Question: This problem is confusing me, can someone plz help! Homework: CH 12 HW Save Score: 2.73 of 3 pts 3 of 6 (6 complete) HW

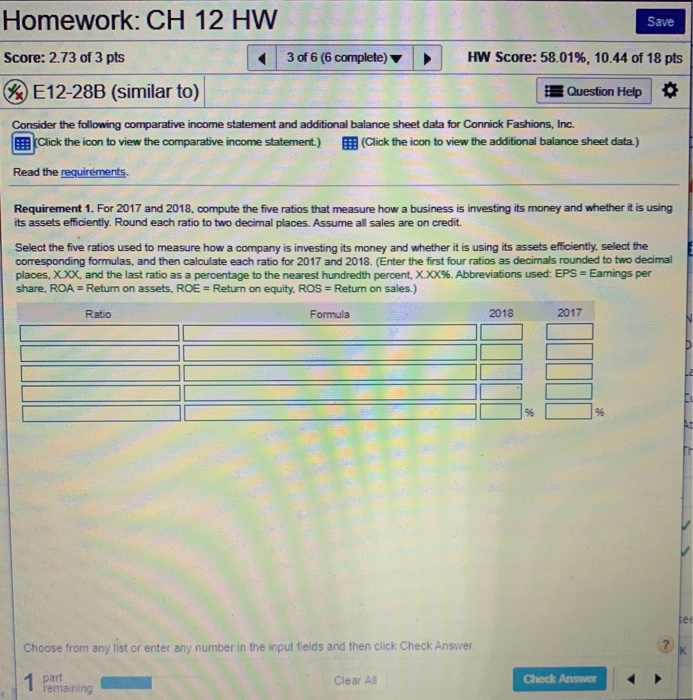

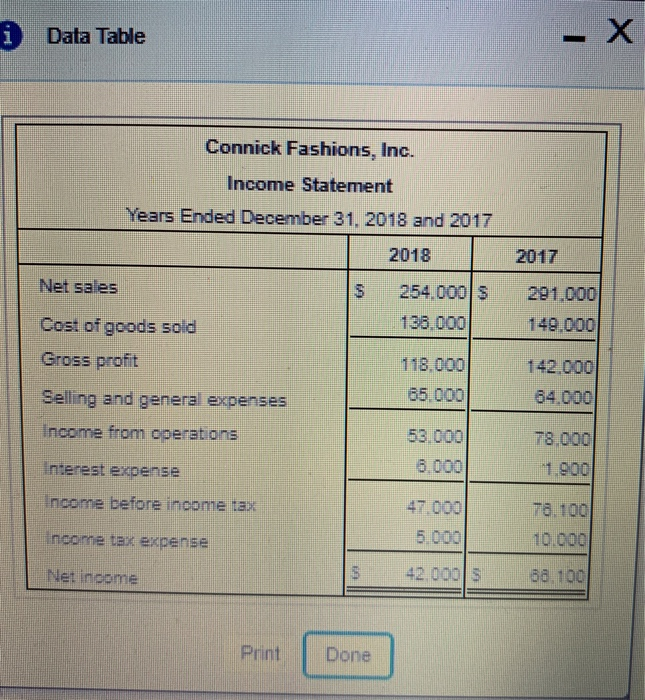

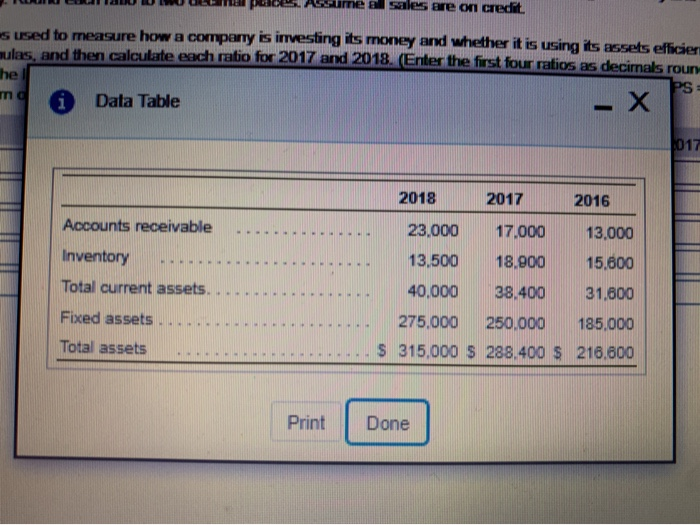

Homework: CH 12 HW Save Score: 2.73 of 3 pts 3 of 6 (6 complete) HW Score: 58.01%, 10.44 of 18 pts E12-28B (similar to) Question Help Question Help Consider the following comparative income statement and additional balance sheet data for Connick Fashions, Inc. Click the icon to view the comparative income statement.) (Click the icon to view the additional balance sheet data) Read the requirements. Requirement 1. For 2017 and 2018, compute the five ratios that measure how a business is investing its money and whether it is using its assets efficiently. Round each ratio to two decimal places. Assume all sales are on credit. Select the five ratios used to measure how a company is investing its money and whether it is using its assets efficiently select the corresponding formulas, and then calculate each ratio for 2017 and 2018. (Enter the first four ratios as decimals rounded to two decimal places, X.XX, and the last ratio as a percentage to the nearest hundredth percent. X.XX%. Abbreviations used: EPS = Earnings per share, ROA = Return on assets, ROE = Return on equity, ROS = Return on sales.) Ratio Formula 2018 2017 Choose from any list or enter any number in the input fields and then click Check Answer 1 part Clear All Check Answer I remaining X Data Table Connick Fashions, Inc. Income Statement Years Ended December 31, 2018 and 2017 2018 2017 Net sales 254.000 5 138.000 291.000 149.000 Cost of goods sold Gross profit 118.000 65.000 142.000 64.000 Selling and general expenses Income from coerations 53.000 6.000 78.000 1.900 Interest expense Income before income tax 47.000 5.000 78.100 10.000 Income tax expense Net noome 42 000 68.100 Print Done Asume al sales are on the s used to measure how a company is investing its money and whether it is using its asset ulas, and then calculate each ratio for 2017 and 2018. (Enter the first four ratios as decimals roun he PS ma Data Table 2018 2017 2016 Accounts receivable ........... Inventory .................. Total current assets. 23.000 17.000 13,000 13,500 18.000 15.600 40,000 38.400 31,600 275.000 250,000 185.000 . S 315,000 S 288.400 $ 216,600 Fixed assets ....... Total assets Print Done Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts