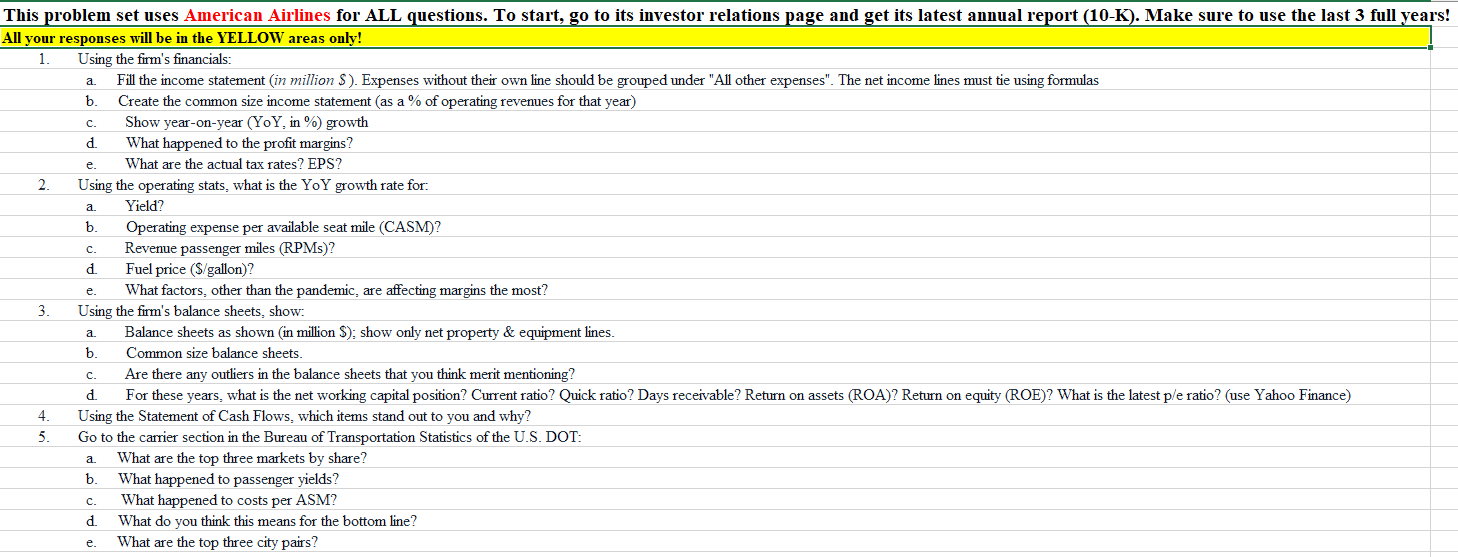

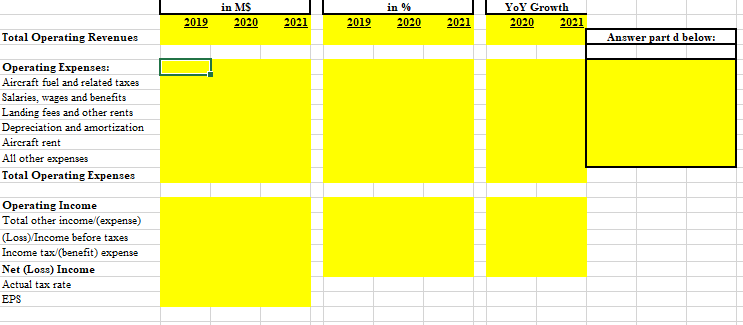

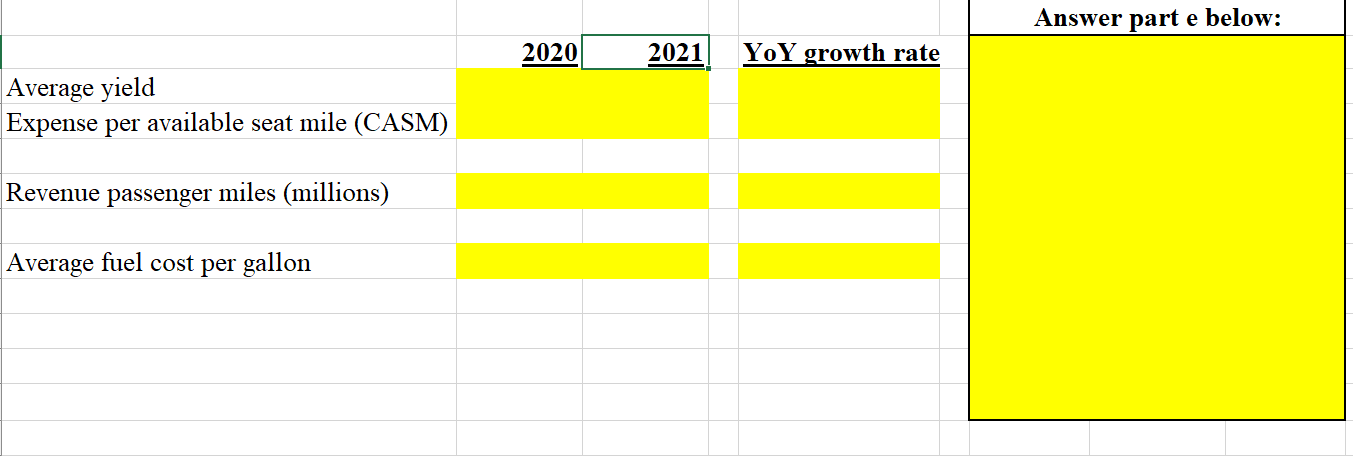

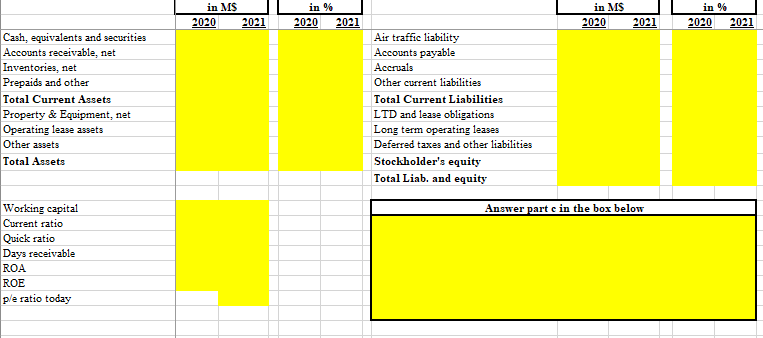

Question: This problem set uses American Airlines for ALL questions. To start, go to its investor relations page and get its latest annual report (10-K). Make

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock