Question: This problem has you consider how to maximize profits when you have one manufacturing facility (say in Ohio) that serves two markets (say in Michigan

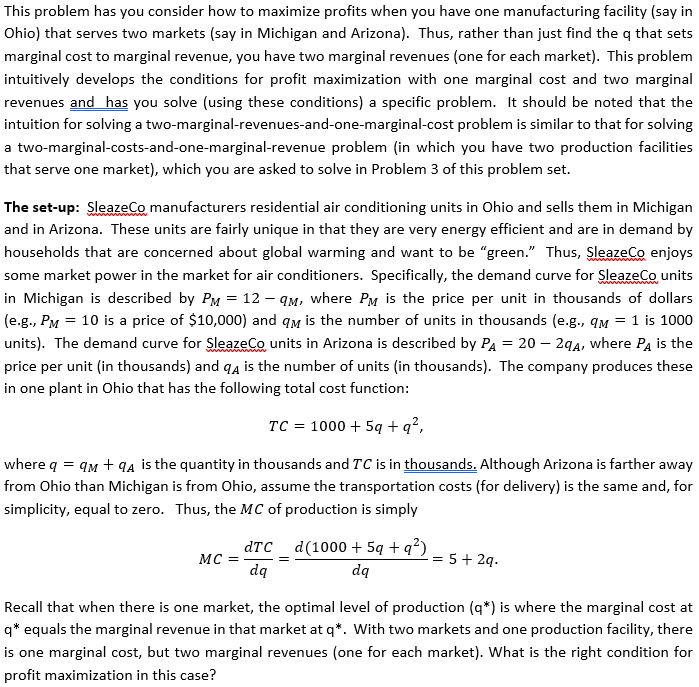

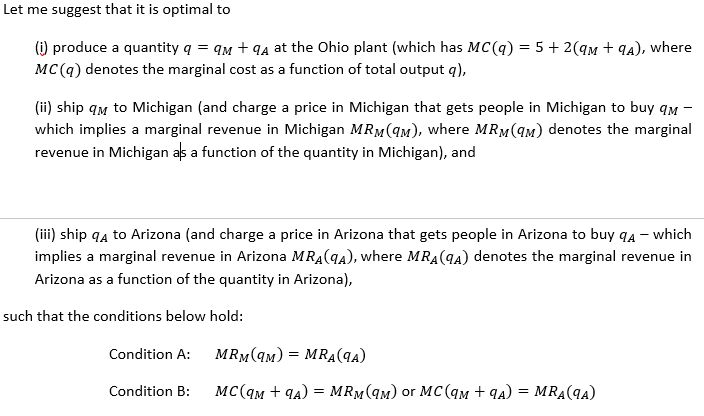

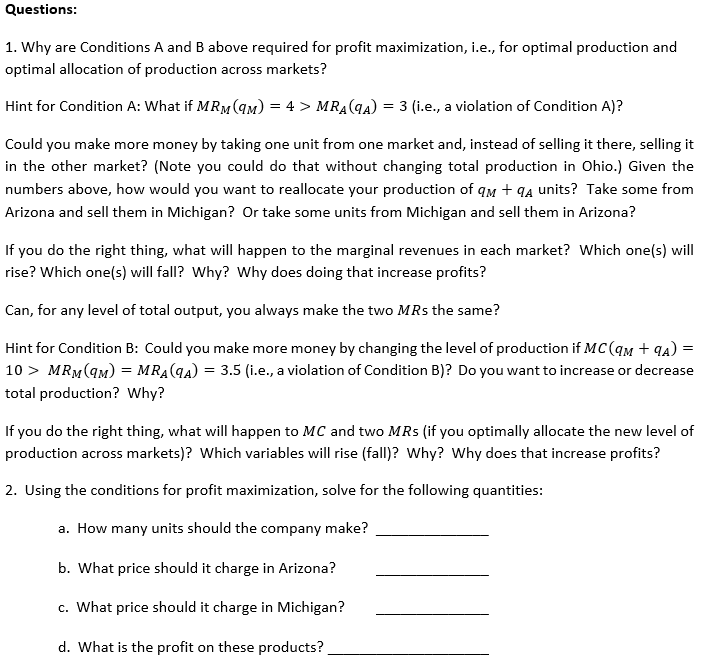

This problem has you consider how to maximize profits when you have one manufacturing facility (say in Ohio) that serves two markets (say in Michigan and Arizona). Thus, rather than just find the q that sets marginal cost to marginal revenue, you have two marginal revenues (one for each market). This problem intuitively develops the conditions for profit maximization with one marginal cost and two marginal revenues and has you solve (using these conditions) a specific problem. It should be noted that the intuition for solving a two-marginal-revenues-and-one-marginal-cost problem is similar to that for solving a two-marginal-costs-and-one-marginal-revenue problem (in which you have two production facilities that serve one market), which you are asked to solve in Problem 3 of this problem set. The set-up: SleazeCo manufacturers residential air conditioning units in Ohio and sells them in Michigan and in Arizona. These units are fairly unique in that they are very energy efficient and are in demand by households that are concerned about global warming and want to be "green." Thus, SleazeCo enjoys some market power in the market for air conditioners. Specifically, the demand curve for SleazeCo units in Michigan is described by PM = 12 - 9m, where PM is the price per unit in thousands of dollars (e.g., PM = 10 is a price of $10,000) and qm is the number of units in thousands (e.g., 9M = 1 is 1000 units). The demand curve for SleazeCo units in Arizona is described by PA = 20 - 29A, where PA is the price per unit (in thousands) and qa is the number of units (in thousands). The company produces these in one plant in Ohio that has the following total cost function: TC = 1000 + 5q + q, where q = 9m + 9A is the quantity in thousands and TC is in thousands. Although Arizona is farther away from Ohio than Michigan is from Ohio, assume the transportation costs (for delivery) is the same and, for simplicity, equal to zero. Thus, the MC of production is simply dTC MC = dq (1000 + 59 +92) -= 5 + 2q. dq Recall that when there is one market, the optimal level of production (q*) is where the marginal cost at q* equals the marginal revenue in that market atq*. With two markets and one production facility, there is one marginal cost, but two marginal revenues (one for each market). What is the right condition for profit maximization in this case? Let me suggest that it is optimal to () produce a quantity q = 9m + 9A at the Ohio plant (which has MC(q) = 5 + 2(9m + 9A), where MC(q) denotes the marginal cost as a function of total output q), (ii) ship qm to Michigan (and charge a price in Michigan that gets people in Michigan to buy 9M- which implies a marginal revenue in Michigan MRM9m), where MRM9m) denotes the marginal revenue in Michigan as a function of the quantity in Michigan), and (iii) ship 9A to Arizona (and charge a price in Arizona that gets people in Arizona to buy 9A - which implies a marginal revenue in Arizona MRA9A), where MRA9A) denotes the marginal revenue in Arizona as a function of the quantity in Arizona), such that the conditions below hold: Condition A: MRM9m) = MRA9A) Condition B: MCOM +9A) = MRM9m) or MC (am + 9A) = MRA(CA) Questions: 1. Why are Conditions A and B above required for profit maximization, i.e., for optimal production and optimal allocation of production across markets? Hint for Condition A: What if MRM9m) = 4 > MRA9A) = 3 (i.e., a violation of Condition A)? Could you make more money by taking one unit from one market and, instead of selling it there, selling it in the other market? (Note you could do that without changing total production in Ohio.) Given the numbers above, how would you want to reallocate your production of qm + 9A units? Take some from Arizona and sell them in Michigan? Or take some units from Michigan and sell them in Arizona? If you do the right thing, what will happen to the marginal revenues in each market? Which one(s) will rise? Which one(s) will fall? Why? Why does doing that increase profits? Can, for any level of total output, you always make the two MRs the same? Hint for Condition B: Could you make more money by changing the level of production if MCM +9A) = 10 > MRM9M) = MRA9A) = 3.5 (i.e., a violation of Condition B)? Do you want to increase or decrease total production? Why? If you do the right thing, what will happen to MC and two MRs (if you optimally allocate the new level of production across markets)? Which variables will rise (fall)? Why? Why does that increase profits? 2. Using the conditions for profit maximization, solve for the following quantities: a. How many units should the company make? b. What price should it charge in Arizona? c. What price should it charge in Michigan? d. What is the profit on these products? This problem has you consider how to maximize profits when you have one manufacturing facility (say in Ohio) that serves two markets (say in Michigan and Arizona). Thus, rather than just find the q that sets marginal cost to marginal revenue, you have two marginal revenues (one for each market). This problem intuitively develops the conditions for profit maximization with one marginal cost and two marginal revenues and has you solve (using these conditions) a specific problem. It should be noted that the intuition for solving a two-marginal-revenues-and-one-marginal-cost problem is similar to that for solving a two-marginal-costs-and-one-marginal-revenue problem (in which you have two production facilities that serve one market), which you are asked to solve in Problem 3 of this problem set. The set-up: SleazeCo manufacturers residential air conditioning units in Ohio and sells them in Michigan and in Arizona. These units are fairly unique in that they are very energy efficient and are in demand by households that are concerned about global warming and want to be "green." Thus, SleazeCo enjoys some market power in the market for air conditioners. Specifically, the demand curve for SleazeCo units in Michigan is described by PM = 12 - 9m, where PM is the price per unit in thousands of dollars (e.g., PM = 10 is a price of $10,000) and qm is the number of units in thousands (e.g., 9M = 1 is 1000 units). The demand curve for SleazeCo units in Arizona is described by PA = 20 - 29A, where PA is the price per unit (in thousands) and qa is the number of units (in thousands). The company produces these in one plant in Ohio that has the following total cost function: TC = 1000 + 5q + q, where q = 9m + 9A is the quantity in thousands and TC is in thousands. Although Arizona is farther away from Ohio than Michigan is from Ohio, assume the transportation costs (for delivery) is the same and, for simplicity, equal to zero. Thus, the MC of production is simply dTC MC = dq (1000 + 59 +92) -= 5 + 2q. dq Recall that when there is one market, the optimal level of production (q*) is where the marginal cost at q* equals the marginal revenue in that market atq*. With two markets and one production facility, there is one marginal cost, but two marginal revenues (one for each market). What is the right condition for profit maximization in this case? Let me suggest that it is optimal to () produce a quantity q = 9m + 9A at the Ohio plant (which has MC(q) = 5 + 2(9m + 9A), where MC(q) denotes the marginal cost as a function of total output q), (ii) ship qm to Michigan (and charge a price in Michigan that gets people in Michigan to buy 9M- which implies a marginal revenue in Michigan MRM9m), where MRM9m) denotes the marginal revenue in Michigan as a function of the quantity in Michigan), and (iii) ship 9A to Arizona (and charge a price in Arizona that gets people in Arizona to buy 9A - which implies a marginal revenue in Arizona MRA9A), where MRA9A) denotes the marginal revenue in Arizona as a function of the quantity in Arizona), such that the conditions below hold: Condition A: MRM9m) = MRA9A) Condition B: MCOM +9A) = MRM9m) or MC (am + 9A) = MRA(CA) Questions: 1. Why are Conditions A and B above required for profit maximization, i.e., for optimal production and optimal allocation of production across markets? Hint for Condition A: What if MRM9m) = 4 > MRA9A) = 3 (i.e., a violation of Condition A)? Could you make more money by taking one unit from one market and, instead of selling it there, selling it in the other market? (Note you could do that without changing total production in Ohio.) Given the numbers above, how would you want to reallocate your production of qm + 9A units? Take some from Arizona and sell them in Michigan? Or take some units from Michigan and sell them in Arizona? If you do the right thing, what will happen to the marginal revenues in each market? Which one(s) will rise? Which one(s) will fall? Why? Why does doing that increase profits? Can, for any level of total output, you always make the two MRs the same? Hint for Condition B: Could you make more money by changing the level of production if MCM +9A) = 10 > MRM9M) = MRA9A) = 3.5 (i.e., a violation of Condition B)? Do you want to increase or decrease total production? Why? If you do the right thing, what will happen to MC and two MRs (if you optimally allocate the new level of production across markets)? Which variables will rise (fall)? Why? Why does that increase profits? 2. Using the conditions for profit maximization, solve for the following quantities: a. How many units should the company make? b. What price should it charge in Arizona? c. What price should it charge in Michigan? d. What is the profit on these products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts