Question: This problem set uses American Airlines for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make

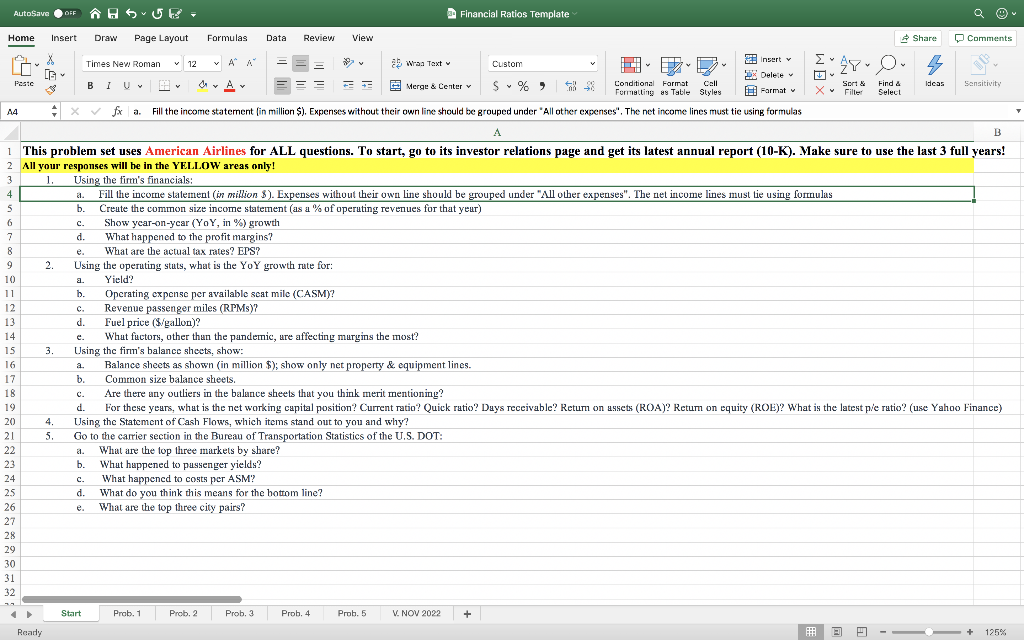

This problem set uses American Airlines for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make sure to use the last 3 full years!

https://americanairlines.gcs-web.com/financial-results/financial-aal

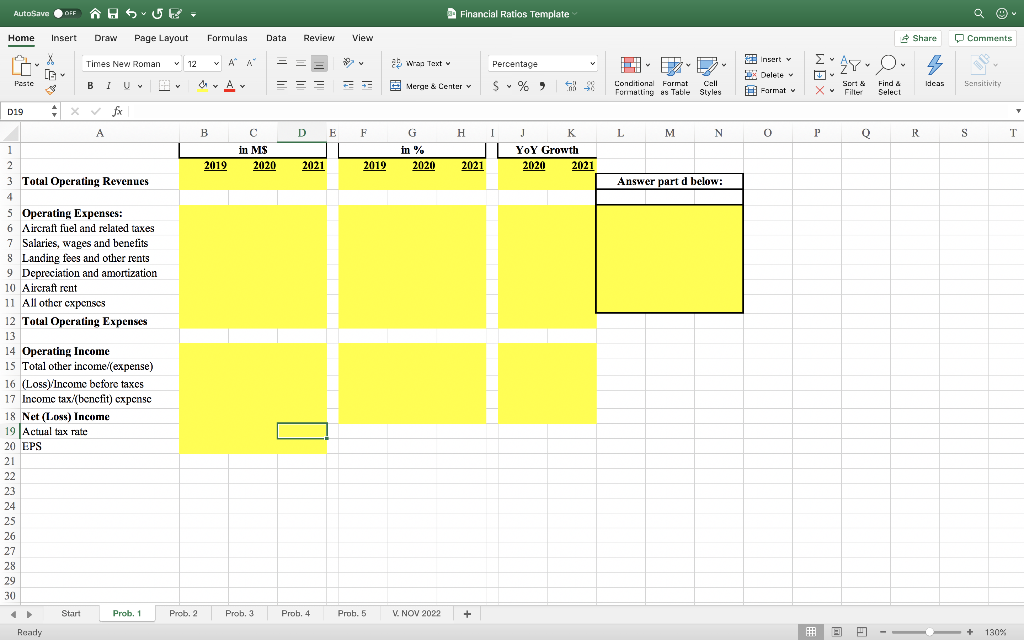

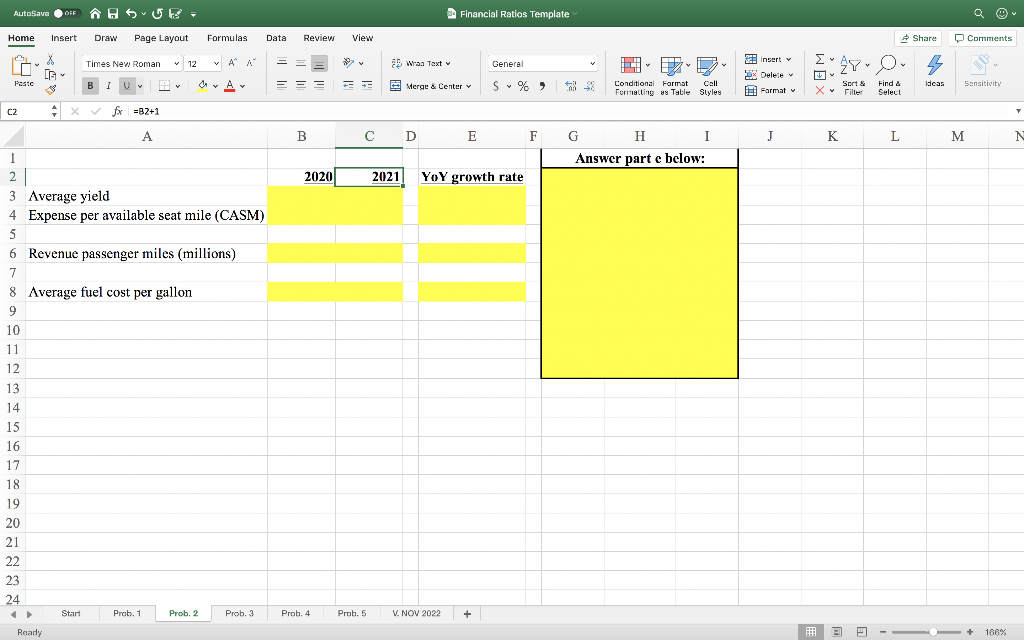

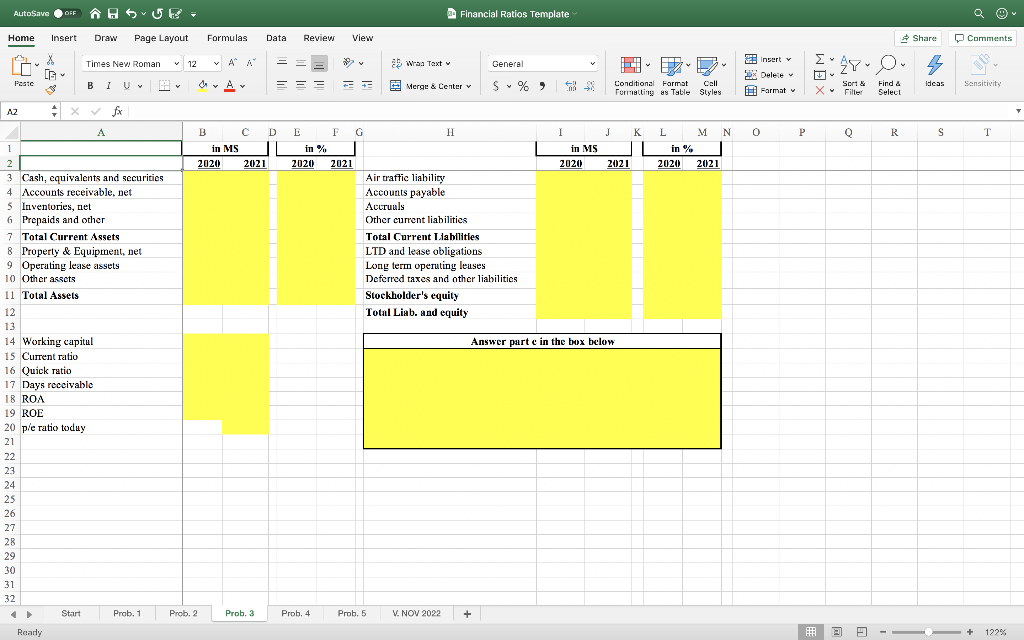

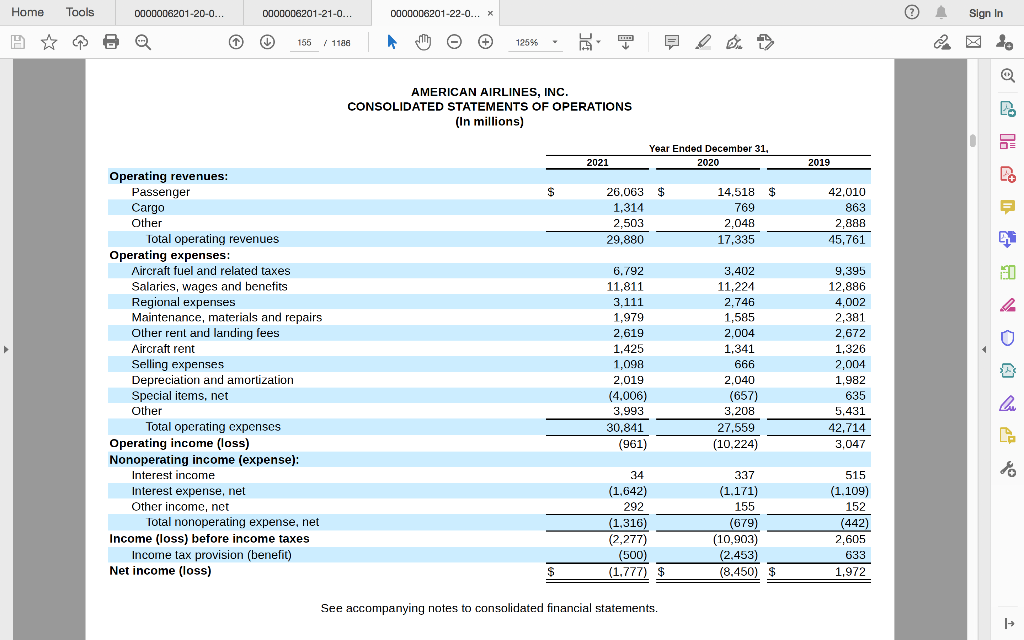

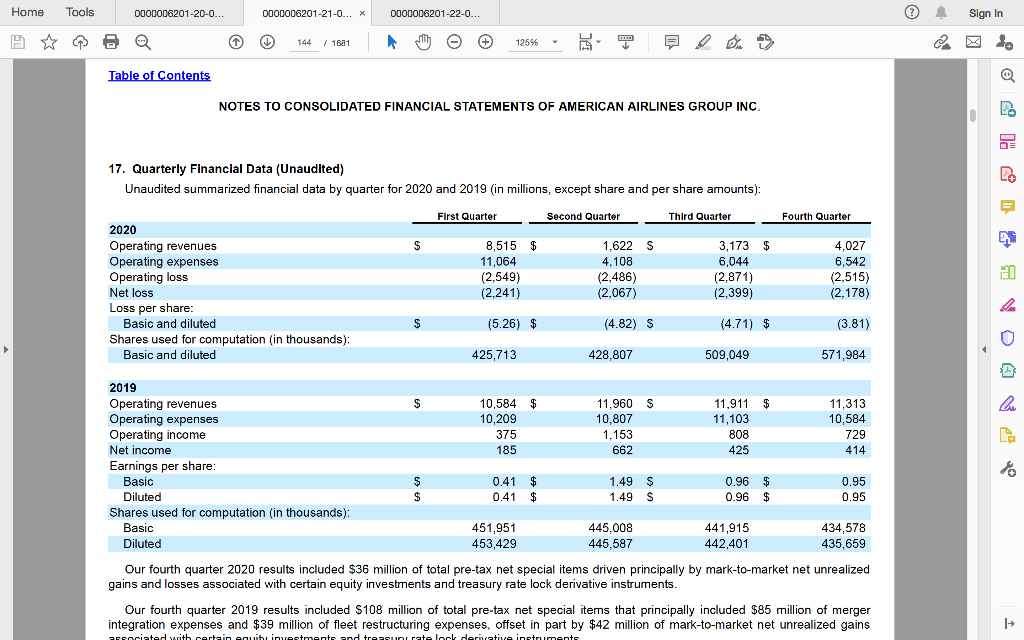

A4 fx a. Fill the income statement fin million $ ). Expenses without their own line should be grouped under "All other expenses". The net income lines must tie using formulas This problem set uses American Airlines for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make sure to use the last 3 full years! All your responses will be in the YELLOW areas only! 1. Using the firm's financials: a. Fill the income statement (in million 8). Expenses without their own line should be grouped under "Mll other expenses". The net income lines must lie using formulas b. Create the common size income statement (as a % of operuting revenues for that yeur) c. Show year-on-ycar (YoY, in \%) growth d. What happened to the profit margins? e. What are the actual tax rates? EPS? 2. Using the operuting stuts, what is the YoY growth rute for: a. Yield? b. Operating expense per available scat mile (CASM)? c. Revenue passenger miles (RPMs)? d. Fuel price (\$/gallon)? e. Whut fuctors, other than the pandernic, are affecting murgins the most? 3. Using the firn's balance sheets, show: a. Balance sheets as shown (in million \$); show only net property \& equipment lines. b. Common size balance sheets. c. Are there any outliers in the balance sheets thut you think merit mentioning? d. For these yeurs, what is the net working cupital position? Current ratio? Quick rutio? Days receivable? Retum on assets (ROA)? Retum on equity (ROE)? What is the latest pie rutio? (use Yahoo Finance) 4. Using the Statement of Cash Flows, which items stand out to you and why? 5. Go to the carrier section in the Bureau of Transportation Statistics of the U.S. DOT: a. What are the top three markets by share? b. Whut happened to pussenger yields? c. What happened to costs per ASM? d. What do you think this means for the botrom line? e. What are the top three city pairs? A2fx A2fx 11 12 13 14 15 18 19 20 21 22 23 24 26 L MNOPQ K AMERICAN AIRLINES, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions) See accompanying notes to consolidated financial statements. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC. 17. Quarterly Financlal Data (Unaudited) Unaudited summarized financial data by quarter for 2020 and 2019 (in millions, except share and per share amounts): Our fourth quarter 2020 results included $36 million of total pre-tax net special items driven principally by mark-to-market net unrealized gains and losses associated with certain equity investments and treasury rate lock derivative instruments. Our fourth quarter 2019 results included $108 million of total pre-tax net special items that principally included $85 million of merger integration expenses and $39 million of fleet restructuring expenses, offset in part by $42 million of mark-to-market net unrealized gains A4 fx a. Fill the income statement fin million $ ). Expenses without their own line should be grouped under "All other expenses". The net income lines must tie using formulas This problem set uses American Airlines for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make sure to use the last 3 full years! All your responses will be in the YELLOW areas only! 1. Using the firm's financials: a. Fill the income statement (in million 8). Expenses without their own line should be grouped under "Mll other expenses". The net income lines must lie using formulas b. Create the common size income statement (as a % of operuting revenues for that yeur) c. Show year-on-ycar (YoY, in \%) growth d. What happened to the profit margins? e. What are the actual tax rates? EPS? 2. Using the operuting stuts, what is the YoY growth rute for: a. Yield? b. Operating expense per available scat mile (CASM)? c. Revenue passenger miles (RPMs)? d. Fuel price (\$/gallon)? e. Whut fuctors, other than the pandernic, are affecting murgins the most? 3. Using the firn's balance sheets, show: a. Balance sheets as shown (in million \$); show only net property \& equipment lines. b. Common size balance sheets. c. Are there any outliers in the balance sheets thut you think merit mentioning? d. For these yeurs, what is the net working cupital position? Current ratio? Quick rutio? Days receivable? Retum on assets (ROA)? Retum on equity (ROE)? What is the latest pie rutio? (use Yahoo Finance) 4. Using the Statement of Cash Flows, which items stand out to you and why? 5. Go to the carrier section in the Bureau of Transportation Statistics of the U.S. DOT: a. What are the top three markets by share? b. Whut happened to pussenger yields? c. What happened to costs per ASM? d. What do you think this means for the botrom line? e. What are the top three city pairs? A2fx A2fx 11 12 13 14 15 18 19 20 21 22 23 24 26 L MNOPQ K AMERICAN AIRLINES, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions) See accompanying notes to consolidated financial statements. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC. 17. Quarterly Financlal Data (Unaudited) Unaudited summarized financial data by quarter for 2020 and 2019 (in millions, except share and per share amounts): Our fourth quarter 2020 results included $36 million of total pre-tax net special items driven principally by mark-to-market net unrealized gains and losses associated with certain equity investments and treasury rate lock derivative instruments. Our fourth quarter 2019 results included $108 million of total pre-tax net special items that principally included $85 million of merger integration expenses and $39 million of fleet restructuring expenses, offset in part by $42 million of mark-to-market net unrealized gains

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts