Question: This problem is worth 14 points. INCLUDE DETAILS OF YOUR CALCULATIONS THAT SUPPORT YOUR SOLUTIONS. Diamond Autobody purchased new equipment for $90,000. Residual value at

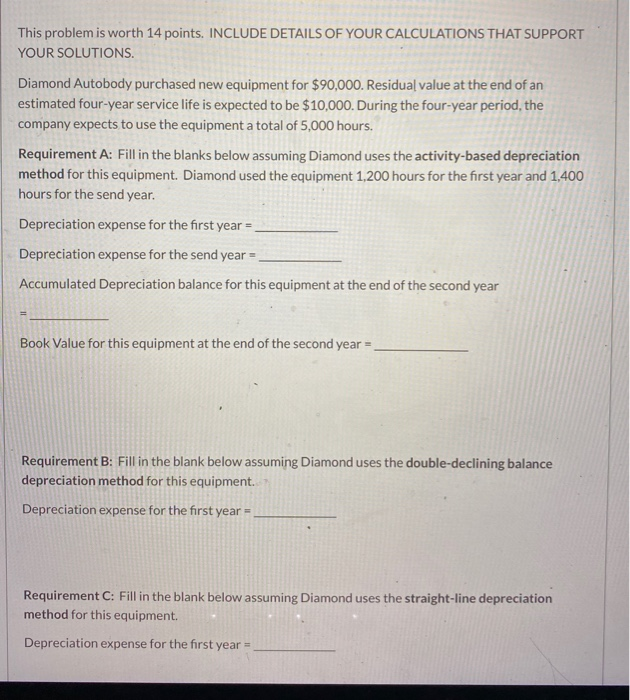

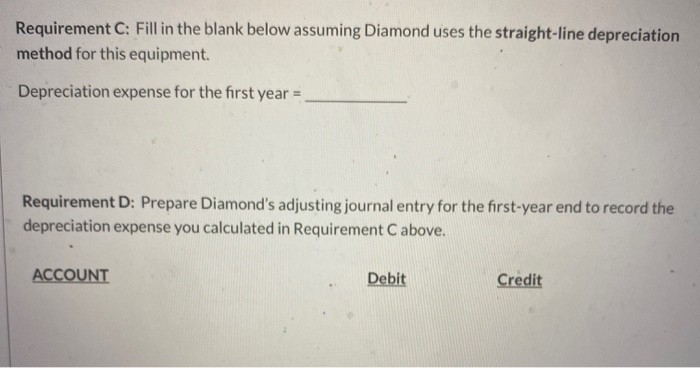

This problem is worth 14 points. INCLUDE DETAILS OF YOUR CALCULATIONS THAT SUPPORT YOUR SOLUTIONS. Diamond Autobody purchased new equipment for $90,000. Residual value at the end of an estimated four-year service life is expected to be $10,000. During the four-year period, the company expects to use the equipment a total of 5,000 hours. Requirement A: Fill in the blanks below assuming Diamond uses the activity-based depreciation method for this equipment. Diamond used the equipment 1,200 hours for the first year and 1,400 hours for the send year. Depreciation expense for the first year = Depreciation expense for the send year = Accumulated Depreciation balance for this equipment at the end of the second year Book Value for this equipment at the end of the second year = Requirement B: Fill in the blank below assuming Diamond uses the double-declining balance depreciation method for this equipment. Depreciation expense for the first year = Requirement C: Fill in the blank below assuming Diamond uses the straight-line depreciation method for this equipment. Depreciation expense for the first year = Requirement C: Fill in the blank below assuming Diamond uses the straight-line depreciation method for this equipment. Depreciation expense for the first year = Requirement D: Prepare Diamond's adjusting journal entry for the first-year end to record the depreciation expense you calculated in Requirement C above. ACCOUNT Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts