Question: Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount

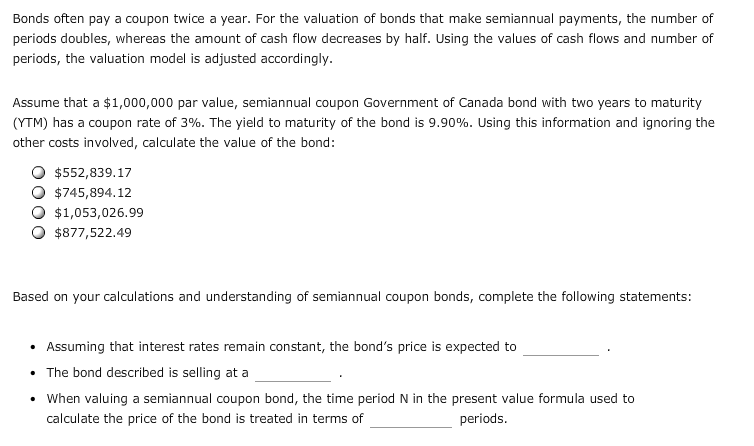

Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon Government of Canada bond with two years to maturity (YTM) has a coupon rate of 3%. The yield to maturity of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the bond: $552,839.17 $745,894.12 $1,053,026.99 $877,522.49 Based on your calculations and understanding of semiannual coupon bonds, complete the following statements: Assuming that interest rates remain constant, the bond's price is expected to The bond described is selling at a When valuing a semiannual coupon bond, the time period N in the present value formula used to calculate the price of the bond is treated in terms of periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts