Question: This part has 5 questions, worth 30 marks in total. For questions requiring numerical answers, show your work to receive partial credit, in case your

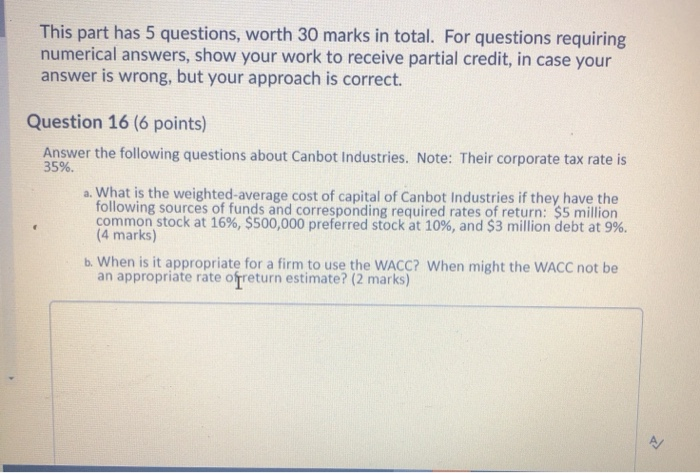

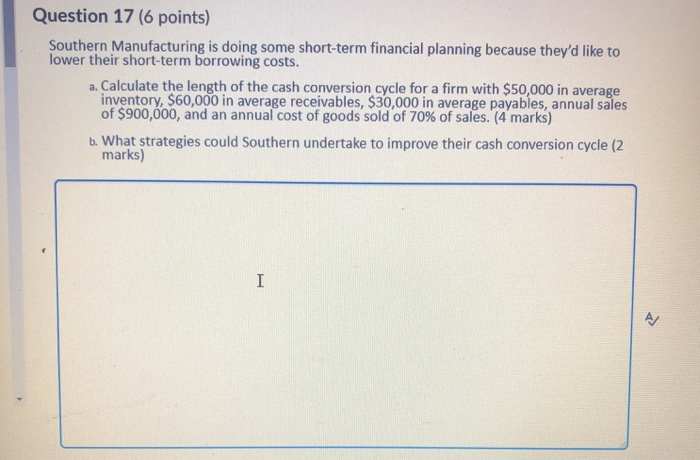

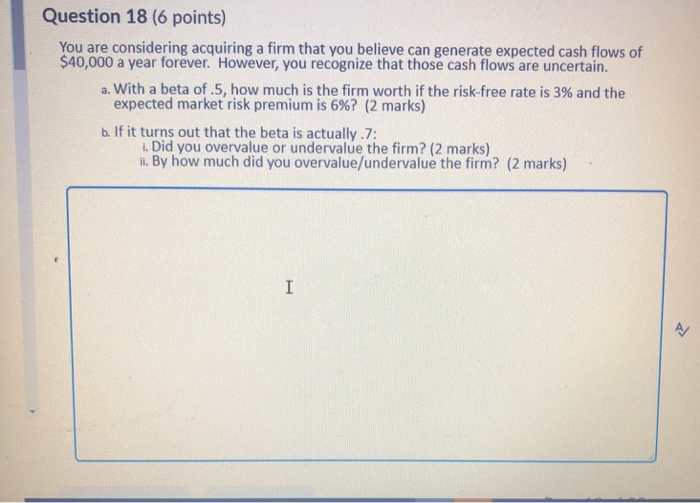

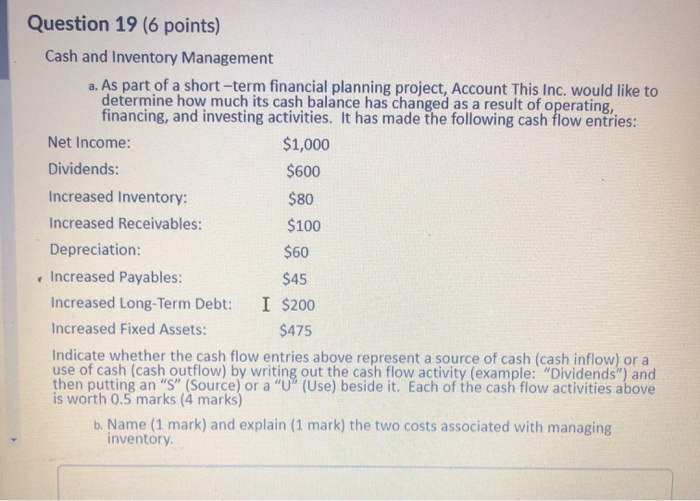

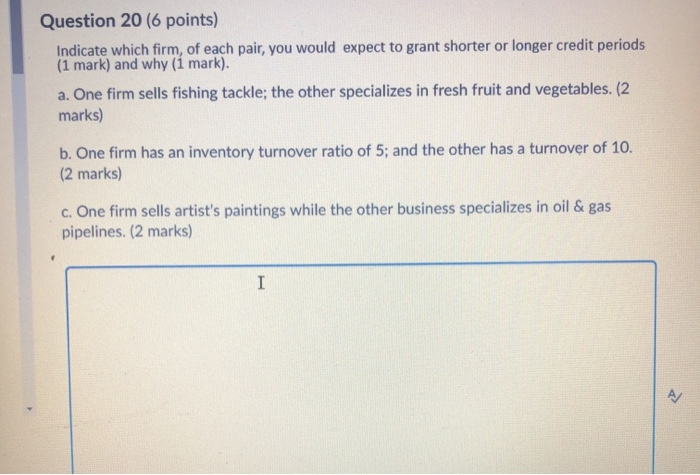

This part has 5 questions, worth 30 marks in total. For questions requiring numerical answers, show your work to receive partial credit, in case your answer is wrong, but your approach is correct. Question 16 (6 points) Answer the following questions about Canbot Industries. Note: Their corporate tax rate is 35%. a. What is the weighted-average cost of capital of Canbot Industries if they have the following sources of funds and corresponding required rates of return: $5 million common stock at 16%, $500,000 preferred stock at 10%, and $3 million debt at 9%. (4 marks) b. When is it appropriate for a firm to use the WACC? When might the WACC not be an appropriate rate ofreturn estimate? (2 marks) Question 17 (6 points) Southern Manufacturing is doing some short-term financial planning because they'd like to lower their short-term borrowing costs. a. Calculate the length of the cash conversion cycle for a firm with $50,000 in average inventory, $60,000 in average receivables, $30,000 in average payables, annual sales of $900,000, and an annual cost of goods sold of 70% of sales. (4 marks) b. What strategies could Southern undertake to improve their cash conversion cycle (2 marks) I A Question 18 (6 points) You are considering acquiring a firm that you believe can generate expected cash flows of $40,000 a year forever. However, you recognize that those cash flows are uncertain. a. With a beta of.5, how much is the firm worth if the risk-free rate is 3% and the expected market risk premium is 6%? (2 marks) b. If it turns out that the beta is actually.7: i. Did you overvalue or undervalue the firm? (2 marks) ii. By how much did you overvalue/undervalue the firm? (2 marks) I I Z Question 19 (6 points) Cash and Inventory Management a. As part of a short-term financial planning project, Account This Inc. would like to determine how much its cash balance has changed as a result of operating, financing, and investing activities. It has made the following cash flow entries: Net Income: $1,000 Dividends: $600 Increased Inventory: $80 Increased Receivables: $100 Depreciation: $60 Increased Payables: $45 Increased Long-Term Debt: I $200 Increased Fixed Assets: $475 Indicate whether the cash flow entries above represent a source of cash (cash inflow) or a use of cash (cash outflow) by writing out the cash flow activity (example: "Dividends") and then putting an "S" (Source) or a "U" (Use) beside it. Each of the cash flow activities above is worth 0.5 marks (4 marks) b. Name (1 mark) and explain (1 mark) the two costs associated with managing inventory Question 20 (6 points) Indicate which firm, of each pair, you would expect to grant shorter or longer credit periods (1 mark) and why (1 mark). a. One firm sells fishing tackle; the other specializes in fresh fruit and vegetables. (2 marks) b. One firm has an inventory turnover ratio of 5; and the other has a turnover of 10. (2 marks) c. One firm sells artist's paintings while the other business specializes in oil & gas pipelines. (2 irks) I A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts