Question: This problem will have you verify that when you perform the compound interest computation while compounding sufficiently many times per period, you get close

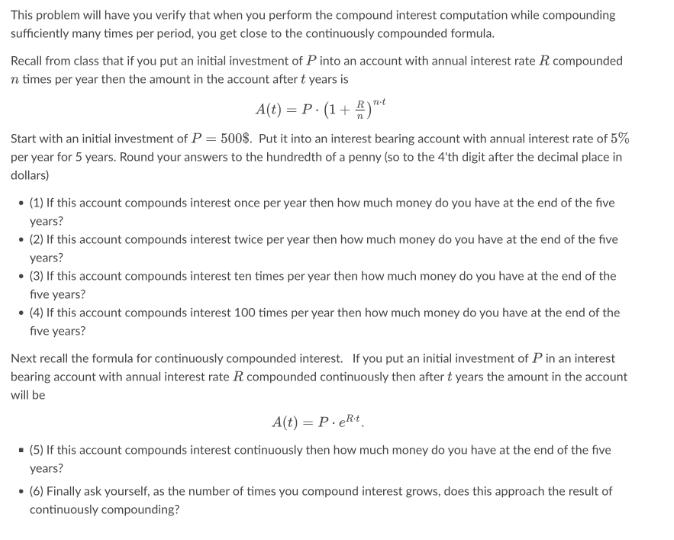

This problem will have you verify that when you perform the compound interest computation while compounding sufficiently many times per period, you get close to the continuously compounded formula. Recall from class that if you put an initial investment of P into an account with annual interest rate R compounded n times per year then the amount in the account after t years is A(t) = P. (1+R) n-t Start with an initial investment of P = 500$. Put it into an interest bearing account with annual interest rate of 5% per year for 5 years. Round your answers to the hundredth of a penny (so to the 4'th digit after the decimal place in dollars) (1) If this account compounds interest once per year then how much money do you have at the end of the five years? . (2) If this account compounds interest twice per year then how much money do you have at the end of the five years? (3) If this account compounds interest ten times per year then how much money do you have at the end of the five years? (4) If this account compounds interest 100 times per year then how much money do you have at the end of the five years? Next recall the formula for continuously compounded interest. If you put an initial investment of P in an interest bearing account with annual interest rate R compounded continuously then after t years the amount in the account will be A(t) = P. et (5) If this account compounds interest continuously then how much money do you have at the end of the five years? (6) Finally ask yourself, as the number of times you compound interest grows, does this approach the result of continuously compounding?

Step by Step Solution

There are 3 Steps involved in it

To answer these questions you can use the compound interest formula and compare the results to the f... View full answer

Get step-by-step solutions from verified subject matter experts