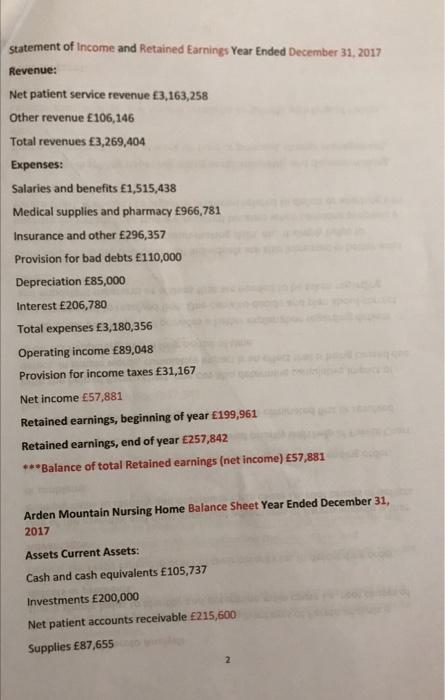

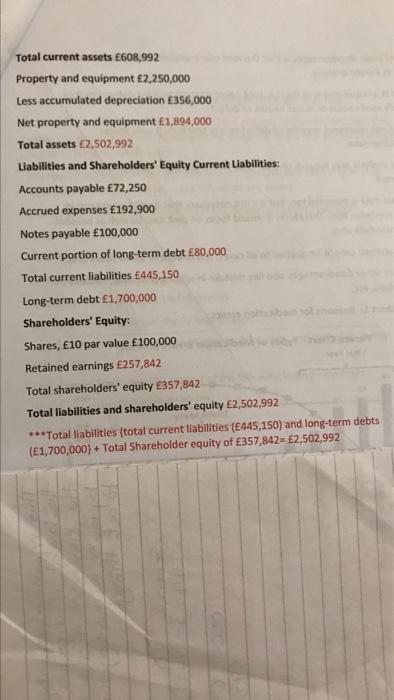

earning Outcomes: After completing the module, you should be able to: - Analyse, evaluate and apply a range of strategic planning models. 2. Calculate, interpret and critique a range of financial strategic performance measures such as Return on Investment (ROI) Residual Income (RI) and Economic Value Added (EVA). 3. Evaluate the use of problem solving and investment appraisal models. 4. Critically evaluate the use of non-financial and multidimensional models of performance management. me residence You are the manager of the Arden Mountain Nursing Home which is an American owned, registered care home operating in England. The American owners note the aging population in England and the ever-increasing demand for private nursing care. Pensioner Loads Their mission statement is a commitment to excellence in long-term care for adults globally and wish to expand over time to a network of at least five facilities in the United Kingdom (UK). Their vision is to achieve the highest possible level of person-centred care in a homelike environment. Long term care includes medical and non-medical care for individuals who need support services such as activities for daily living. These persons may have a chronic illness or disability or may have conditions requiring daily medical attention that prevents them from living independently. The financial statements for Arden Mountain Nursing Home are summarized below: Arden Mountain Nursing Home statement of income and retained Earnings Year Ended December 31, 2017 Revenue: Net patient service revenue 3,163,258 Other revenue E106,146 Total revenues 3,269,404 Expenses: Salaries and benefits 1,515,438 Medical supplies and pharmacy 966,781 Insurance and other 296,357 Provision for bad debts 110,000 Depreciation 85,000 Interest 206,780 Total expenses 3,180,356 Operating income 89,048 Provision for income taxes 31,167 Net income 57,881 Retained earnings, beginning of year 199,961 Retained earnings, end of year E257,842 ***Balance of total Retained earnings (net income) 57,881 Arden Mountain Nursing Home Balance Sheet Year Ended December 31, 2017 Assets Current Assets: Cash and cash equivalents 105,737 Investments 200,000 Net patient accounts receivable 215,600 Supplies 87,655 Total current assets 608,992 Property and equipment 2,250,000 Less accumulated depreciation 356,000 Net property and equipment 1,894,000 Total assets 2,502,992 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable 72,250 Accrued expenses 192,900 Notes payable 100,000 Current portion of long-term debt 80,000 Total current liabilities 445,150 Long-term debt 1,700,000 Shareholders' Equity: Shares, 10 par value 100,000 Retained earnings 257,842 Total shareholders' equity 357,842 Total liabilities and shareholders' equity 2,502,992 ***Total liabilities (total current liabilities (E445,150) and long-term debts (1,700,000) + Total Shareholder equity of 357,842= 2,502,992 earning Outcomes: After completing the module, you should be able to: - Analyse, evaluate and apply a range of strategic planning models. 2. Calculate, interpret and critique a range of financial strategic performance measures such as Return on Investment (ROI) Residual Income (RI) and Economic Value Added (EVA). 3. Evaluate the use of problem solving and investment appraisal models. 4. Critically evaluate the use of non-financial and multidimensional models of performance management. me residence You are the manager of the Arden Mountain Nursing Home which is an American owned, registered care home operating in England. The American owners note the aging population in England and the ever-increasing demand for private nursing care. Pensioner Loads Their mission statement is a commitment to excellence in long-term care for adults globally and wish to expand over time to a network of at least five facilities in the United Kingdom (UK). Their vision is to achieve the highest possible level of person-centred care in a homelike environment. Long term care includes medical and non-medical care for individuals who need support services such as activities for daily living. These persons may have a chronic illness or disability or may have conditions requiring daily medical attention that prevents them from living independently. The financial statements for Arden Mountain Nursing Home are summarized below: Arden Mountain Nursing Home statement of income and retained Earnings Year Ended December 31, 2017 Revenue: Net patient service revenue 3,163,258 Other revenue E106,146 Total revenues 3,269,404 Expenses: Salaries and benefits 1,515,438 Medical supplies and pharmacy 966,781 Insurance and other 296,357 Provision for bad debts 110,000 Depreciation 85,000 Interest 206,780 Total expenses 3,180,356 Operating income 89,048 Provision for income taxes 31,167 Net income 57,881 Retained earnings, beginning of year 199,961 Retained earnings, end of year E257,842 ***Balance of total Retained earnings (net income) 57,881 Arden Mountain Nursing Home Balance Sheet Year Ended December 31, 2017 Assets Current Assets: Cash and cash equivalents 105,737 Investments 200,000 Net patient accounts receivable 215,600 Supplies 87,655 Total current assets 608,992 Property and equipment 2,250,000 Less accumulated depreciation 356,000 Net property and equipment 1,894,000 Total assets 2,502,992 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable 72,250 Accrued expenses 192,900 Notes payable 100,000 Current portion of long-term debt 80,000 Total current liabilities 445,150 Long-term debt 1,700,000 Shareholders' Equity: Shares, 10 par value 100,000 Retained earnings 257,842 Total shareholders' equity 357,842 Total liabilities and shareholders' equity 2,502,992 ***Total liabilities (total current liabilities (E445,150) and long-term debts (1,700,000) + Total Shareholder equity of 357,842= 2,502,992

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts