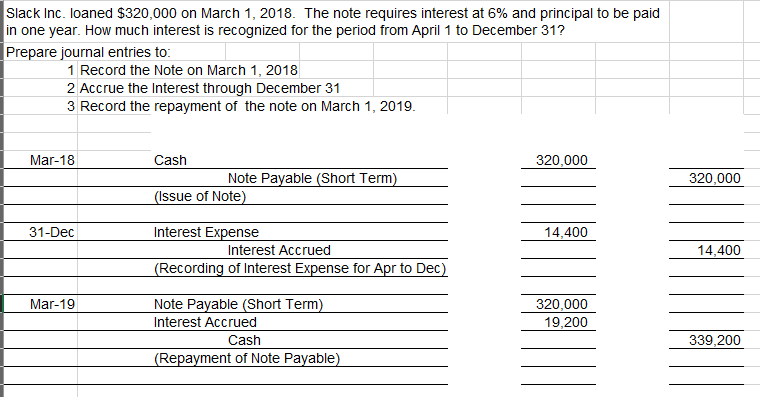

Question: This needs to be a note receivable not a payable. Slack Inc. loaned $320,000 on March 1, 2018. The note requires interest at 6% and

This needs to be a note receivable not a payable.

Slack Inc. loaned $320,000 on March 1, 2018. The note requires interest at 6% and principal to be paid in one year. How much interest is recognized for the period from April 1 to December 31? Prepare journal entries to: 1 Record the Note on March 1, 2018 2 Accrue the Interest through December 31 3 Record the repayment of the note on March 1, 2019. Mar-18 320,000 Cash Note Payable (Short Term) (Issue of Note) 320,000 31-Dec 14.400 Interest Expense Interest Accrued (Recording of Interest Expense for Apr to Dec) 14.400 Mar-19 320,000 19,200 Note Payable (Short Term) Interest Accrued Cash (Repayment of Note Payable) 339,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts