Question: Variable Costing Income Statements; Sales Constant, Production Varies; JIT Impact [LO1, LO2, LO3, LO4, LO5] This makes no sense at all, said Bill Sharp,

![LO3, LO4, LO5] "This makes no sense at all," said Bill Sharp,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2020/09/5f6067c7c9d4f_1600153542663.jpg)

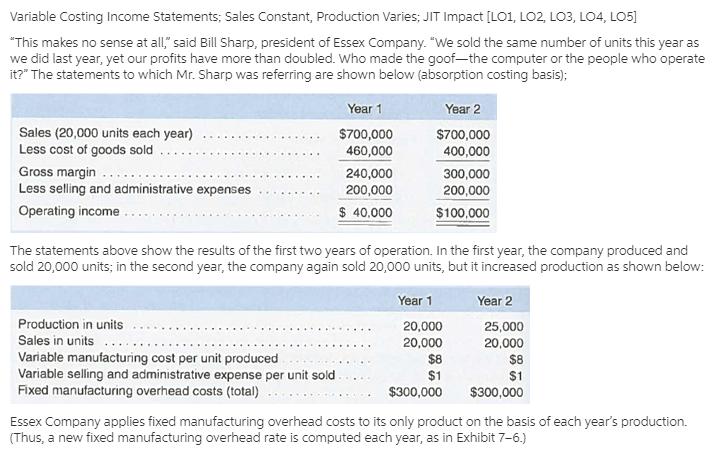

Variable Costing Income Statements; Sales Constant, Production Varies; JIT Impact [LO1, LO2, LO3, LO4, LO5] "This makes no sense at all," said Bill Sharp, president of Essex Company. "We sold the same number of units this year as we did last year, yet our profits have more than doubled. Who made the goof-the computer or the people who operate it?" The statements to which Mr. Sharp was referring are shown below (absorption costing basis); Year 1 Year 2 Sales (20,000 units each year) Less cost of goods sold $700,000 460,000 $700,000 400,000 Gross margin Less selling and administrative expenses 240,000 200,000 300,000 200,000 Operating income $ 40.000 $100,000 The statements above show the results of the first two years of operation. In the first year, the company produced and sold 20,000 units; in the second year, the company again sold 20,000 units, but it increased production as shown below: Year 1 Year 2 Production in units 20,000 25,000 Sales in units 20,000 20,000 Variable manufacturing cost per unit produced Variable selling and administrative expense per unit sold. Fixed manufacturing overhead costs (total) $8 $1 $8 $1 $300,000 $300,000 Essex Company applies fixed manufacturing overhead costs to its only product on the basis of each year's production. (Thus, a new fixed manufacturing overhead rate is computed each year, as in Exhibit 7-6.) Required: 1. Compute the unit product cost for each year under: a. Absorption costing. b. Variable costing. 2. Prepare a variable costing income statement for each year, using the contribution approach. 3. Reconcile the variable costing and absorption costing operating income figures for each year. 4. Explain to the president why, under absorption costing, the operating income for Year 2 was higher than the operating income for Year 1, although the same number of units was sold in each year. 5. a. Explain how operations would have differed in Year 2 if the company had been using JIT inventory methods. b. If JIT had been in use during Year 2, what would the company's operating income have been under absorption costing? Explain the reason for any difference between this income figure and the figure reported by the company in the statements above.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts