Question: This problem set, is designed to help you understand the basic of Mean-Variance Analysis.You will be asked to apply aspects of Mean-Variance Portfolio Theory to

This problem set, is designed to help you understand the basic of Mean-Variance Analysis.You will be asked to apply aspects of Mean-Variance Portfolio Theory to some basic problems.You will also be asked to experiment with a pre-packaged Portfolio Optimization spreadsheet to develop a feel for Mean-Variance Analysis.

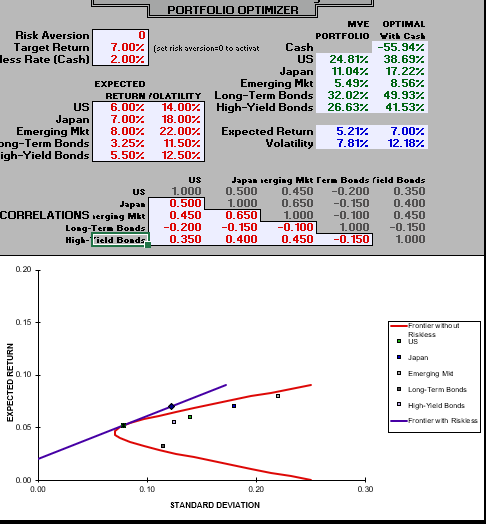

PORTFOLIO OPTIMIZER MYE OPTIMAL Risk Aversion PORTFOLIO With Cash Target Return 7.00% [set risk aversion=0 to activat Cash -55.94% less Rate (Cash] 2.00% US 24.812 38.69% Japan 11.04% 17.22% EXPECTED Emerging Mkt 5.49% 8.56% RETURN /OLATILITY Long-Term Bonds 32.02% 49.937 US 6.00% 14.00% High-Yield Bonds 26.63% 41.53% Japan 7.00% 18.00% Emerging Mkt 8.00% 22.00% Expected Return 5.21% 7.00% ing-Term Bonds 3.25% 11.50% Volatility 7.81% 12. 18% igh-Yield Bonds 5.50% 12.50% US Japan berging Mkt Term Bonds field Bonds US 1.000 0.500 0.450 -0.200 0.350 Japan 0.500 1.000 0.650 -0. 150 0.400 CORRELATIONS verging ME 0. 450 0.650 1.000 -0. 100 0. 450 Long-Term Bonds -0.200 -0. 150 -0. 100 1.000 -0. 150 High-Field Bonds 0.350 0.400 0. 450 -0. 150 1.000 0.20 0. 15 -Front orwithout Riskless O US 0. 10 O Emerging IN EXPECTED RETURN Long Term Bands High Yield Bonds 0.06 0.00 + 0.00 0. 10 1. 20 STANDARD DEVIATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts