Question: This problem is the same as the previous one, except for the following differences: Missoula Company is buying inventory on credit from a British supplier

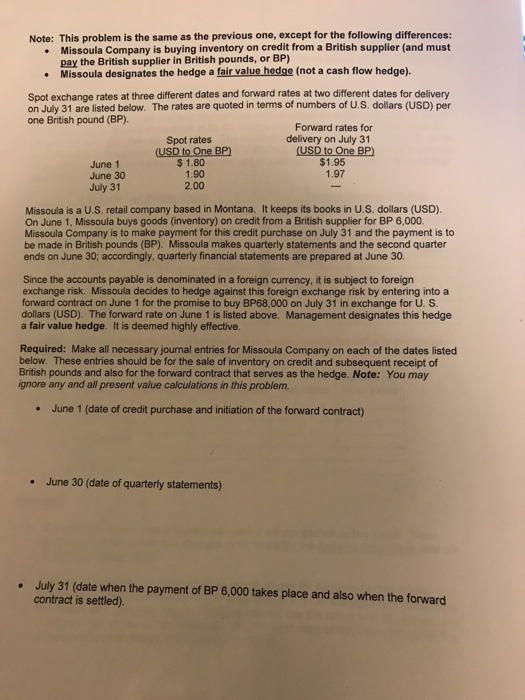

This problem is the same as the previous one, except for the following differences: Missoula Company is buying inventory on credit from a British supplier (and must pay the British supplier in British pounds, or BP) Missoula designates the hedge a fair value hedge (not a cash flow hedge). Note: Spot exchange rates at three different dates and forward rates at two different dates for delivery on July 31 are listed below. The rates are quoted in terms of numbers of U.S. dollars (USD) per one British pound (BP). Forward rates for Spot rates delivery on July 31 USD to One BP) $1.95 June 1 June 30 July 31 $ 1.80 1.90 2.00 1.97 Missoula is a U.S. retail company based in Montana. It keeps its books in U.S. dollars (USD). On June 1, Missoula buys goods (inventory) on credit from a British supplier for BP 6,000. Missoula Company is to make payment for this credit purchase on July 31 and the payment is to be made in British pounds (BP). Missoula makes quarterly statements and the second quarter ends on June 30; accordingly, quarterly financial statements are prepared at June 30. Since the accounts payable is denominated in a foreign currency, it is subject to foreign exchange risk. Missoula decides to hedge against this foreign exchange risk by entering into a forward contract on June 1 for the promise to buy BP68,000 on July 31 in exchange for U. S dollars (USD). The forward rate on June 1 is listed above. Management designates this hedge a fair value hedge. It is deemed highly effective. Required: Make all necessary journal entries for Missoula Company on each of the dates listed below. These entries should be for the sale of inventory on credit and subsequent receipt of British pounds and also for the forward contract that serves as the hedge. Note: You may ignore any and all present value calculations in this problem. June 1 (date of credit purchase and initiation of the forward contract) June 30 (date of quarterly statements) . July 31 (date when the payment of BP 6,000 takes place and also when the forward contract is settled)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts